Connecting to the future:The Launch of One of Asia's Largest Funds Accelerating Growth Investments into Climate Tech Companies

Creating the Future with Climate Tech vol.2

The Launch of One of Asia's Largest Funds

Accelerating Growth Investments into Climate Tech Companies

Investments into climate tech have been ramping up worldwide, as more countries look to get on track to achieving their "net-zero-by-2050" targets. Climate tech is a relatively new field that encompasses technologies and businesses designed to reduce greenhouse gas emissions and address global warming. In April 2023, Marunouchi Innovation Partners (MIP), led by MC, established the "Marunouchi Climate Tech Growth Fund" as a means of supporting new climate tech companies. MIP's President and CEO Ichiro Miyoshi sat down with us to explain the fund's aims and outlook for the future. Interviewer: Kazuhiro Sekine (GLOBE+ Editor in Chief)

Why Dedicate One of the Region's Largest Funds to Startups?

—— Can I start by asking you why you launched a fund specifically for climate tech companies?

Sure. There are still many problems that need to be addressed if we hope to achieve our net-zero-by-2050 goals. One of them is that we won't be able to cut enough greenhouse gas emissions if we rely only on the technologies that are already available. In other words, we need breakthroughs in the field of climate tech, including not only the development of new technologies, but also improvements to and new applications for our existing ones.

To ensure that cutting-edge, decarbonization-oriented technologies are adopted broadly by society, we must support the growth of climate tech companies. That was the thinking behind our decision in April 2023 to establish Marunouchi Climate Tech Growth Fund L.P. It is dedicated to investing in the industry's startups.

