Decarbonizing and electrifying mobility industries is crucial to realizing carbon-neutral societies. In April 2024, MC established its e-Mobility Solution Division as a new arm of the company's Mobility Group.

For the most part, e-mobility refers to electric vehicles (EVs), which despite being relatively better for our planet than their fossil-fuel-driven counterparts, have been slow in replacing them. This is due to the many complex challenges that remain in manufacturing, selling and owning them, challenges that will only be overcome by creating new cross-industry businesses and accelerating moves to decarbonize and electrify them. In the first half of our roundtable discussion with members of MC's e-Mobility Solution Division, we interview Division COO Yusuke Takeuchi, who has been leading the organization with a calm but resolute approach. (Interviewer: Kazuhiro Sekine, Asahi Weekly Digital GLOBE+ Editor in Chief)

A Once-in-a-Century Paradigm Shift

—— I'd like to start by asking you what's behind the global push to decarbonize mobility.

Work that's invested in reaching carbon zero, meaning eliminating all of our greenhouse gas emissions, is crucial to the survival of life on our planet, including that of humankind. This is a very serious matter for global industries, and thus must be addressed by each and every one of them. Mobility is a particular area of concern and is now in the midst of a major, once-in-a-century revolution which in recent years has been defined by the acronym CASE. The C stands for Connected, referring to the linking of vehicles to the internet; the A stands for Autonomous, meaning self-driving; the S stands for Shared (and also Service here in Japan); and the E stands for Electric, referring to switching from fossil-fuel-driven vehicles to EVs or hybrids. Advances in CASE will play a vital role in realizing sustainable societies. The Electric component, or more specifically electrification, is obviously important because it will help us to reduce our consumption of fossil fuels and lower CO2 emissions. Concerted efforts are being made all over the world to speed up EV-market growth, and I think introducing more EVs and expanding their worldwide sales and use are key themes in today's mobility industries.

—— Would you say that the initials EV have become synonymous with the paradigm shift in mobility?

Yes I think so, but growing the EV market alone will not get us to carbon zero, because greater use of EVs will also drive up the demand for electricity. As we work to help roll out more EVs and other types of electrified mobility options, we're also conscious of our mission to promote an industry-wide decarbonization of energy.

EVs an Irreversable Trend, Despite Slow Growth in Japan

—— How much of a global market share do EVs have?

