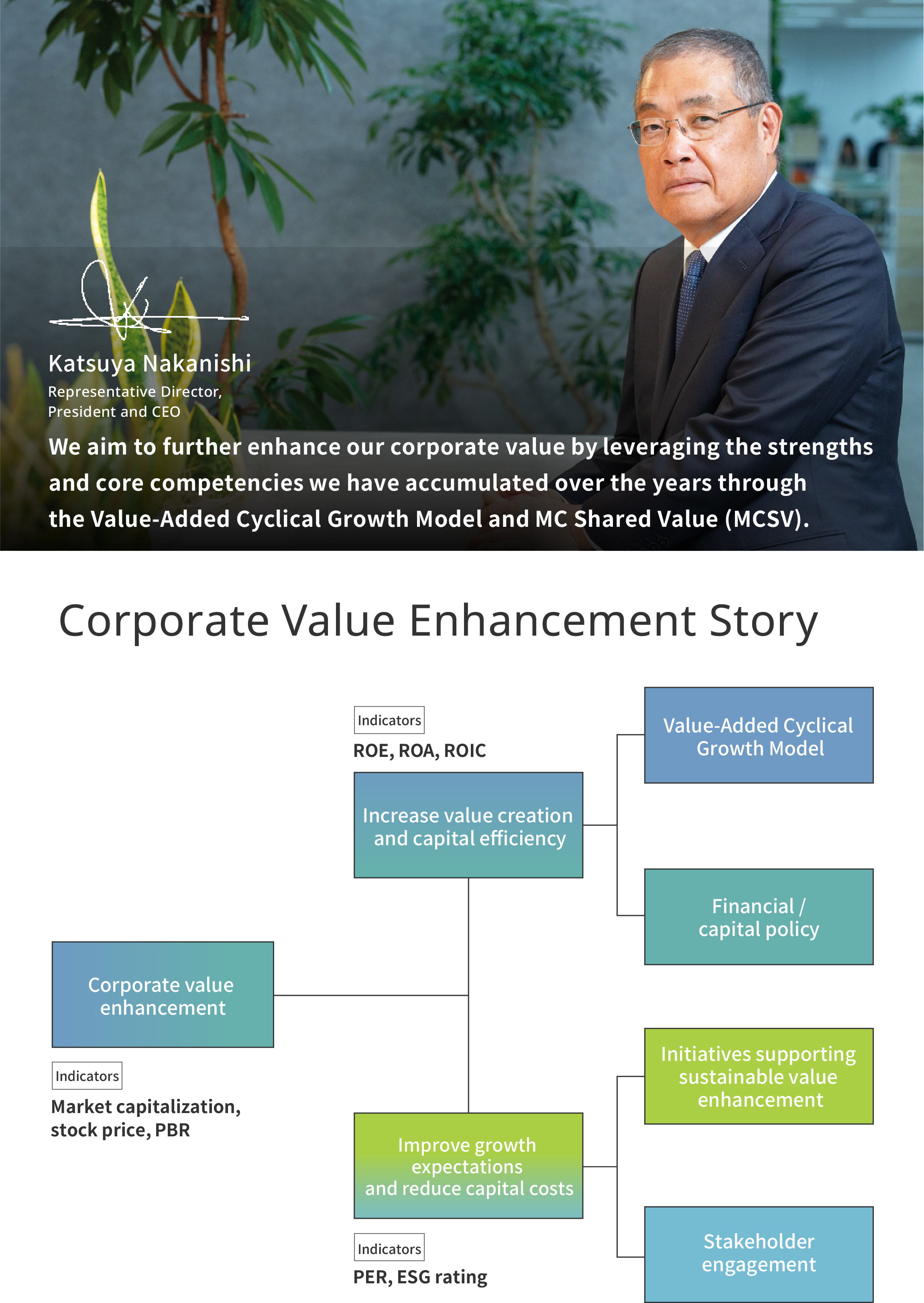

Message from our President and CEO

I would like to address several key topics of interest to all stakeholders:

- Our achievements under Midterm Corporate Strategy 2024, along with our current strategic priorities

- The guiding concerns and commitments that shaped the development of Corporate Strategy 2027 (CS 2027)

- Our evaluation of the current portfolio, and the initiatives underway to optimize it and enhance capital efficiency

- Our vision and efforts to create integrated value

Q1:Looking back at Midterm Corporate Strategy 2024, what are your achievements and management challenges?