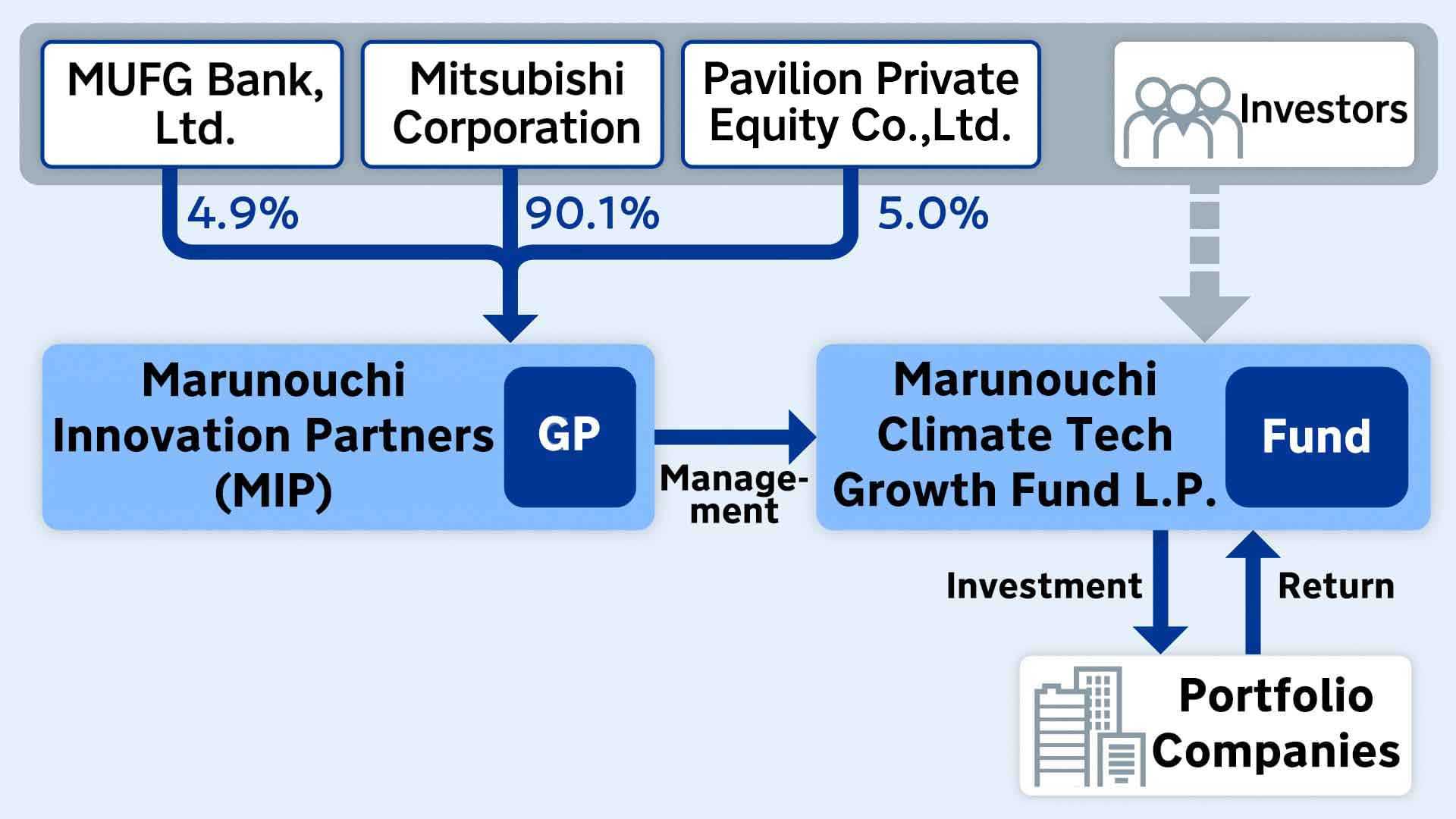

A fund is a pool of invested capital. Its managing entity, in other words the party that raises the capital from investors and determines where it should be allocated, is called its General Partner, or "GP." The GP for this particular fund is Marunouchi Innovation Partners, the establishment of which was led by MC.

The fund is overseen by Marunouchi Innovation Partners, where Mr. Miyoshi serves as the CEO/CIO.

—— How large do you intend to grow this fund?

Our first round of funding closed at $400 million at the end of April 2023, but we plan to continue raising capital until we have not only become one of the largest funds in Asia, but also one that ranks among the largest in the world.

As you wrote in your first article for this series, the world needs to invest an annual average of $4.55 trillion between 2020 and 2030 if it hopes to achieve its net-zero-by-2050 goal. There's no way that one fund can possibly raise that much money, but we're excited to do our part and help in any way we can.

Our intended period for this fund is about 12 years, the first five or so of which will be dedicated to collecting seed money. We're hoping to distribute the money between 20 or so companies, each of which would receive an investment of several billions of yen. The remaining seven years would be spent helping each of our portfolio companies to boost its value, and we'll consider a number of appropriate exit strategies, including IPOs and M&As.

Promoting Global Applications of Cutting-edge, Decarbonization Technologies

—— What fields are you envisioning your portfolio companies to be active in?

Our fund will focus on startups that already possess advanced technologies or new solutions in climate tech.

So we're envisioning quite a broad range of fields. For example, next-generation energies like hydrogen and SAFs (sustainable aviation fuels), and renewables like solar and wind. Businesses in those fields that are employing new technologies, energy storage, energy conservation techniques, CO2 sequestration and reuse, and so on will all be up for consideration.

Steady progress is being made in climate tech, so I imagine that the fields qualifying for our support are only going to diversify further in the coming years.

—— So you're looking to invest in companies that have already made a certain amount of progress, such as those that have developed technologies or completed demonstration tests?

Exactly. Our focus won't be on those companies that are still in the early phases of developing or testing their technologies, but rather those that have at least to some degree already verified the practicality or commercial viability of their technologies. So we'll be targeting middle- to late-stage companies that are ready to commercialize or scale up their products, or in other words, growth-stage businesses.

This is because once a company completes its tests and begins work to scale up its business and send its technologies to market, it will need significantly more capital to set up and manage factories, equipment, facilities and so on. No matter how amazing its technologies may be, it will never get the world using them if it can't raise the necessary capital. Fund raising is a tough hurdle to clear, but it's one that all of these companies have to face. Another challenge insofar as the practical application of new technologies is concerned, is finding customers who will actually buy and use them.

By narrowing its scope to startups with promising technologies, our fund will help those companies to achieve steady growth through invested capital and marketing support.

