Through its myriad businesses in retail, apparel, healthcare, food distribution, finance and digital technologies, Mitsubishi Corporation (MC) is dedicated to providing us with a prosperous society and higher standard of living. Central to this ambition is the company's Smart-Life Creation (S.L.C.) Group, which is strengthening its operations in Japan and rapidly growing international markets by leveraging its expertise in services targeting Japanese consumers. These include the "Ponta" loyalty points systems and other services available through the Lawson convenience store and Life supermarket chains.

In October 2024, MC announced its decision to invest in Globe Fintech Innovations, Inc. ("Mynt") through AC Ventures Holdings Corp. Mynt is a leading smartphone-payment services provider in the Philippines and the parent company of GCash, an app used by 80% of Filipinos for mobile payments, digital loans and other such services. MC plans to build on its partnership with Mynt to strengthen its own digital-finance operations.

In the first half of our next roundtable discussion, Asahi Globe+ Editor in Chief Kazuhiro Sekine speaks with three members of MC's Digital Finance Department, which is aiming to develop new businesses outside Japan.

-

Tokuichiro Suzuki

Digital Finance Department

Financial Business Division

Retail Division -

Hayato Nakamura

Manager

Digital Finance Department

Financial Business Division -

Toshihiko Matsumura

Manager

Digital Finance Department

Financial Business Division

[Interviewer] Kazuhiro Sekine (Asahi GLOBE+ Editor in Chief)

How Has Digital Finance Changed Things?

—— I'm joined today by three members of MC's Digital Finance Department, and I'd like to begin by asking how digital finance has changed our day-to-day lives. Mr. Nakamura, how would you answer that question?

Nakamura Basically, there are three ways that digital technologies have changed both the world of finance and our lives in general. The first is that they've made financial services more accessible and convenient. Nowadays, as long as we have an Internet connection, we can use a variety of financial services whenever and wherever we want, 24 hours a day, 365 days a year. We can use our smart phones or PCs to not only set up bank accounts, check our balances and transfer funds, but also apply for loans, purchase insurance, buy and sell stocks, and so on. Apps have also made it easier for individuals to do things like send money to one another or split payments. Furthermore, we're now seeing new financial services that take advantage of artificial intelligence. One example is a robo-advisor, which is an online platform that automatically manages clients' assets based on their risk tolerances, investment goals, and other criteria. I think by now, all of your readers will have realized how much easier it's getting to access financial services.

The second change born of digitalization has been the use of highly sophisticated data to ensure that we're being provided only the most appropriate financial services. For example, the growth of QR-code payments has enabled financial institutions to gather a much broader scope of data than they could in the past. Those data include payment information, such as where and when we made our purchases and how much we spent on them, and location information, which maps our movement patterns. By analyzing a wealth of data within the boundaries of privacy protection, money managers can perform very scrupulous credit-risk checks and offer customers financial products that are tailored to their individual needs. Essentially, we're now living in a world where we can provide the right financial services to the right people. We're also seeing more embedded finance, which is the practice of non-financial entities integrating financial services into their traditional apps and services. For example, when we purchase electronics or other products online, our purchases will automatically include extended warranties, which insure us against malfunctions for longer than standard product warranties. This provision makes things easy for us and gives us peace of mind, plus it raises the seller's value as well, so it's mutually beneficial. The third impact of digital technologies is that they've forced financial institutions to change their traditional business models. Up to now, banks, securities companies, insurance providers and other financial players have set up nationwide networks of brick-and-mortar branches and had their sales staff respond to customer needs; but as you know, many of these players are now transitioning away from in-person service provision and relying more on digital channels.