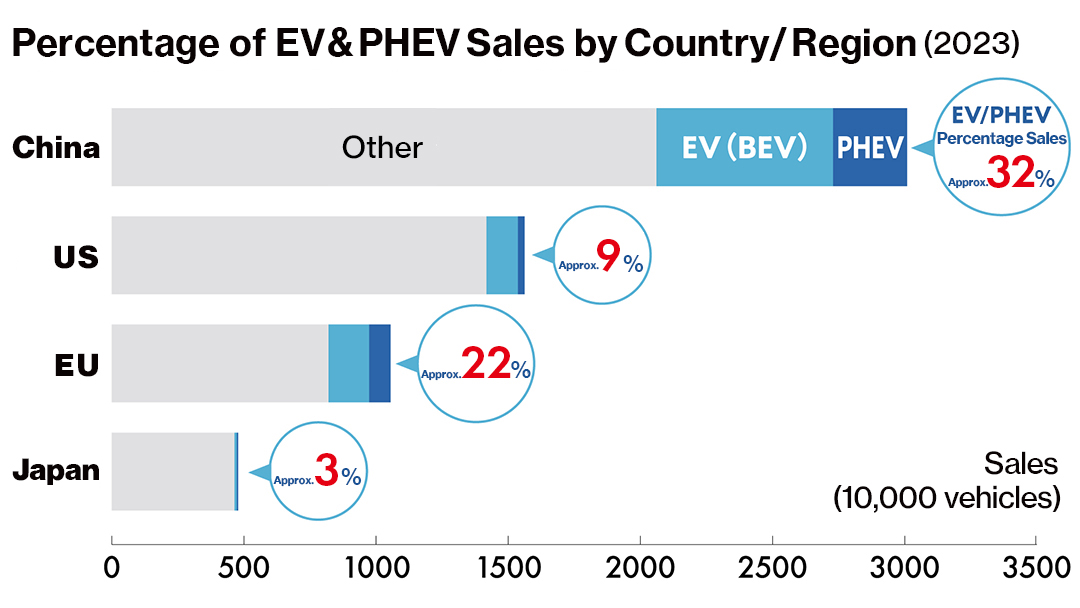

In 2023, approximately 90 million new automobiles were sold worldwide. Normally, the majority of global sales would be conventional, gasoline-powered vehicles, but in the last few years the annual percentage of new EV sales has been skyrocketing. Most of that growth has been in China, where in 2023 roughly 22% of all new vehicles sold were EVs. If we add plug-in hybrid electric vehicles (PHEVs), that percentage goes up to about one-third of all cars sold in China. A big reason for that growth is the government backing that battery and EV makers get in that country, where electrification of the auto sector is a national strategy. The next biggest market is the EU, which leads the world in climate action. Third is the US. America's EV market will likely see a surge in growth in the coming years, due in part to government economic-security measures that include subsidies and tax deductions aimed at promoting investments in EV and battery production facilities. In India, where roughly five million new cars are sold every year, only about 2% are EVs, but that figure is expected to grow quite rapidly, especially if sales of e-bikes and other electrified two-wheel modes of transportation are included. Here in Japan, new car sales are also about five million per year, but even together, EVs and PHEVs only make up about 3% of those sales.

—— China and the EU really seem to be outpacing the rest of the world. What's your outlook for the future?

Industry policies, subsidies and other factors differ from one country or region to the next, and these will continue to influence how quickly their respective EV markets grow. There could also be backlashes to such rapid transformations. Having said that, I think it's impossible to doubt that over the medium to long term, regions all over the world are going to see steady growth in EV, PHEV, and FCEV* sales percentages.

*Fuel cell electric vehicles

Range and Charging Infrastructure Not the Only Barriers to EV Growth

—— Why aren't people buying more EVs here in Japan?

There are a lot of reasons, but a major problem is the fact that we've yet to develop an EV ecosystem.* In other words, we don't have the charging infrastructure or maintenance capabilities that those other countries have.

*The term "ecosystem" typically refers to a natural environment in which plants, animals and other biological organisms interact with one another and support life. In business, the term refers to an environment cohabitated by various businesses that leverage their respective strengths to support mutual growth and development.

There are many issues from the customer's perspective as well. For example, concerns about range, or in other words how far their EVs will go on a single charge, the lack of chargers making EV ownership inconvenient, battery degradation and lifespan. An EV will also typically cost a lot more than a comparable gasoline-powered car, and because the used-EV market has yet to mature, many drivers worry that second-hand options won't be appropriately priced. I think the fact that these concerns have yet to be dealt with explains why so few Japanese people are switching to EVs.

—— What do you mean by second-hand options not being appropriately priced?

Let's say you buy a new EV for four million yen now and after 5 years, you decide to sell it and buy something else. If you take it to a used-car dealership in Japan today, they wouldn't be able to price it. So you wouldn't be able to sell it, which means for the five years you got out of the vehicle, you're out four million yen, namely at least 800,000 yen per year that you've spent on, plus the electricity to charge it. You can see how expensive that is compared to the five-year cost of owning a gasoline-powered car. The reason we can't price the cars is because we don't have any means of accurately gauging the state of used EV batteries. If we could effectively monitor the batteries, we could better assess and price the cars. Were we to know that a particular type of EV were driven for five years it would have a remaining maximum charge capacity of 80%, we could then confidently price the vehicle for a potential buyer or tell them that it could, for example, be driven for at least another two or three years. The fact that Japan's used-EV market has yet to develop is not just because the associated costs will be passed through to the price of the vehicles. There's an even bigger problem. Most of Japan's unpriceable used EVs are being exported to New Zealand and other countries. This means that expensive, scarce resources that are used to make the vehicles, such as the lithium, copper, nickel and manganese in the batteries, are draining out of Japan. Nowadays, the struggle to secure those rare resources is a global one, therefore, it is critical to address that problem promptly. So in summary, our inability to manage or recycle the batteries rebounds on EV users in the form of high vehicle costs, which hinders EV proliferation, while the scarce resources in the batteries, motors and other components are being allowed to leave Japan. That's the current situation in our country.

