Connecting to the future : Investments in Breakthrough Startups the Key to Achieving 2050 Goal

Creating the Future with Climate Tech vol.1 Investments in Breakthrough Startups the Key to Achieving 2050 Goal

"Climate tech" refers to technologies and businesses that are invested in reducing greenhouse gas emissions and finding solutions to global warming. Investments in climate tech have surged in recent years, and expectations are that this sector will only continue to grow in the future. Many parts of the world have adopted policies to achieve net-zero carbon emissions by 2050, and with that deadline now less than three decades away, climate tech is garnering more and more attention. What are the challenges and trends in climate-tech investing? This feature spotlights possibilities in the field of "fusion energy," where MC invested in a new technology in the spring of 2023.

Rapid Growth in Global EX Investments

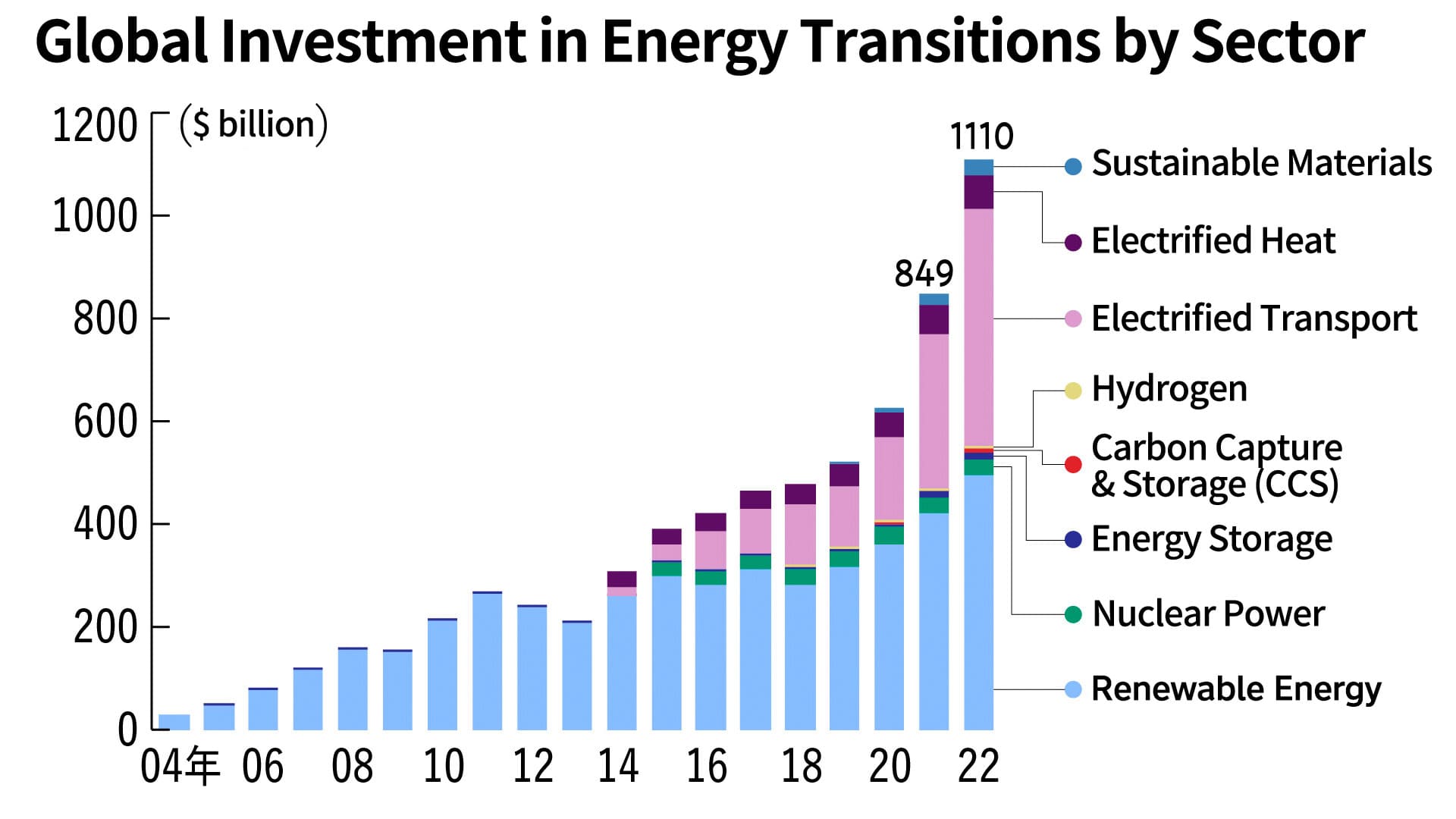

Sector Exceeds $1 Trillion Mark for First Time in 2022

With over 140 countries and regions now seeking to achieve net-zero-by-2050 targets, investments in energy transformations (EX) are rapidly gaining momentum. More and more money is being pumped into renewable energy, energy storage, electrified transport, hydrogen production, storage and delivery systems, carbon recycling and so on. In 2022, the world invested $1.11 trillion (US) in energy transitions, which was a 31% increase from 2021 and the largest single-year total on record. (BloombergNEF)