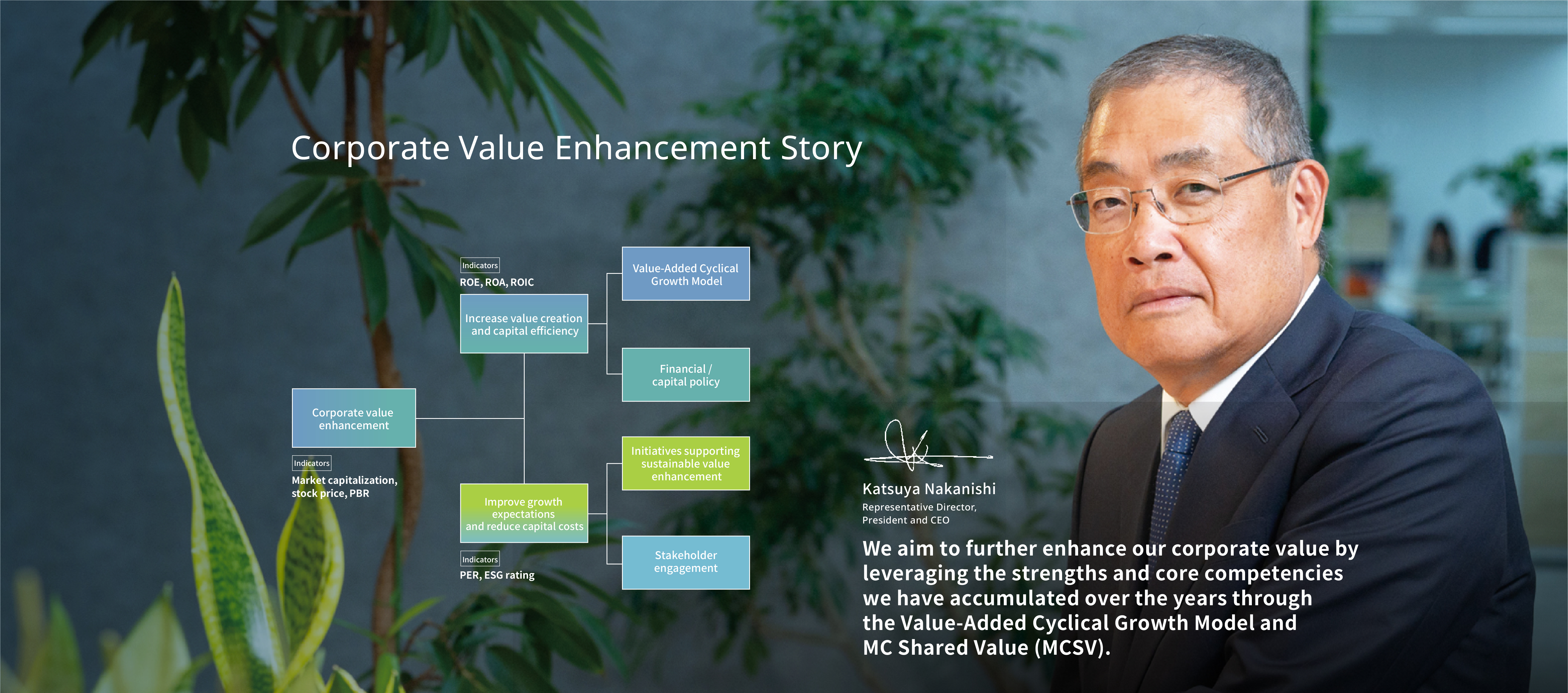

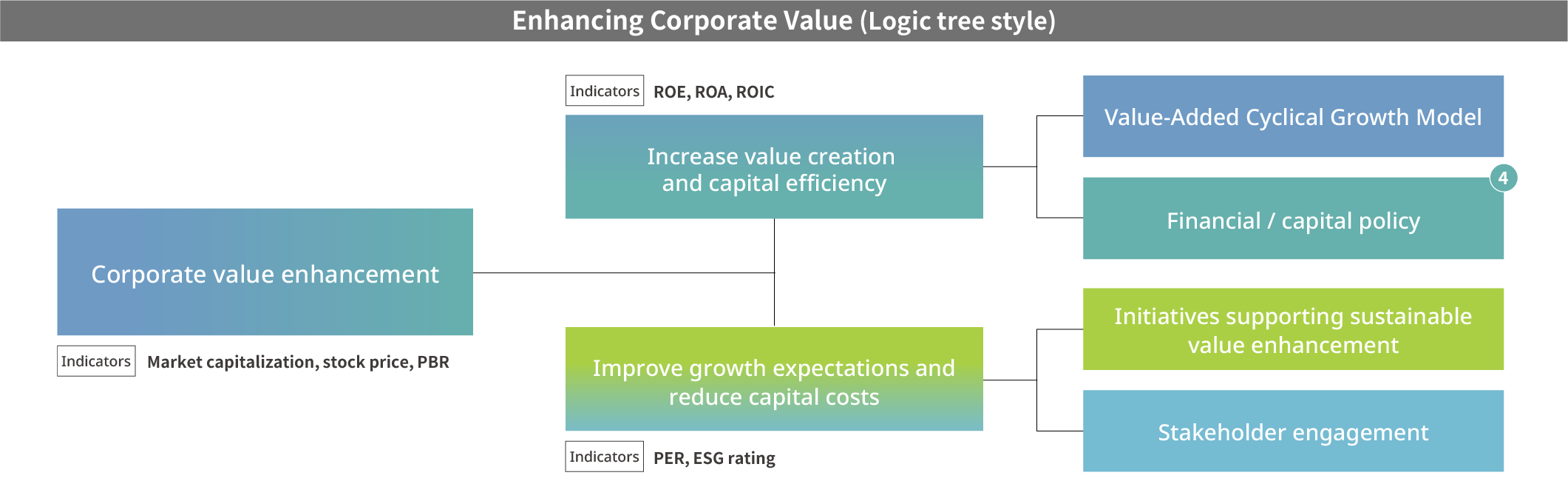

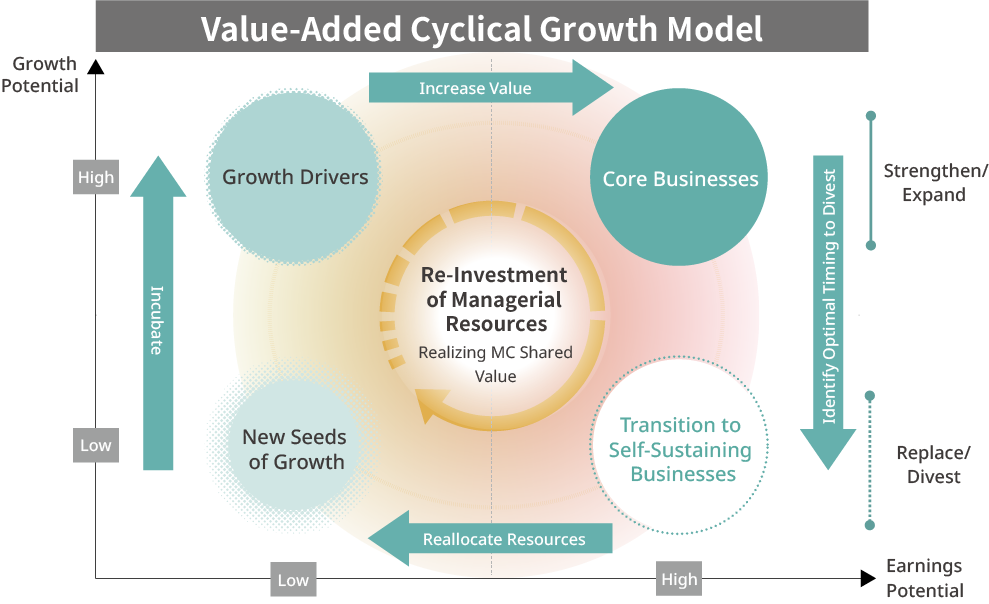

Under Midterm Corporate Strategy 2024 (MCS 2024), we articulated our vision for creating MC Shared Value (MCSV) in response to rapid shifts in the external environment, including global supply chain restructuring, the transition to a digital society, and advancements in decarbonization. Guided by this vision, we pursued a growth strategy centered on portfolio optimization, advancing our Value-Added Cyclical Growth Model through continuous business recycling, and implementing our “Creating a New Future” initiative, driven by our EX and DX strategies. We also prioritized strengthening the earning power of existing businesses and developing new ventures that transcend sector boundaries. To support these efforts, we reorganized the company to enhance the capabilities of each business segment and accelerate cross-industry business development.

