Message from our CSEO

A Look Back at the Capital Markets

Since assuming the role of CSEO in April 2023, I have remained committed to deepening and expanding our engagement with shareholders, investors, and other stakeholders. At MC, we believe that sustainable growth in corporate value requires not only clear communication of our strategic initiatives, but also a genuine commitment to listening to stakeholder feedback and incorporating it into our management activities.

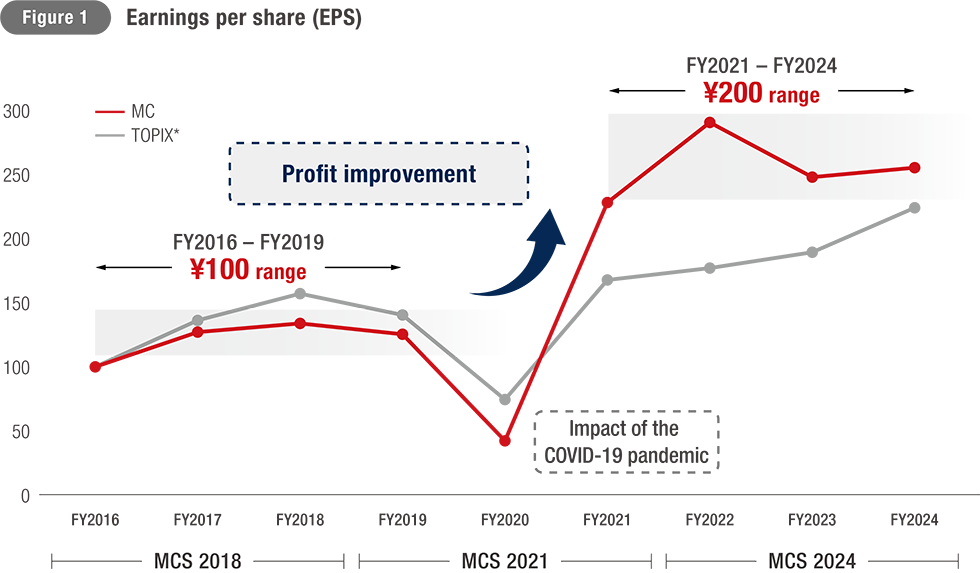

Reflecting on our progress, the Value-Added Cyclical Growth Model has enabled us to build a robust portfolio and increase our earning power. Under Midterm Corporate Strategy (MCS) 2018, our earnings per share (EPS) were in the ¥100 range; by MCS 2024, they had grown to the ¥200 range (see Figure 1).

- *A comparison of the TOPIX average’s fluctuations, expressed as an index

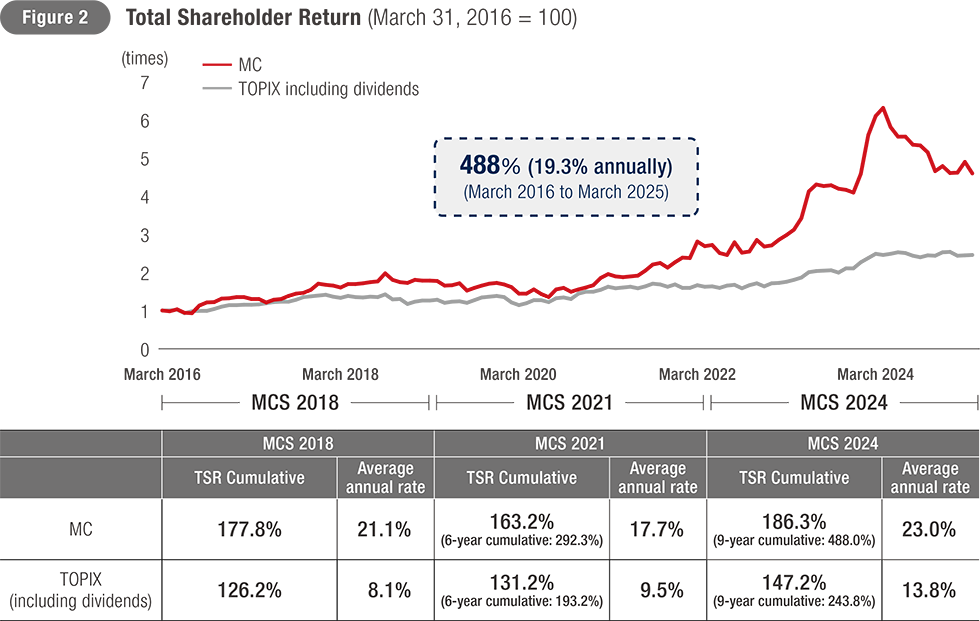

In terms of shareholder returns, we have steadily increased dividends in line with profit improvements and market expectations since adopting progressive dividends in FY2016, taking our dividend per share from ¥27 in FY2016 to ¥110 in FY2025.