By sector, most of the capital invested in 2022 went towards wind, solar, bio-fuels and other renewable energies ($495 billion for a year-on-year increase of 17%). Due to the spread of electric vehicles, investments in electrified transport grew even quicker (a total of $466 billion was committed to that sector, up 54% from the previous year).

Virtually all of the other sectors saw tremendous investment growth as well. Commitments of $64 billion, $15.7 billion, and $6.4 billion went to electrified heat, energy storage, and carbon capture and storage respectively. Although hydrogen currently accounts for the smallest commitment at $1.1 billion, the growth in that sector has been by far the quickest, having tripled from the previous year.

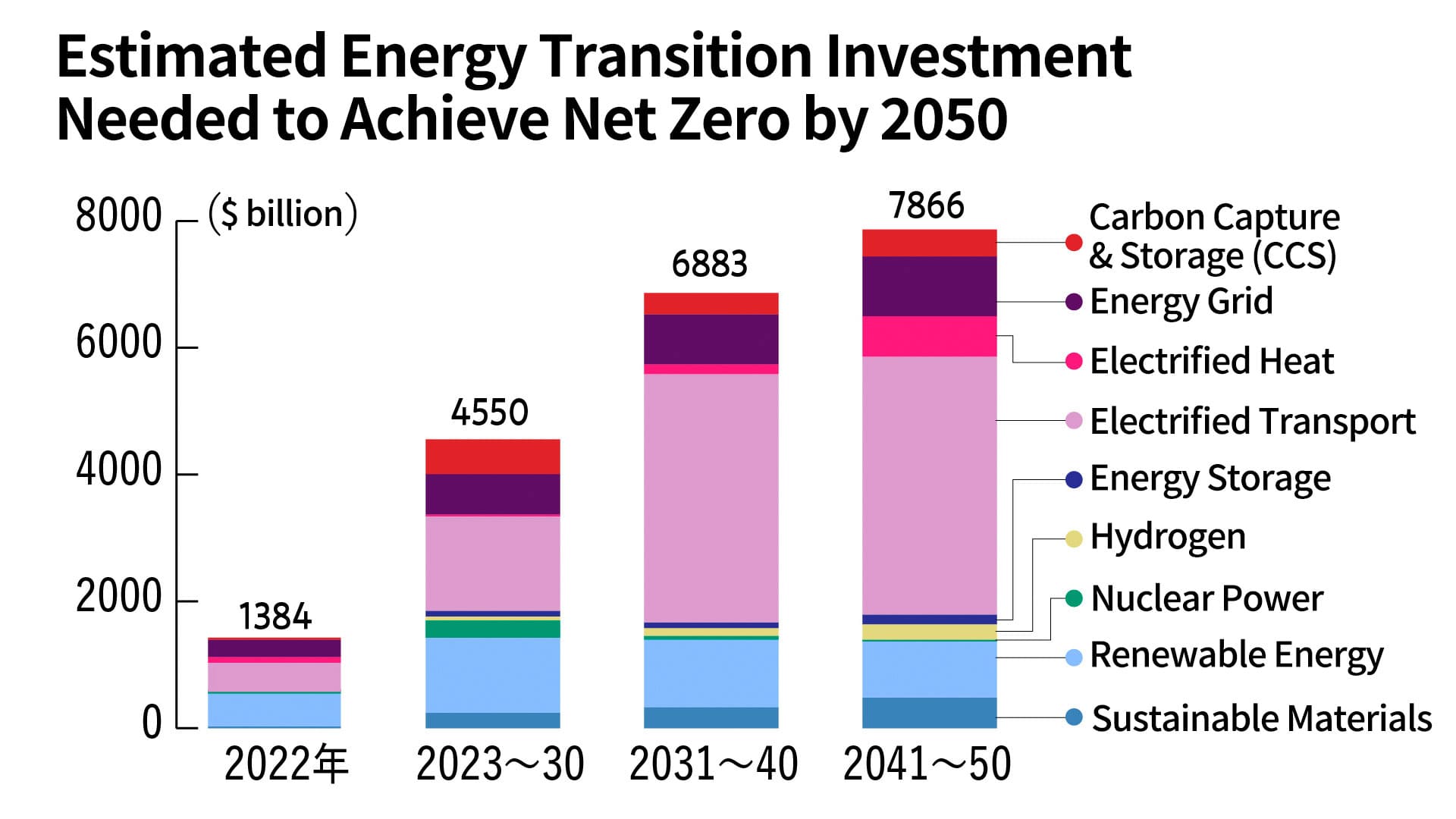

Sixfold Increase in Annual Investment Required from 2040 to 2050

At first glance, it would seem that growth in EX investments has been fairly steady, but net-zero is a long-term goal and we are still only halfway there. BloombergNEF estimates that the world will need to invest an annual average of $4.55 trillion between 2023 and 2030 to be on track towards achieving net zero. That is more than three times the record investment realized in 2022. The post-2030 numbers look even more daunting, with the required annual averages being $6.88 trillion and $7.87 trillion through the 2030s and 2040s respectively. To put that in perspective, an annual investment of $7.87 trillion would be roughly six times the record commitment of 2022.

As mentioned, more than 140 countries and regions have announced their intentions to be carbon neutral by 2050, and we are even seeing some compromises being made as administrations look to collaborate on climate policies. Even so, it is going to take an enormous, worldwide financial commitment if we hope to actually achieve this goal.

High Hopes Pinned on Startups for Tech Breakthroughs

