Investor Day

In June 2025, we hosted the MC Shared Value Creation Forum, welcoming 68 institutional investors and analysts.

As the first year of Corporate Strategy 2027 (CS 2027), the forum showcased key policies and frameworks that form the foundation of the strategy.

This special feature focuses on the Enhance, Reshape, and Create initiatives, and shares candid insights from discussions held with participants throughout the event.

Materials Solution Group

Ko Imamura

Executive Vice President

Group CEO, Materials Solution Group

Since joining MC in 1990, Mr. Imamura has spent nearly 30 years in the chemicals industry. His experience spans a wide range of areas, including trading, business investments, and company-wide investment screening as a member of the Investment Committee. He has held several key leadership roles, including Division COO of the Performance Materials Division, President of Metal One, and Group CEO of the Chemicals Solution Group. He assumed his current position in 2024.

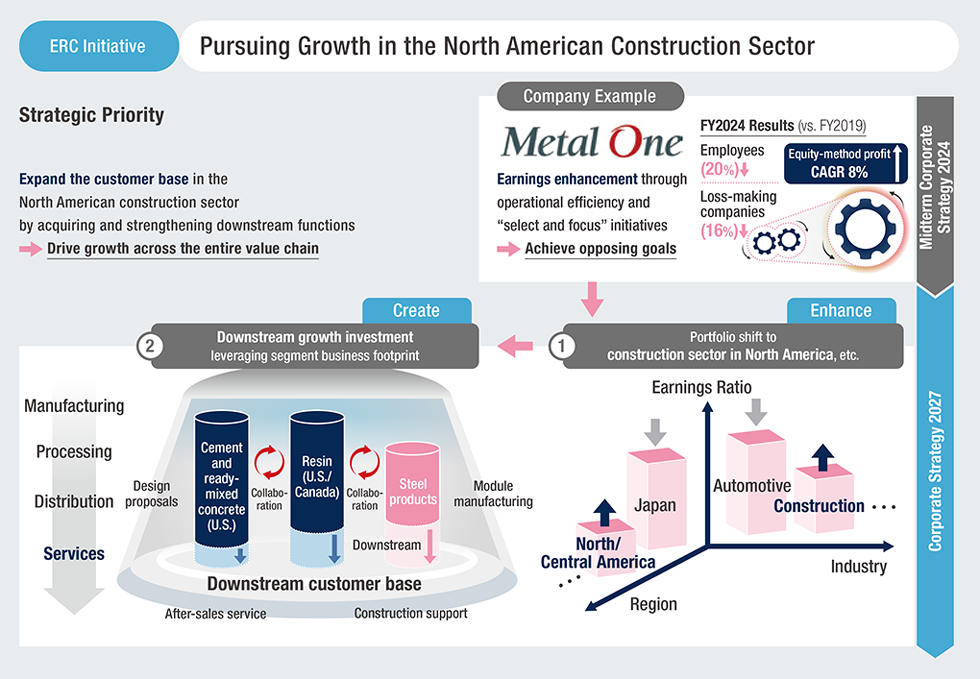

North America has been identified as a key region for investments aimed at achieving discontinuous growth. What specific products are being targeted?

Rather than targeting specific products, our focus is on building competitive business models—defining what risks to take, which functions to develop, and what returns to pursue. This includes strategies like local production for local consumption and niche global approaches. That said, if I were pressed to name one, it would be building materials. The U.S. accounts for 60 - 70% of the segment’s profits, driven by businesses such as steel distribution, plastic building materials, and cement and ready-mixed concrete—all fundamentally tied to construction and infrastructure. By taking a holistic view of the construction sector beyond individual product lines and leveraging these networks, we aim to invest in local production for local consumption businesses within North America’s construction and infrastructure space, where we already have a presence. This strategy encompasses both horizontal expansion and vertical downstream development. While sectors like public infrastructure and housing are influenced by economic trends, I expect demand to remain stable, supported by factors such as U.S. population growth and the need for infrastructure renewal driven by national resilience efforts.

Food Industry Group

Hideyuki Hori

Executive Vice President

Group CEO, Food Industry Group

Since joining MC in 1991, Mr. Hori has focused primarily on grain-related businesses, including trading and business investments across the U.S., Brazil, and other countries. He has held key leadership roles such as General Manager of the Grain & Oilseeds Department and General Manager of the Corporate Strategy & Planning Department, and also served as a director of Olam Group. During his tenure in Corporate Strategy & Planning, he led the development and implementation of Midterm Corporate Strategy 2021. Mr. Hori assumed his current position in 2024.