To improve the earning power of existing businesses under the Value-Added Cyclical Growth Model, we initially focused on areas that could be enhanced without additional capital investment. At the end of FY2021, we had identified 160 underperforming and/or low-growth companies out of a total of 311 operating companies at the time*. By setting clear targets for each business segment, we encouraged autonomous business reviews and yield improvement initiatives. I personally led efforts to advance the “select and focus” process with a strong emphasis on capital efficiency (Enhance 1.0). As a result of the Enhance 1.0 initiatives, we achieved approximately ¥100 billion in profit improvement in FY2024 compared to FY2021. This contributed to significant gains in consolidated net income and underlying operating cash flow (CF), and allowed us to achieve our target of double-digit ROE. Additionally, thanks to exceeding our initial cash generation projections, we delivered strong returns to shareholders and investors through two dividend increases and large-scale share buybacks.

Despite these accomplishments, several priorities remain. First, we must continue to strengthen our earning power. The current business environment—marked by political, economic, environmental, and technological uncertainty, as exemplified by the Trump administration’s tariff policies—is increasingly volatile. In this context, it is essential to drive steady improvements to our profitability by starting from our existing businesses where we maintain a competitive edge. Building on the success of Enhance 1.0 under MCS 2024, our next strategy, Corporate Strategy 2027, will include Enhance 2.0. This initiative will involve additional capital investment and expand the scope to all business investments, aiming to further boost profits and elevate overall earnings.

A second priority is the creation of MCSV. While we did not launch any major MCSV projects during the MCS 2024 period, we are currently exploring several promising new concepts rooted in our existing businesses. Looking ahead, we intend to act at the right moment to transform these concepts into co-creation projects that combine our strengths.

- *Excludes affiliates or investments not subject to management control (e.g., dormant companies, or those slated for liquidation or withdrawal).

Related information

Q2:What issues and commitments influenced the formulation of Corporate Strategy 2027?

One of the first considerations was the strategic positioning of CS 2027 itself. We began detailed discussions in the fall of 2024, coinciding with the peak of the U.S. presidential election. At the time, we carefully evaluated how potential shifts in the global business environment, particularly in the event of President Trump’s re-election, might impact our strategic direction. Recognizing the possibility of significant changes, we concluded that it was precisely in such an uncertain environment that a clear and resilient strategy was most essential. Thus, we committed to formulating Corporate Strategy 2027. My personal conviction was to define the ideal form MC should pursue, one that enables us to maintain a sustainable growth trajectory. This requires a strategy that is both reliable and adaptable, capable of bold revisions in response to volatility while remaining grounded in long-term vision.

We also continued to emphasize quantitative management indicators focused on growth and efficiency, core priorities for us. However, several elements of these indicators reflect my own perspectives. Traditionally, we have used net income as a growth metric. For CS 2027, we shifted to cash flow from business activities, which excludes asset and business sales or one-time items, and decided to evaluate its average growth rate. This change reflects our belief that stable, recurring CF is a more accurate measure of our capacity for sustainable investments and shareholder returns. Its consistent growth is directly tied to shareholder expectations and the enhancement of our corporate value.

For efficiency, we reaffirmed ROE as our key indicator. However, rather than using vague targets like “medium to long-term” or “double-digit growth,” we set a specific goal of 12% or higher by FY2027. In addition, we announced a ¥1 trillion share buyback program in April 2025, aimed at rebalancing the capital accumulated during MCS 2024. I view this as a clear demonstration of our commitment to capital-efficient management.

To ensure the successful execution of CS 2027, we have strengthened our Value Creation Framework beyond the traditional Value-Added Cyclical Growth Model. It now comprises three strategic initiatives: Enhance, Reshape, and Create. These initiatives will guide us in achieving both growth and efficiency, while maintaining our shareholder return policy of progressive dividends and flexible share buybacks.

Related information

Q3:How would you evaluate the current portfolio? What are your ideas for optimizing the portfolio, and what steps will you take to improve capital efficiency?

Our current portfolio spans a wide range of industries, including mineral resources, natural gas, automotive, and food. This diversity reflects the company’s broad industrial footprint, varied business models, and global presence. These characteristics are among our greatest strengths. They provide resilience against shifts in market conditions and allow us to detect early signs of change in one industry that may affect others. This capacity is essential for identifying new business opportunities and plays a key role in advancing cross-industry initiatives such as MCSV creation.