The Rapid Global Growth of "Super Apps"

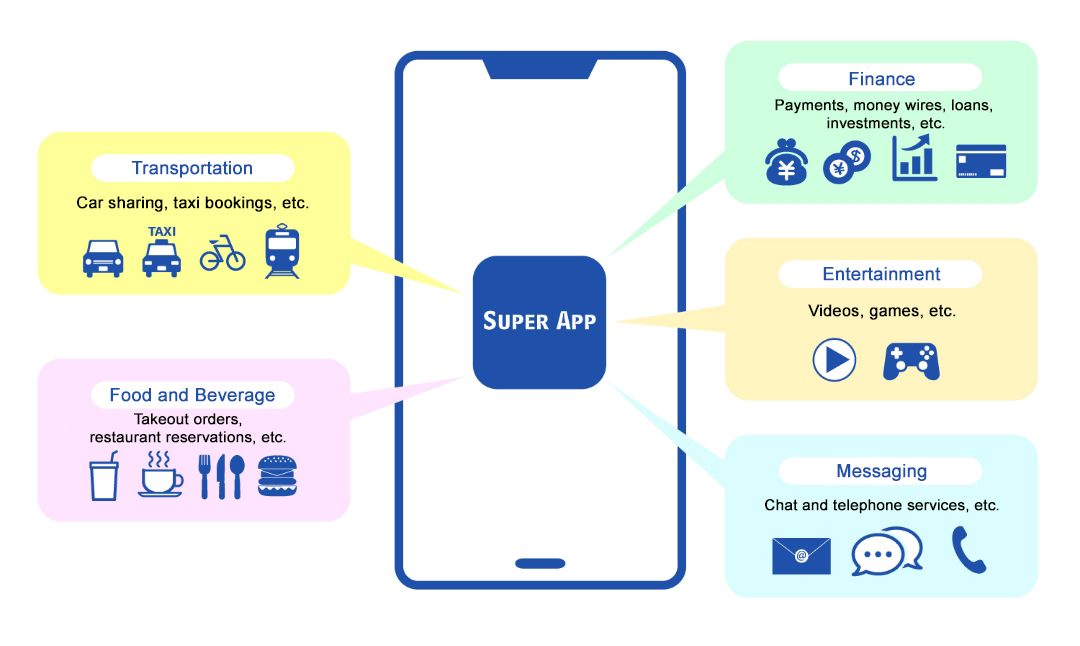

—— Digital financial services have certainly made things more convenient and triggered radical reforms in the financial industry. In recent years, finance platforms and super apps have been making headlines. Mr. Matsumura, can you explain what those are?

Matsumura A finance platform is a new ecosystem that combines all of the financial services offered by different players, such as banks, securities companies and insurance providers, on a single platform. Those platforms have evolved even further into what are now referred to as "super apps." A super app includes a myriad of non-financial services as well, such as retail (EC), communications, transportation, healthcare and entertainment, basically all the functions we typically rely on in our day-to-day lives. As you can imagine, super apps are becoming more and more popular.

From the provider's perspective, a super app is an opportunity to both cross-sell and upsell, the former of which refers to encouraging customers to buy related products and services, and the latter of which refers to getting customers to upgrade their purchases to better models or buy higher-priced goods and services. Super apps make it easier for businesses to attract and retain a wide range of customers, and by using the data gathered through the apps, they can start offering new services that are more personalized.

—— Super apps are growing in number, both in Japan and around the world, and they seem to be especially popular in China and Southeast Asia. What's behind that growth?

Matsumura Just from the viewpoint of financial services, it used to be very expensive for banks and other financial institutions to acquire fixed assets and invest in systems infrastructure, plus they had to adhere to a lot of regulations in building their operations and providing their services. Technological advances have made it possible to do those things much more affordably, and many companies, including those in other industries, are now able to develop their own financial services. While some banks and other financial institutions are using super apps to branch out into non-financial services, entities in other industries are now moving into finance the same way they've diversified through messaging, taxi-dispatching and other apps. Furthermore, the presence of Chinese companies providing investment services, technologies and know-how is a big reason for the rapid growth of super apps among QR-code payment providers in Southeast Asia.

What Is the "GCash" Platform Used by 80% of People in the Philippines?

