Message from our CFO

Overview of Financial and Capital Policies Under Midterm Corporate Strategy 2024

As outlined in last year’s Integrated Report, under Midterm Corporate Strategy 2024 (MCS 2024), we have pursued sustainable growth in corporate value. As CFO, I have prioritized four key factors: (1) promoting the recycling of existing businesses and improvement in the rates of return, (2) disciplined growth investment and risk management, (3) shareholder returns aligned with market expectations, and (4) maintaining financial soundness.

Our efforts to enhance the performance of existing businesses were guided by the Value-Added Cyclical Growth Model. We identified approximately 160 operating companies that faced profitability and growth challenges, and worked to improve their efficiency, or in some cases, divest those businesses. These initiatives contributed to an increase of approximately ¥100 billion in consolidated net income compared to FY2021. The introduction of ROE targets for each business segment as a monitoring indicator has helped embed capital efficiency-conscious management across business segments. As a result, we have achieved the double-digit ROE target set in MCS 2024. While this marks a significant milestone, we view it not as a final goal but as a foundation for continued efforts to further improve capital efficiency.

Our second focus was disciplined growth investment and risk management. Over the three-year period, we made a total of ¥2.9 trillion in strategic investments in the EX and DX fields — key investment priorities under MCS 2024 — including ¥0.3 trillion in fund management. This total was slightly below our initial ¥3 trillion target, reflecting our commitment to investment discipline and rigorous project selection amid significant macroeconomic changes, rather than strict adherence to the original plan.

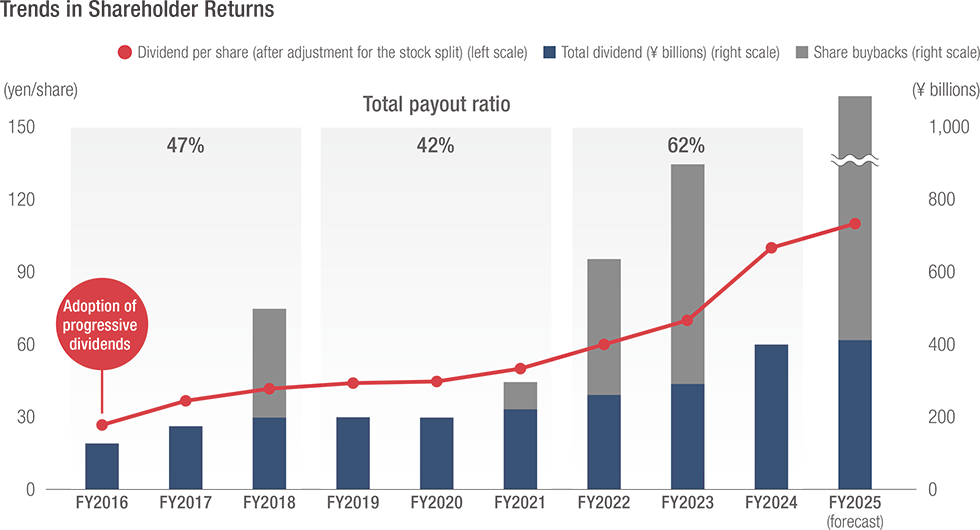

In collaboration with the CSEO organization, which maintains direct engagement with shareholders and investors, we worked to deliver shareholder returns in line with market expectations. When MCS 2024 was first announced, we set a total payout ratio target of 30% - 40%, aiming to deliver progressive dividends while retaining the flexibility to provide additional returns based on cash flow trends. As our earning power improved, we increased the dividend per share from ¥60 to ¥70, and then to ¥100. We also flexibly executed additional returns through share buybacks. As a result, total shareholder returns during the MCS 2024 period reached approximately ¥1.9 trillion, including dividends of about ¥950 billion and share buybacks of about ¥970 billion, resulting in a total shareholder return ratio of 62%.

In terms of maintaining financial soundness, we achieved a positive free cash flow (FCF) after shareholder returns and upheld a strong Single-A credit rating through our managed cash flow system.