Leveraging Industry Know-how to run alongside Climate Tech Companies

—— How would you describe MIP's strengths and significance when it comes to fund management?

I think that MC's complex know-how and network are huge strengths for this fund. To start, MC has a lot of financial savvy. Its Urban Development Group has been involved in fund businesses for more than 30 years, and over its history the shosha has built up a great deal of expertise as a financial investor. Its capabilities in sourcing (identifying investment projects), due diligence (investigating a potential investment's value, risks, etc.) and adding value to its investments should all prove to be significant advantages.

MC also has its own, unique brand of industry acumen. Not only has it accumulated diverse industry know-how and extensive professional networks through its operations, but it also has the ability to effectively combine all of those different assets. That skill to mix and match is something we can really take advantage of in our fund management business.

Another point worth mentioning is the knowledge that MC has gained in energy transformations (EX), which it has been focusing on under its latest management plan, Midterm Corporate Strategy 2024. Its EX operations span everything from renewables, hydrogen and the sourcing of lithium, nickel and other resources, to carbon-neutral construction materials and products like next-generation fuels. That knowledge will likely prove very beneficial to our fund.

—— So are you saying that MC's comprehensive know-how is what will distinguish your fund from other financial-service-type funds?

Absolutely. By applying MC's know-how and resources, and getting support from our strategic investors, we can collaborate and support businesses in a variety of ways, such as providing them with marketing help, introducing them to investors and customers, and extending them opportunities to make deals. Those will be big merits I think, and quite unique to our fund.

Even after their technologies are monetized, collaborations with MC and other initiatives could encourage these startups to develop their operations into more expansive EX businesses. Connections like that will provide impetus to energy transformations, which I believe in turn will help us get to net zero.

This Fund Will Help Shed Light on Our Collective Future

—— There are a lot of eyes on climate tech businesses now. What impressions are you getting from the front lines?

We just launched our fund this past April, but it has already invested in its first startup, a company based in the US. Our investors have praised the fund and shown trust in it, and their positive reactions to its first commitment have reminded us that they truly see this as a long-term partnership. Everyone at MIP has been buoyed by that response, and it has made us even more determined to make this fund succeed.

We're now considering several other investments, but the sheer number of companies and other funds that have reached out to us, both from here in Japan and overseas, is indicative of just how big a need there is for the Marunouchi Climate Tech Growth Fund.

MIP's staff from MC include not only pros from the shosha's financial operations, but also those experienced in its energy, infrastructure and other sectors. Our organization truly is a microcosm of MC's "collective capabilities." All of our employees share the same professional dedication to realizing net zero and making our future brighter, and I have no doubt that they will continue to demonstrate that in their day-to-day work.

—— I'd like to conclude our interview by asking you about your own hopes and aspirations for this fund business.

Leveraging funds to promote EX is a very tough challenge. Worldwide, there are still only a few startups in climate tech that have experienced significant growth, yet there remain many untapped domains with myriad barriers to success.

On the other hand, I'm getting a strong sense of the diverse interests in tackling climate change on a global scale. Players from many different industries are showing a willingness to work together and face these challenges head on, which is very encouraging. Both our fund's investors and portfolio companies include interests from Asia, western nations and other parts of the world. Together they form a nucleus of private enterprises, government bodies, academic institutions and a host of other organizations that are all keen to clear the barriers I mentioned and collaborate in ways that will support the growth of promising climate tech companies.

So yes, this is a challenging business, but our team is committed to taking it on, and as a member of that team, I'm determined to work with all of my colleagues at MIP to get us closer to net zero.

- Part 3 of this series will introduce an entrepreneur support program that is applying the results of research by Kyoto University.

-

Creating the Future with Climate Tech vol.1

Investments in Breakthrough Startups the Key to Achieving 2050 Goal -

Creating the Future with Climate Tech vol.2

The Launch of One of Asia's Largest Funds Accelerating Growth Investments into Climate Tech Companies -

Creating the Future with Climate Tech vol.3

MC Donates 600 Million Yen to Kyoto University Startup Support Program Finding Societal Solutions and Boosting Japan's Economy