The "Net Zero by 2050" analysis performed by the International Energy Agency (IEA) in 2021 was a stark reminder of just how steep this climb will be. The IEA concluded that about half of the emission cuts necessary to achieve net zero will not be possible with current commercially viable technologies. In other words, we will not only need to rely on the technologies we already have, but also research, develop and scale up new technologies, because if we fail to get them to market, we will not be able to meet our 2050 target.

Much of our hope lies with climate tech startups, new companies that are working hard to commercialize cutting-edge technologies and pave the way for breakthroughs in climate policy. Most of the technologies in question are still in the trial or proof-of-concept stages, but there are high expectations surrounding the work being done by these startups.

According to PitchBook, an American provider of data on capital markets, VC investments in climate tech companies have been on the rise. In 2021, there were 2074 such deals, worth a total of $48.4 billion. That was approximately 35 times the VC climate-tech investment in 2012 and roughly six times that of 2017. Research by PwC provides further evidence of growing climate tech investment activity in recent years. The group's consulting arm found that from 2021 to 2022, climate tech deals accounted for roughly one fourth of all VC investments.

Larry Fink is chairman and CEO of BlackRock, one of the world's largest investment management companies. He has suggested that the next 1,000 unicorns* will be startups that help the world to decarbonize, which is indicative of just how seriously investors are looking at global startups in climate tech.

*A unicorn is defined as a privately held startup company that is valued at over $1 billion and remains unlisted for its first ten years of operation.

Fusion Energy a Promising New Field for Tech Investments

MC is demonstrating a firm commitment to EX that has the potential to revolutionize entire industries, starting with the energy sector. The shosha plans to have invested about two trillion yen in the forging of a next-generation energy supply chain and other EX initiatives by fiscal year 2030.