We attribute the achievement of all quantitative goals under MCS 2024, including income and cash flow targets, to the growth initiatives led by individual businesses and the effective application of the Value-Added Cyclical Growth Model, which strengthened the resilience of our portfolio.

Financial and Capital Policies Under CS 2027: Our Thoughts

Quantitative Targets

In Corporate Strategy 2027 (CS 2027), we have set two quantitative targets aimed at achieving both growth and efficiency. First, we have adopted underlying operating CF as a growth indicator, with a target of an average growth rate of 10% or higher. We selected underlying operating CF as a more effective measure of earning power, given that net income can fluctuate year to year due to capital recycling gains and losses and one-time items. Historically, the average growth rate of underlying operating CF has been around 8%, so the 10% target represents a meaningful step up. However, based on strategy discussions and reviews with each business segment, we believe this target is fully achievable through our Enhance, Reshape, and Create initiatives.

Aligned with our focus on underlying operating CF, we will continue our basic approach of continuously recovering returns from equity-method affiliates through dividends.

Going forward, we will clarify whether we intend to pursue these businesses by converting them into subsidiaries or treating them as investments to be harvested through dividends and divestitures. This approach enables us to autonomously manage the resulting cash flows.

On the other hand, while we will continue to use ROE as an efficiency indicator, the previous target of double-digit ROE under MCS 2024 has been refined to a clearer goal of 12% or higher in FY2027. Our estimated cost of equity is approximately 8-10%, based on the Capital Asset Pricing Model (CAPM). We estimate that ROE of at least 10% is necessary to consistently maintain a price-to-book of 1.0 or higher. However, we are aiming for an ROE of 12% or more, which not only exceeds our cost of equity but also better reflects market expectations. Achieving this target will be challenging in the current business environment, but we are committed to reaching this level by implementing the measures outlined in CS 2027, particularly by strengthening our earnings base through the Enhance initiatives, which aim to increase the value of all of our existing businesses. That said, we do not see 12% ROE as our final goal, and we will continue striving for even higher levels over the medium to long-term.

We also recognize the ongoing need to reduce our strategic shareholdings to improve capital efficiency. Every year, we review the rationale for these holdings from both qualitative and quantitative perspectives and report the findings to the Board of Directors.

In FY2024, we reduced strategic shareholdings by a total of ¥59.9 billion in market value as of the end of FY2024, including ¥14.1 billion in deemed shareholdings contributed to retirement benefit trusts. This resulted in a 10% year-on-year reduction, and the book value of our listed strategic shareholdings now accounts for less than 10% of our net assets. Going forward, we will continue to steadily reduce these holdings by gradually selling shares (taking market conditions into account) if we determine that the rationale for holding them has diminished.

We have adopted two quantitative targets: ROE improvement and growth in underlying operating CF.

However, we will not prioritize one over the other. Instead, our goal is to achieve both efficiency and growth potential simultaneously

- *Note: Includes non-listed FVOCI

Financial Soundness

We previously used the investment leverage ratio as our primary indicator of financial soundness. However, we have now switched to the net debt-to-equity ratio (net D/E ratio), a more widely recognized metric, to provide greater clarity for our shareholders and investors. Our financial soundness has significantly improved, supported by our adoption of positive FCF post shareholder returns as a target under MCS 2024.

As a result, our net D/E ratio stood at a relatively low 0.29 as of the end of 2024. While the appropriate level of leverage depends on the risk concentration of our assets, we estimate that a net D/E ratio of around 0.6 represents the upper threshold for maintaining our current Single-A flat credit rating. Using this as a benchmark, our policy under CS 2027 is to utilize leverage within a range that ensures the continued preservation of financial soundness.

From Enhance 1.0 to Enhance 2.0

As outlined above, under our previous midterm corporate strategy, we pursued Enhance 1.0 initiatives focused on businesses with low profitability or growth. These efforts primarily aimed to improve returns or recycle underperforming businesses. Under CS 2027, we are strengthening this approach through Enhance 2.0, which targets value improvement across all 244 operating companies, including those already delivering satisfactory returns. We believe that in today’s unpredictable business environment, reliable profit growth depends on focusing on existing businesses, where we have deep familiarity, and pursuing value enhancement measures such as bolt-on investments using our own financial resources, as well as exploring asset recycling options within individual businesses. A key feature of CS 2027 is the allocation of substantial funds for these purposes. (See Capital Allocation Strategy).