—— MC has announced that, through AC Ventures Holdings Corporation, it has invested in the "GCash" finance super app, a new platform that's become a hallmark of progress in the Philippines. Mr. Nakamura, can you explain what this product is?

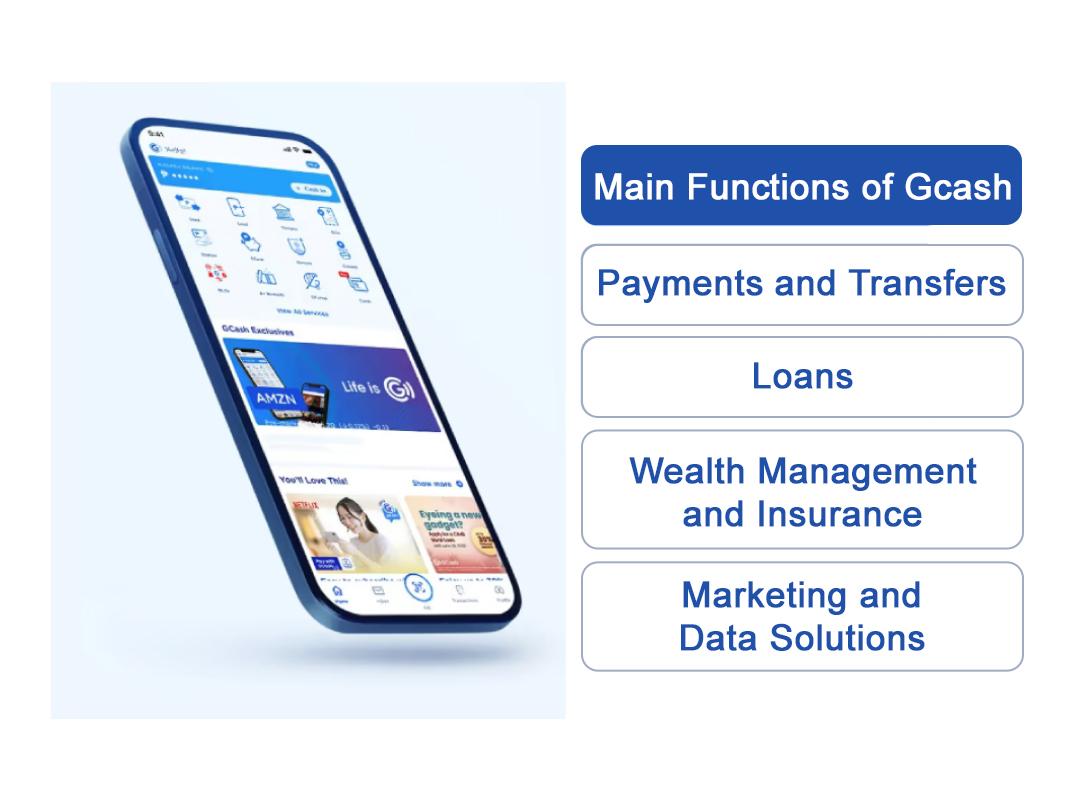

Nakamura Sure. As you noted, GCash was developed in the Philippines. Designed primarily as a smartphone-based digital payments platform, it's already been used by roughly 94 million users in the Philippines, a number equivalent to about 80% of the country's entire population (almost 116 million people). It's amazing to think that such a large majority of a country's citizens would be using the same product. In the Philippines, it's common to refer to the act of paying or sending money as "GCash it," and store cashiers will often ask customers, "Would you like to pay by cash or GCash?" That's how ubiquitous the platform has become.

The biggest strength of GCash is definitely its payment services backed by a ubiquitous ecosystem. People can use it for QR-code payments at not only supermarkets, convenience stores and other common retailers, but also at the so-called "sari-sari stores," which are small variety shops found throughout communities in the Philippines. Obviously, GCash can also be used to shop or pay bills online, but it even allows users to transfer funds from their GCash accounts or otherwise make deposits into their bank accounts.