New Organization Finally Up and Running, Ready to Tackle Challenges in e-Mobility

—— Tell us about MC's e-Mobility Solution Division, which was set up in the spring of 2024 to address the challenges you've been speaking of.

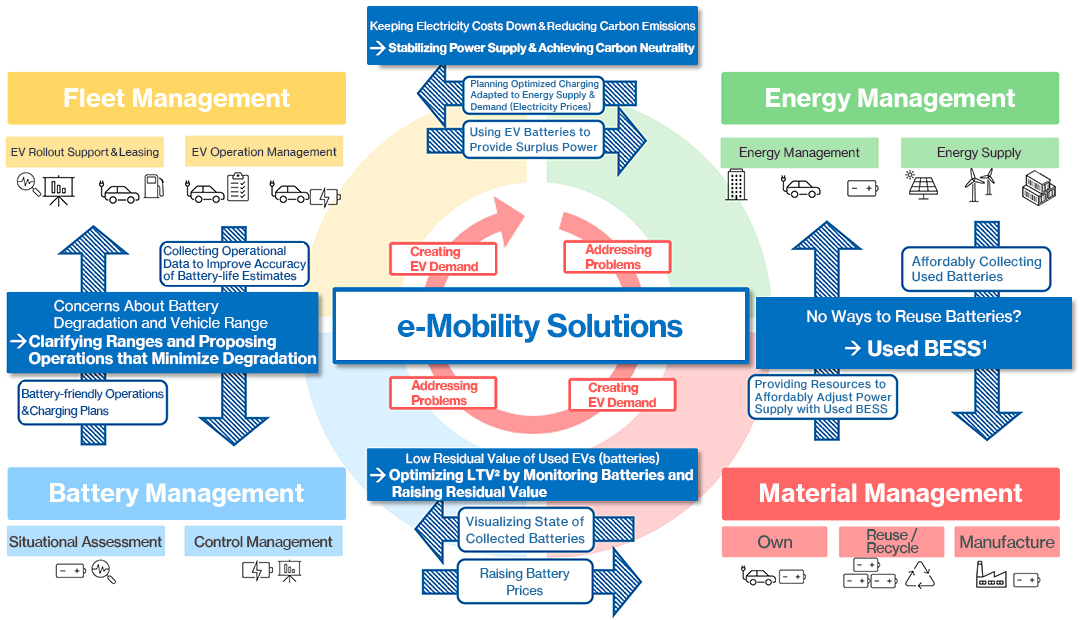

The division is a new organization in the Mobility Group that's dedicated to expediting new business developments in e-mobility. Its mission is to leverage growth in EV-and-battery-oriented businesses and services to quicken the rollout and proliferation of these vehicles without sacrificing any of their driver-or-passenger-friendly aspects, and at the same time help Japan reach net zero. To address the EV challenges I spoke of, the division offers e-mobility solutions that combine four types of management, which we've categorized as Fleet, Battery, Energy and Material. As work is done to promote growth of the EV market, other challenges will likely emerge, and we envision the e-Mobility Solution Division responding to those as well.

1. Battery Energy Storage System

2. Lifetime Value

—— Can you explain each of these four categories of management for us?