CS 2027 outlines our vision to “optimize our business portfolio to achieve sustainable growth and increase our corporate value by leveraging our integrated strength in response to a rapidly changing business environment.” In a world where trends are increasingly difficult to predict, even in the short term, we remain committed to building an optimal portfolio that evolves with the times while continuing to strengthen each business sector.

One example is our involvement in the crop-based biofuels business, which is expected to contribute to the transition toward a decarbonized society. Because we operate in both the food and energy sectors, we were able to act early in developing a bio-resource value chain, creating a new cross-industry integration. This includes leveraging the Food Industry segment’s global networks to establish a strategic alliance through a MOU with a major grain company , as well as advancing our initiatives in sustainable aviation fuel production within the Environmental Energy segment. Our long-term vision is to build a portfolio composed of multiple strong businesses, each capable of enhancing corporate value through active management. We expect these businesses to grow together and generate synergies where their activities intersect.

To improve capital efficiency, our basic policy is to strengthen the earning power of existing businesses through our Value Creation Framework, with a particular focus on the Enhance and Reshape initiatives. We are pursuing operational efficiency improvements through technologies such as AI, while also working with urgency to build a solid earnings base and restructuring where needed. This includes using our business knowledge to make additional investments and expand our footprint. A recent example is our salmon farming subsidiary Cermaq’s acquisition of businesses from Grieg Seafood , announced in July 2025. During the formulation of CS 2027, I personally reviewed all 244 of our operating companies to assess their potential for earnings improvement. This review confirmed that many of our existing businesses still have room to grow. We are confident that in areas where we have deep expertise and competitive strengths, we can deliver tangible results in a shorter timeframe. To support these efforts, we have made structural adjustments, including setting ROE targets for each business segment and strengthening the link between executive compensation and ROE performance.

Related information

Q4:What are your aspirations for realizing integrated value, and how will you approach this goal?

Our advantage lies in our integrated strength, which is rooted in our diversity. While diversification is also a feature of other business models, such as private equity funds, I believe our true competitive advantage comes from how we leverage that diversification to create integrated strength. This belief has grown stronger throughout my more than three years in management.

Beyond strengthening their individual business activities, our business segments aim to collaborate and combine their capabilities to generate synergies. As the business environment continues to evolve and new opportunities emerge, we are focused not only on pursuing synergies, but also on creating new MCSV through new cross-industry integrations. We remain committed to enhancing corporate value and maximizing our integrated value through these efforts. Currently, there are only a few projects that we can confidently highlight as examples of this approach. However, during the period covered by MCS 2024, we successfully developed the organizational structures and corporate culture needed to support MCSV creation. We also expect that the Corporate Venture Capital Office and the AI Solution Task Force, both established in 2025, will play important roles in generating future business opportunities.

Over the past year, some investment projects were postponed due to factors such as high share prices, a weak yen, and negotiation challenges. Despite these delays, we have made progress on several new concepts aimed at generating synergies between business segments. Projects like the bio-resource value chain initiative are now moving toward consideration for large-scale investment.

Looking ahead, we will continue to bring together our strengths, including the trust and reliability we have earned from stakeholders and the global intelligence we gather across our business fields. By fully leveraging our integrated strength and addressing the societal issues identified in our materiality, we aim to create new value and maximize our integrated strength.

Related information

Q5:Do you have any final comments for shareholders and investors?

Since assuming the role of President and CEO in 2022, I have placed a strong emphasis on dialogue with shareholders and investors. This commitment has led to more frequent and meaningful engagement, involving not only myself but also our independent directors and the management teams of our business segments.

At the Investor Day event held in June 2025, speakers included the CSEO and the CEOs of four business segments, one of whom also leads Energy Transformation and AI Solutions. Many attendees shared that hearing directly from these executives provided a deeper and more comprehensive understanding of our strategies in each business area. Feedback and advice from stakeholders are promptly shared with management and incorporated into our business activities as soon as practically possible. We will continue to maintain this two-way dialogue approach without change.

Looking ahead, we will build on the achievements of MCS 2024 as a foundation for further growth through the Value Creation Framework outlined in CS 2027. This will include expanding our cash generation capacity and continuing to deliver returns that meet shareholder expectations. We view the high level of uncertainty in the current business environment as a valuable opportunity to leverage the integrated strength we have cultivated over many years. We are committed to creating new value through bold yet prudent actions.

Related information