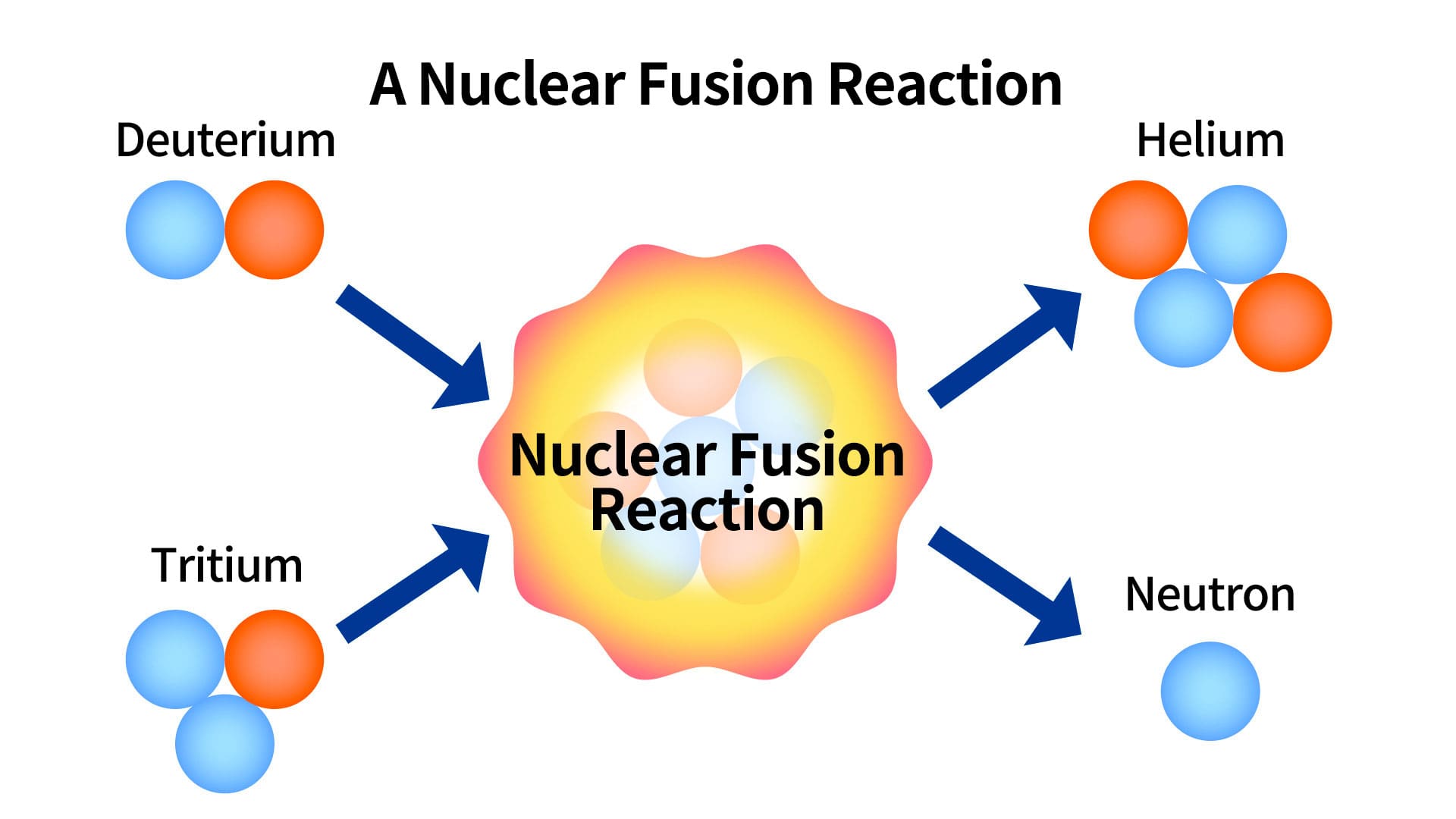

One such initiative which MC announced in May 2023, was an investment in Kyoto Fusioneering Ltd., a startup that possesses some advanced fusion-energy technologies. Fusion energy is produced when lightweight atomic nuclei (such as deuterium or tritium) collide to form a heavier nucleus (such as helium). The idea is that by artificially replicating a nuclear fusion reaction, which occurs inside the sun and is the source of its energy, humans can create sustainable energy in the form of electricity, heat and so on.

Fusion energy has the following advantages: 1) Carbon neutrality(Carbon dioxide is not emitted during the process of power generation); 2) Abundant fuel (On top of the fact that the fuel exists abundantly in seawater and can be generated nearly inexhaustibly, a huge amount of energy can be produced from a small amount of fuel); 3) Inherently safe (The fusion reaction stops when the fuel supply or the power supply is cut off). As such, fusion energy is expected to be the next generation of energy source.

Expectations surrounding Kyoto Fusioneering are building here in Japan, as the startup has already positioned itself at the forefront of the country's climate tech industry. MC's decision to invest in the company is also encouraging, considering the shosha's extensive, industrywide connections. Together, they are poised to take on some exciting new challenges, and in the meantime, MC will continue its quest to balance decarbonization and stable energy supply across the many businesses it is engaged in, always on the lookout for both societal and industrial solutions.

- Part 2 of this series will feature Marunouchi Innovation Partners, which is investing in the growth of climate tech companies, cutting-edge technologies and businesses that all share the goals of addressing climate change and achieving carbon neutrality.

-

Creating the Future with Climate Tech vol.1

Investments in Breakthrough Startups the Key to Achieving 2050 Goal -

Creating the Future with Climate Tech vol.2

The Launch of One of Asia's Largest Funds

Accelerating Growth Investments into Climate Tech Companies -

Creating the Future with Climate Tech vol.3

MC Donates 600 Million Yen to Kyoto University Startup Support Program

Finding Societal Solutions and Boosting Japan's Economy