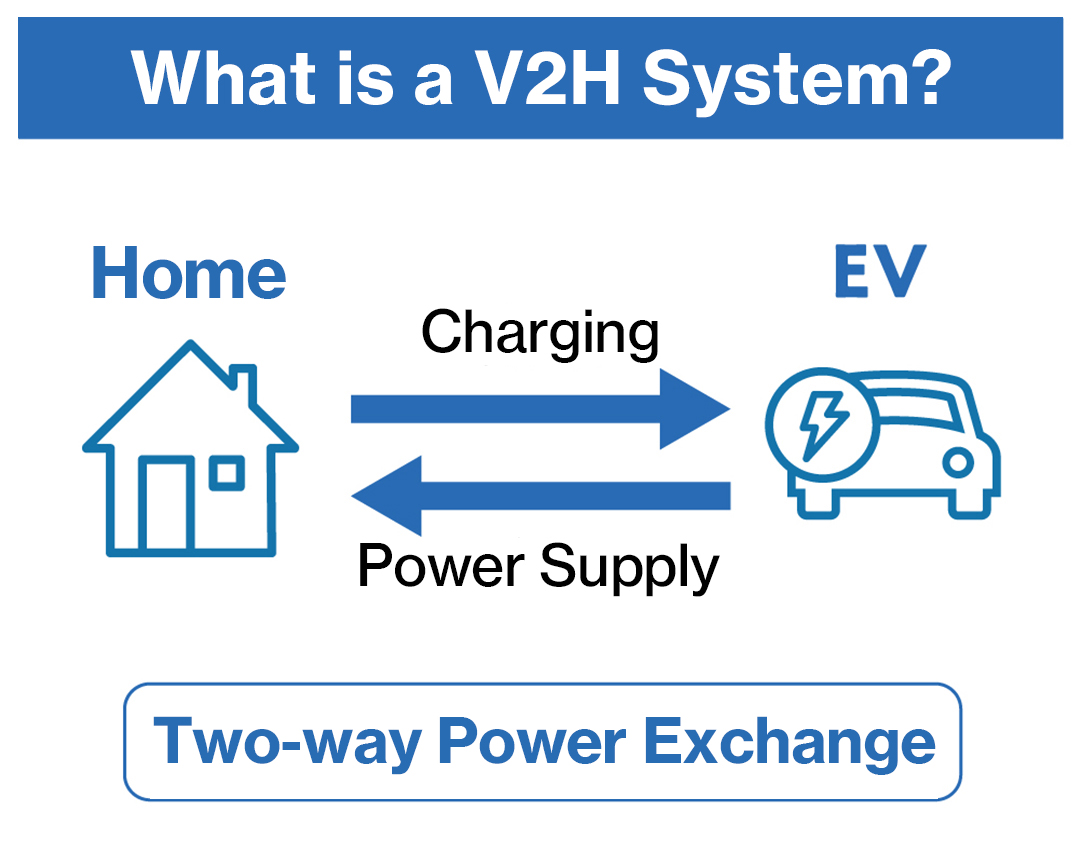

Yes, to start off with Fleet management, it involves gathering operational data on how vehicles are being run and charged, so that we can offer optimized methods of operating them that eradicate concerns over their range, battery degradation, and the time and cost necessary to charge them. We're also developing businesses to lease EVs, assist corporate customers in adopting them, and so on. Our plan is to take advantage of digital technologies (IT) to refine our services. A key to all of that will be Battery management. Accurately monitoring the state of EV batteries should change how the used vehicles are priced. We're also making progress with operations to repurpose used EV batteries as stationary storage batteries. Material management is also important. It refers to work done to reuse and recycle scarce resources, which include not only the battery materials like lithium, copper, nickel and manganese which I mentioned earlier, but also the rare-earth metals used to make the motor magnets. The meaning of Energy management is quite broad. From the user's perpective, timing their EV charging to take advantage of electricity rates determined by the energy supply-and-demand balances will result in lower electricity bills. Furthermore, if they can use their vehicles' batteries as stationary storage batteries for home power supply, it will help them to use energy more efficiently. These are referred to as V2H (Vehicle-to-Home) systems, and they're already being used. I think raising awareness of their benefits will lead to more EV purchases in the future.

—— Can you explain in more detail how EV batteries can be used as storage batteries?

Sure. Here in Japan, the use of renewables has been gathering momentum, but power capacity from solar, wind and other clean energy sources depends on factors like climate, time of day. That makes them less reliable for anything other than intermittent power supply. To cover the gaps and ensure stability in our power supply, we have to make adjustments using other energy sources or storage technologies. As of now, the latter of those involves installing power-grid storage batteries* and using batteries installed in EVs.

*Grid-scale storage batteries are sometimes directly installed at power generation plants, transformers and other such facilities for charging and discharging.

Unless our energy supply and demand is balanced in real time, our power grids won't function normally. As I mentioned, in recent years there's been good progress in terms of introducing renewables to our energy mix, so much so in fact, that at times our grid can't handle the excess capacity and it ends up going to waste. For example, if we're using solar power, the power generated during the sunniest hours might be more than our systems can accommodate, so we have to deliberately curb output.

Planning ways to use grid storage batteries and EV batteries to balance supply and demand will decrease the need for those energy curtailments and help us to conserve valuable, domestically produced renewable power. We'll be able to increase the proportion of renewables in our overall energy mix and make headway in our goal to be energy self sufficient. And of course, we'll also be able to reduce our carbon emissions.