Specifically, we have set three-year profit and ROIC targets for all operating companies. Progress toward these targets will be regularly reviewed by management, including the President and CEO. By building on the solid foundation of our existing businesses, we aim to further improve profitability and capital efficiency through expanded and bolt-on investments.

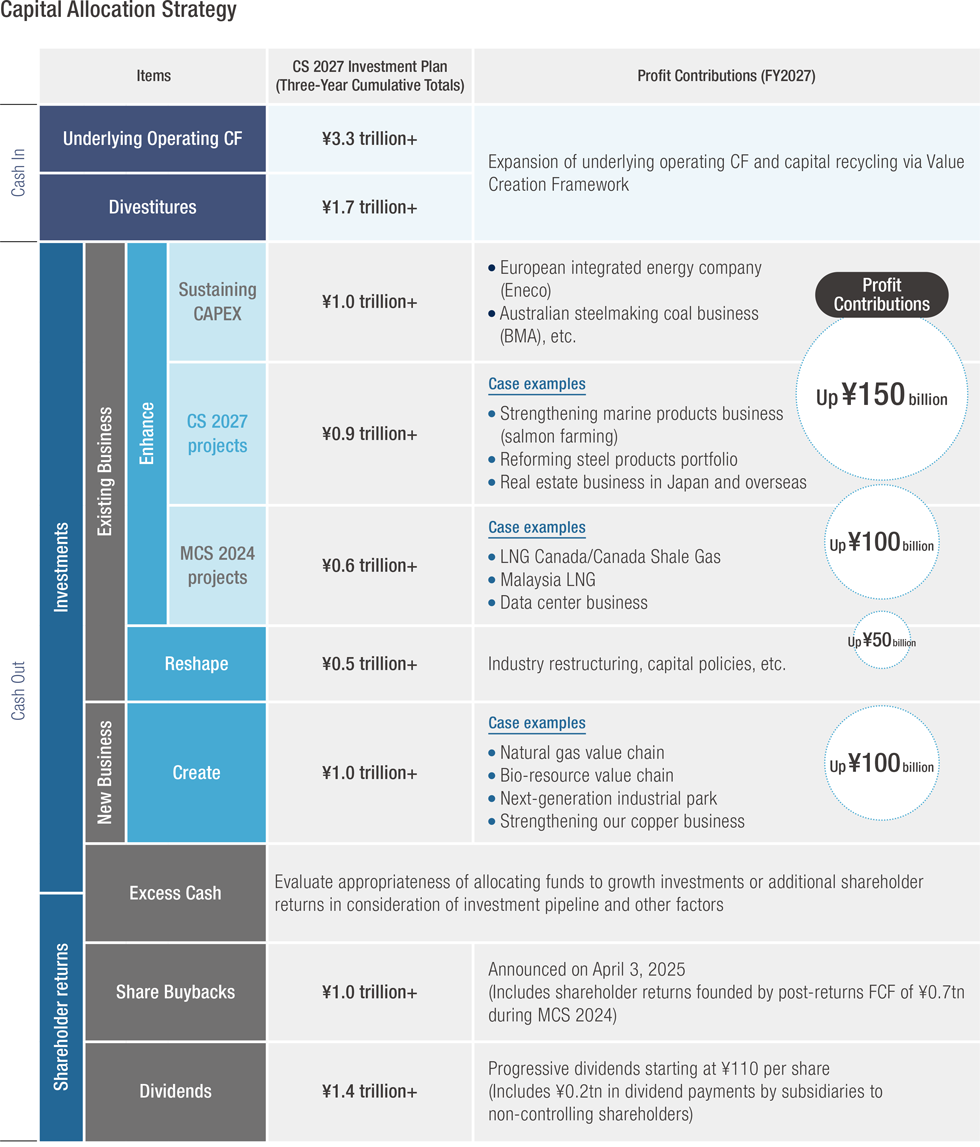

Capital Allocation Strategy and Shareholder Returns in Line with Market Expectations