We have also flexibly implemented share buybacks, based on our investment pipeline and financial soundness —¥370 billion in FY2022, ¥600 billion in FY2023 and a planned ¥1 trillion in FY2025. As shown in Figure 2, this steady profit growth and proactive shareholder return strategy are also reflected in the growth of Total Shareholder Return (TSR), earning us a strong level of recognition in the capital markets.

At the same time, we acknowledge that some of our core businesses have been temporarily affected by a challenging and uncertain business environment and are still in the process of recovery. Additionally, certain projects aimed at creating MC Shared Value (MCSV), a key goal under our previous midterm strategy, have yet to bear fruit.

While we believe that the vision and quantitative targets of Corporate Strategy 2027 (CS 2027) are generally understood by stakeholders, we have also received feedback suggesting that some find it difficult to differentiate between initiatives in our previous midterm corporate strategy and the current “Enhance” initiatives designed to achieve significant profitability improvements in our existing businesses in the period to FY2027. We recognize the need to improve the clarity of our messaging in this area.

Achieving Further Improvement in Corporate Value

Our top priorities to achieve further improvement in corporate value in the current business environment are the steady implementation of the “Value Creation Framework” outlined in CS 2027, including ongoing efforts to enhance profitability and growth potential, especially for existing businesses.

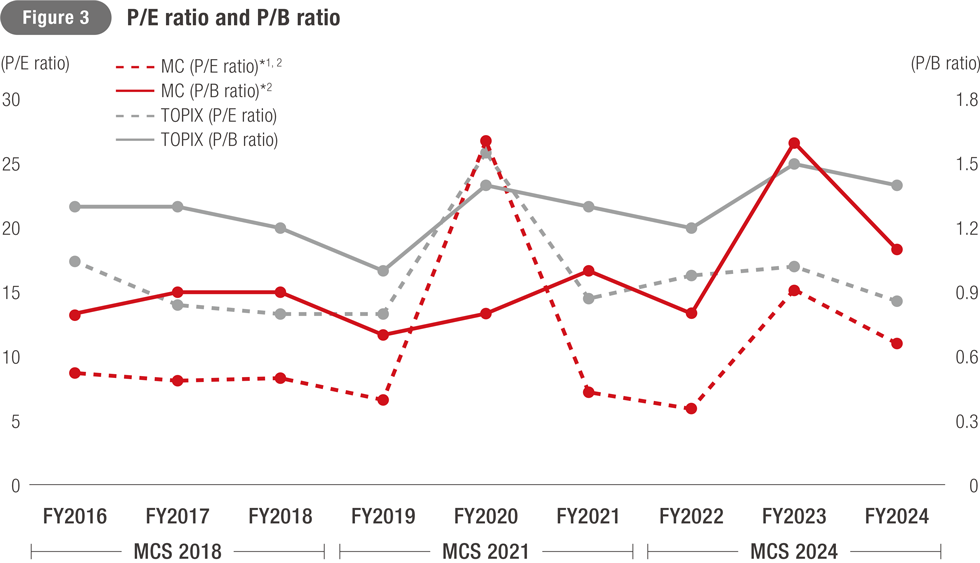

As CSEO, my focus will be to further clarify our growth strategies to raise shareholder and investor confidence and ultimately, improve our P/E ratio (see Figure 3).

We are aware that investors, including overseas and individual investors, are encountering MC as an investment opportunity for the first time. The sogo shosha, or trading and investment company, is a uniquely Japanese business model, and our business portfolios are diverse and complex. We are aware that these characteristics may make it difficult for investors to understand some aspects of our business. To address this, we are committed to engaging with our investors in ways that reflect their perspectives.

During the CS 2027 period, we will focus on providing clear explanations and disclosures related to our unique investment opportunities, growth strategies and business activities, including their scalability and reproducibility.

For example, we are providing more detailed information about our initiatives in core business areas, such as natural gas, mineral resources, automotive, and salmon farming, through the MC Shared Value Creation Forum and other channels.

However, we recognize the need to further improve disclosures for our smaller-scale businesses and cross-segment initiatives, such as MCSV projects. Given the breadth of our operations, detailing each individual businesses alone does not fully capture MC’s overall strategic direction and competitive advantages. We are therefore exploring approaches that allow us to better communicate our strategic direction more effectively, such as presenting growth strategies on a cross-segment or partially consolidated basis, supported by relevant quantitative data.

We will also continue to enhance our disclosure and communication efforts by leveraging the unique characteristics of various channels, including video content, integrated reports and other media.

To drive further growth, we must continue evolving in response to societal expectations and emerging needs. In my new role as Head of Capital Alliances, I am responsible for driving change by leveraging our partnerships with financial institutions and venture companies, and integrating those external catalysts into our management strategy to accelerate the speed and scale of our “Reshape” initiatives under CS 2027.

- *11 P/E ratio is calculated by dividing the closing price at the end of the fiscal year (Tokyo Stock Exchange share price) by the basic net income (loss) per share (attributable to owners of the parent).

- *22 Stock prices between FY2015 and FY2024 show the highest and the lowest stock prices after the stock split.

Related information