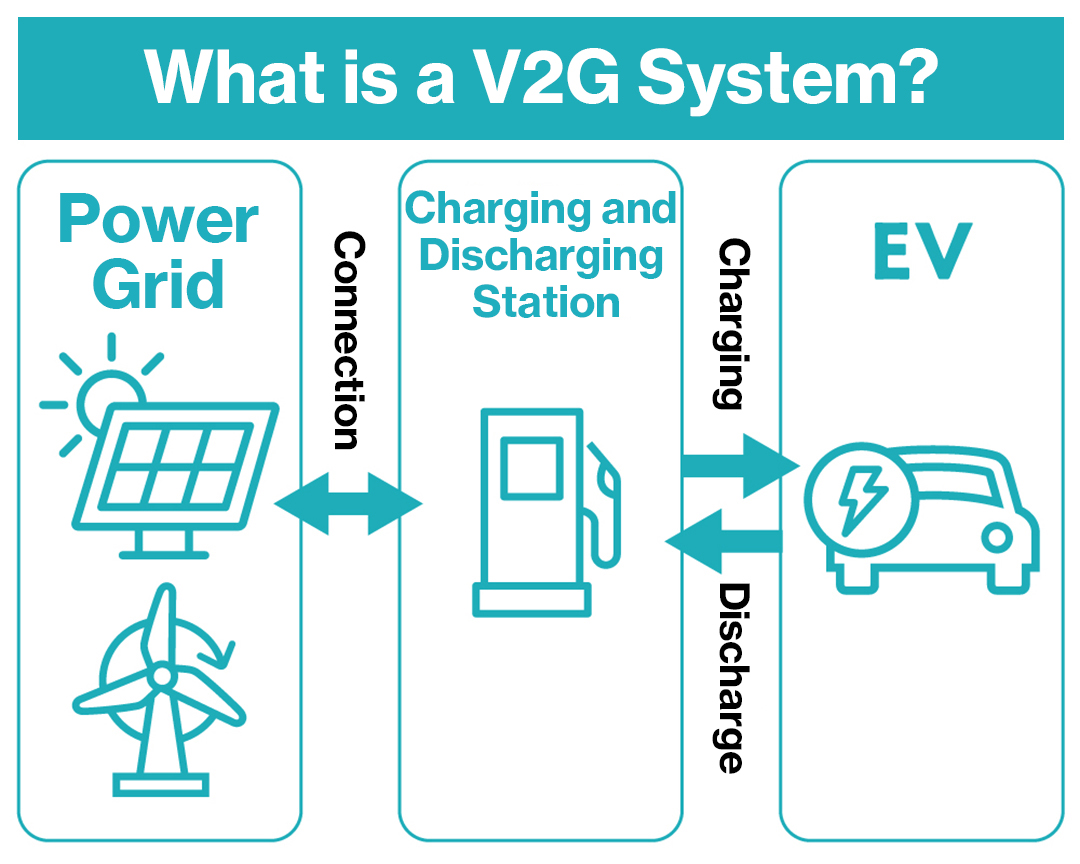

In the future, we're hoping to connect EV batteries to our energy grid to create V2G (Vehicle-to-Grid) systems. They will enable EV users to lower their electricity costs by syncing the charging of their vehicles to times when there is a decrease in grid demand, and conversely, discharge power from their vehicles back to the grid when there is a decrease in grid supply.

Exciting Chemistry Between MC and Honda

—— MC is now championing its mission to "create MCSV (MC shared value)." If we hope to overcome the challenges faced by the EV market, it's vital that we get collaboration across a wide range of sectors. I guess that makes shared value a key component of the businesses you've been talking about.

Certainly. In 2022, when I was working in the Corprate Strategy & Planning Department's Business Creation Office, we launched a task force dedicated to formulating a comprehensive strategy for battery-related operations. The responsibility of that task force was to identify new business developments in collaboration with six of MC's business groups that have interests in batteries, and over time it has evolved into our newly established e-Mobility Solution Division. As you would expect from an organization formed by close ties with six different business groups, its operations encompass solutions in not only mobility, but also energy, materials, DX and other sectors. This is why we're still working with the Power Solution Group on a daily basis. With respect to our battery-recycling operations, we're teaming up with both the Materials Solution Group and Mineral Resources Group, and for financial and data-DX expertise we've established a good partnership with the S.L.C. Group. Every day, we're deepening those cross-sector connections and making progress in new business development. I think MC's diverse industry connections and shared value, both in-house and throughout the broader business community, are the very reasons why it will be possible to grow the EV market and ultimately realize net zero.