—— Besides payments, what other services does GCash offer?

Nakamura GCash has used payment data to build a proprietary credit-scoring model, which it uses to offer large and small loans, as well as other services, such as a buy-now-pay-later plan that enables customers to defer payments on purchases until later. Customers can also purchase both life and non-life insurance through the platform and even invest in the stock market. Mynt, the parent company responsible for GCash, has also developed an online marketplace for merchants called "GLife." Customers can use GLife to order and pay for food from restaurants, connect and make payments to online shopping sites, and so on.

—— You mentioned at the start of our discussion how digital finance has been making services more accessible, and that certainly seems to be the case in the Philippines with GCash.

Nakamura Absolutely. It's not that easy to open a bank account in developing countries. Traditional banks have strict conditions like minimum opening deposits and required documentation, not to mention the service fees that have to be paid to keep the accounts active. Historically, the number of people who have bank accounts in the Philippines is quite low, even compared to other countries in ASEAN; but all you need to register with GCash are a smartphone, a mobile number, and a means of personal identification. That's enough to use the app to transfer money to other people or financial institutions, and you can connect to a bank and set up an account with it through the app as well. It's the convenience of GCash that has fueled its explosive growth.

Suzuki With GCash, people can access electronic-payment and other many other financial services without having to first obtain bank accounts or credit cards, and in that sense, it's a good example of the leapfrogging phenomenon. The reason that GCash is so widely used in the Philippines is its focus on much-needed financial services. Having said that, the Philippines' economy is growing, and that growth will likely fuel more demand for car loans, mortgages, securities investments, insurance and other financial products. By providing Filipinos with those financial services, GCash is supporting their quality of life and encouraging them to accumulate personal assets. Money is the lifeblood of any economy, and GCash is helping to ensure its circulation and drive continuous economic growth. There's also a lot of potential here to develop new or even yet-to-be-discovered services in both the finance and non-finance spaces.

C2B Finance the Foundation of New Business

—— I mean to ask each of you for your thoughts on the significance of MC investing in GCash and your outlooks for the business's future (see second half), but first I'd like to know how MC has otherwise been developing its financial operations. Mr. Suzuki, what can you tell me about that?

Suzuki We're a sogo shosha, so our foundations are in trade, or in other words, brokering purchases for buyers and sellers. Naturally then, both those transactions and real-asset-backed financing are a fundamental part of our financial operations. Our main business is leasing, which we're developing through MC Group companies like Mitsubishi HC Capital and Mitsubishi Auto Leasing Corporation. They deal in a wide range of assets, including aircraft, automobiles, containers, renewable energy, and real estate. The second pillar of our financial business is our private-equity fund activities. Our investments address challenges to improve operations at our portfolio companies, help those businesses expand outside Japan, and otherwise raise their corporate value. We conduct those investments with a number of companies that MC has significant interests in, including AIGF Advisors, Marunouchi Innovation Partners, and MC's wholly owned fund-management company, Marunouchi Capital.

—— What kinds of financial businesses will the S.L.C. Group be concentrating on in the future?

Suzuki We're looking forward to developing customer-to-business (C2B) financial services, and in doing so, organically connect them to the business-to-business (B2B) services that MC has traditionally been very adept at. Incidentally, the reason we use "C2B" rather than the more typical "B2C" abbreviation, is because at MC, the needs of consumers have always come first. I think in this respect, getting involved in GCash is a big step forward. As we've mentioned, about 80% of Filipinos use this super app, so providing it with greater added value is a worthwhile aim. We're fully committed to that aim, and our focus will be on non-financial services. Thinking more long term, we hope to apply MC's business assets, know-how and multi-industry connections to build C2B businesses that will form the bedrock of new consumer services.

- Our next article will feature the second half of the roundtable discussion with members of MC's S.L.C. Group.