In addition to approximately ¥1 trillion in sustaining CAPEX for existing businesses, CS 2027 allocates around ¥3 trillion for expansion and new investments aligned with the Value Creation Framework priorities of the Enhance, Reshape, and Create initiatives. This represents an increase of ¥1 trillion compared to the ¥2.9 trillion invested under MCS 2024 (which included ¥1 trillion in sustaining CAPEX and ¥0.3 trillion in fund management investments). These investments will be funded through expanded underlying operating CF, asset recycling, and by leveraging the improvements in financial soundness achieved under MCS 2024.

Regarding shareholder returns, in April 2025, we announced the continuation of progressive dividends and increased dividends to ¥110 per share—a ¥10 increase over FY2024—bringing the total payout over the three-year period to ¥1.4 trillion. We also announced ¥1 trillion in share buybacks for FY2025.

The ¥10 dividend increase was determined to be sustainable under our progressive dividend system, based on our assessment of continued strong cash generation capacity. We will flexibly consider further dividend increases, depending on improvements in our earning power and underlying operating CF.

The decision to implement ¥1 trillion in share buybacks was primarily driven by the need to rebalance accumulated capital, reflecting the significant improvement in financial soundness under the previous corporate strategy and the current state of our investment pipeline.

This move also underscores our commitment to capital efficiency-conscious management. We will maintain a flexible approach to additional shareholder returns, based on comprehensive evaluations of business performance, investment pipeline status, overall financial soundness, and other relevant factors.

- *¥1 trillion in share buybacks was announced in April 2025, including ¥0.7 trillion funded by FCF post shareholder returns under MCS 2024.

Enhancing Risk Management and Strengthening Disclosure

Given the rising uncertainty in the business environment over the past few years, we recognize the need to develop and implement an enhanced risk management framework.

While our current framework is robust, we continuously review and update our systems to address emerging risks and the increasing complexity of existing ones.

As part of our intensive risk management efforts, we periodically assess our business portfolio from multiple perspectives, including business segment, industry, country, and currency. Based on these reviews, we manage the level of risk assets in specific areas to ensure they remain within our financial capacity. This approach allows us to minimize the impact on our financial soundness in the event of significant losses within any one area.

In FY2024, we incurred a loss due to fraudulent activities at a trading business. We treated this not as an isolated incident, but as a vital lesson. Following a thorough investigation, we implemented company-wide systems to prevent recurrence and are actively identifying and applying measures to further strengthen our risk management capabilities.

We continue to enhance our response to environmental and social risks, recognizing that appropriate management of these issues and improved disclosure are essential for sustaining business activities in an uncertain environment.

We also believe these initiatives continue to lower our capital costs. In preparation for the upcoming disclosure standards from the Sustainability Standards Board of Japan (SSBJ), we are working to enhance our sustainability disclosures. Led by the finance and corporate accounting departments, we are working collaboratively with the corporate teams involved in areas such as climate change and human capital to identify material issues and evaluate their financial impact in alignment with the SSBJ standards.

Final Thoughts

Under MCS 2024, we accelerated initiatives aligned with the Value-Added Cyclical Growth Model, aiming to improve asset efficiency. As a result, we successfully achieved all of the quantitative targets we had set. While we made reasonable progress in moving away from businesses that failed to meet required rates of return or demonstrated low growth, we recognize that further improvements in asset efficiency are still possible.

Regarding the external environment, concerns about the economic outlook continue to grow. At the same time, the business landscape is rapidly evolving amid a complex mix of geopolitical and economic risks, contributing to rising uncertainty.

In light of these domestic and international conditions, we remain strongly committed to not only reinforcing our current earnings base but also building a foundation that will support the next generation. We will continue to devote our efforts to achieve the CS 2027 targets through open, twoway communication with our shareholders and investors.

Related information