—— MC established ALTNA in July 2024. Tell us a little about this new company.

It's a joint venture between MC and Honda Motor Co. that's dedicated to EV growth and decarbonization. Its first mission is to develop businesses with the following aims: optimizing the cost of using EVs, raising the value of the scarce-resource-rich batteries, ensuring those resources are efficiently circulated throughout Japan, and leveraging grid-installed storage batteries to provide power-adjustment capacities. Those adjustments will be crucial to meet growing grid demand and making renewables a larger part of our energy mix. We had in-depth discussions with Honda for about two years. Our companies coming together might seem unusual or surprising, but our corporate cultures are a good fit and we do have a lot in common, including the spirit to take on new challenges. Perhaps the most important thing is that we share the same vision for the future, so even if we occasionally disagree, our strength is that we're both willing to step back and ask what's best for ALTNA. Operations at our joint venture have only just gotten underway, but it's exciting to think about how the chemistry between Honda and MC will manifest itself in the years ahead.

—— What are your prospects from ALTNA?

Considering that this is literally part of the company's name, I expect it to fulfill its mission to continuously develop alternatives, in terms of new products and ideas, that are invested in realizing EV market growth and decarbonization.

ALTNA's first challenge will be to commercialize the concept of decoupling batteries from EVs, or in other words, separating ownership of the vehicles and their batteries. The details* of that I'll leave to our frontline employees, but I think this concept has tremendous business potential and I'm really looking forward to see how it pans out.

*See the second half of the roundtable discussion

Questioning Conventional Wisdom and Moving from Strategy to Action

—— I understand that the e-Mobility Solution Division was already involved in the business of energy storage before ALTNA was established. Can you tell us a bit about those operations?

Yes, that's right. MC, NTT Anode Energy Corporation and Kyushu Electric Power Company are conducting energy-storage trials in Kyushu, where energy curtailments are quite common due to power output from the region's solar and other facilities exceeding demand. Furthermore, due to demand-and-supply imbalances, the local authorities anticipate that the amount of power generated by the region's renewables that ends up going to waste will increase in the coming years. Our three-company trials involve setting up storage batteries in the area's grid to decrease solar-energy curtailments and provide power when the market is tight.

—— Are there any other technologies or businesses that we should be paying attention to?

We're preparing to offer services that take advantage of battery-management technology jointly developed with Bosch, a multinational engineering and tech company based in Germany. These services will include real-time battery-monitoring status assessments, residual lifespan estimates, and big-data-based recommendations on how customers should use their EVs/batteries. I also think battery-swapping technologies have a lot of promise. These days, logistics, taxi and bus companies are also under pressure to electrify their fleets, but one thing that has hindered their ability to do so is the frequent need to recharge the batteries. Providing them with a battery-swap service can help them go electric without having to worry about any loss in operational efficiency, which can take decades for companies to achieve and is not something they want to sacrifice. Furthermore, if we can set up EV service stations that perform the battery swaps in various locations across Japan, it will alleviate concerns that EV users have about range. Those stations might come to be regarded as distributed energy storage facilities, meaning that they could also be used to provide power at times when demand exceeds supply.

—— I'd like to conclude our discussion by asking what you're expecting of your division's employees.

The industries in which we operate are vulnerable to a lot of sudden, discontinuous changes, so if our attitude is to only abide by conventional practices, we won't do very well. I'd like our employees to anticipate change and consider how they can brush up their powers of conception and creativity, because those strengths are the sources of new businesses and solutions. They also need to ask themselves how they can incorporate those strengths into our division's strategies. Determining how we can work with all concerned locales to nurture ideas into action is going to test our capabilities. I'd like every member of the e-Mobility Solution Division to be fully committed to the success of their projects and work with a true sense of ownership.... But perhaps I'm setting the bar too high? Seriously though, I have faith in our people, and I think they are more than capable of exceeding my expectations, however lofty they may be.

- The second half of our roundtable discussion will feature two employees of MC's e-Mobility Solutions Division.