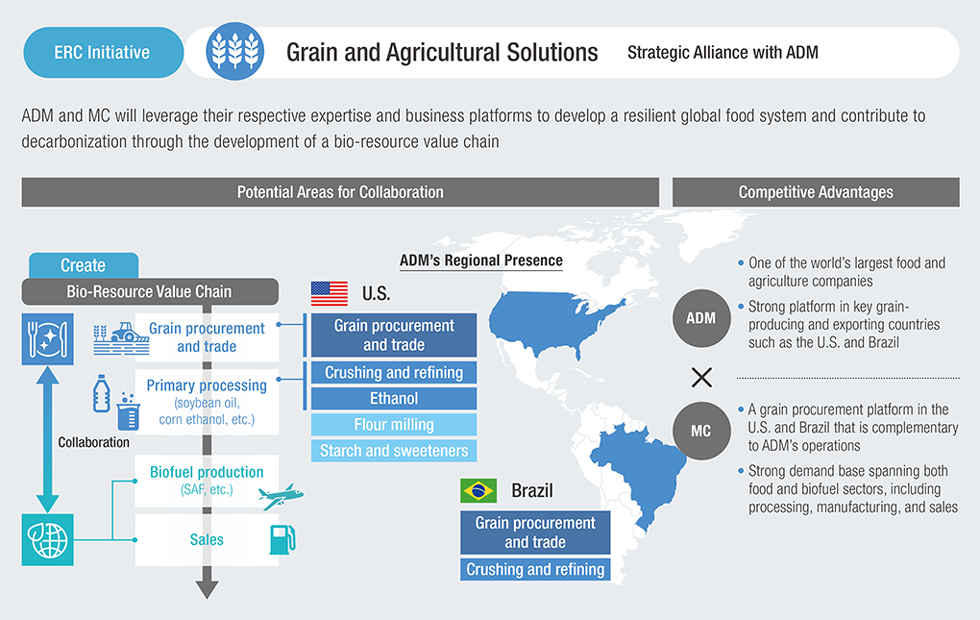

In many cases, partnerships between Japanese trading and investment companies and large companies tend to remain at a surface level. If the partnership with ADM is limited to traditional trading, it wouldn’t represent a significant shift. How do you specifically envision the strategic direction of this partnership moving forward?

While other trading and investment companies have also engaged in the grain business and worked with major grain companies, our partnership with ADM stands apart. What ADM values is MCSV. Biofuels are a critical area for major grain companies, given the potential of soybean oil and corn ethanol as renewable energy sources. In our case, the partnership goes beyond traditional grain trading to include collaboration in biofuel-related sectors. ADM recognizes our strong presence in the energy and resource domains, along with our expertise in areas such as sustainable aviation fuel (SAF). With this in mind, they see MC not only as a grain industry player but also as a strategic partner capable of contributing across multiple sectors. While I can’t share further details at this stage, we have presented ADM with a proposal built around a unique MC narrative that integrates food and energy, and we are currently engaged in ongoing discussions.

Mobility Group

Shigeru Wakabayashi

Executive Vice President

Group CEO, Mobility Group

Since joining MC in 1986, he has spent a total of 19 years stationed in Thailand, Europe, and India, consistently working in the Isuzu Motors business. While in India, he was involved in the launch of Isuzu Motors India. During his six-year tenure as Division COO of the Isuzu Motors Division, he focused on new business development. He assumed his current position in 2022

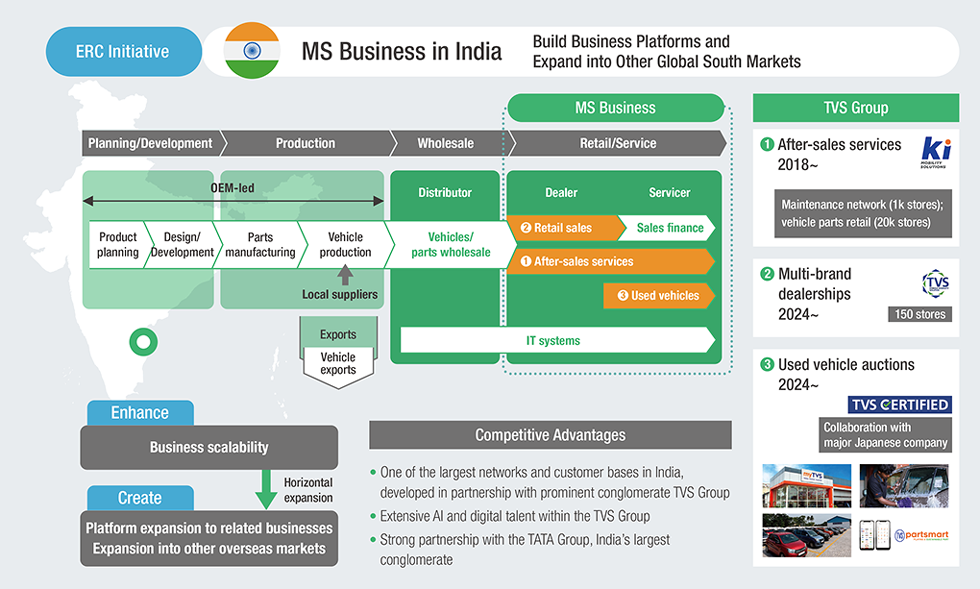

The profit scale of the Mobility Services (MS) business appears smaller compared to other trading and investment companies. What are the factors behind this, and what strategies are in place to drive future growth?

One factor is that we have historically focused our business development on building strong relationships with automotive OEMs and developing Value Chain (VC) business, particularly in the ASEAN region. Our current strategy takes a dual approach: continuing to strengthen these existing initiatives while also positioning MS as a new core business by leveraging our extensive industry networks and customer touchpoints. For example, in India, we are collaborating with the TVS Group — a prominent local conglomerate with one of the country’s largest networks and customer bases — to launch businesses in after-sales services, multi-brand dealerships, and used vehicle auctions. Looking ahead, we plan to expand into other Global South markets. In Japan, a country facing advanced challenges such as an aging population, we are developing business models that address these issues, including on-demand bus services and auto leasing. Our long-term vision is to become a fleet management company that builds a vehicle ecosystem in anticipation of the autonomous driving era. Beyond financing and after-sales services, we aim to expand into used vehicles, improve fleet utilization rates, and ultimately connect these services to energy and battery management.

Related information