Mitsubishi Corporation Subsidiary Marunouchi Infrastructure Launches Japan's First Diversified Infrastructure Fund

December 11, 2017

Mitsubishi Corporation

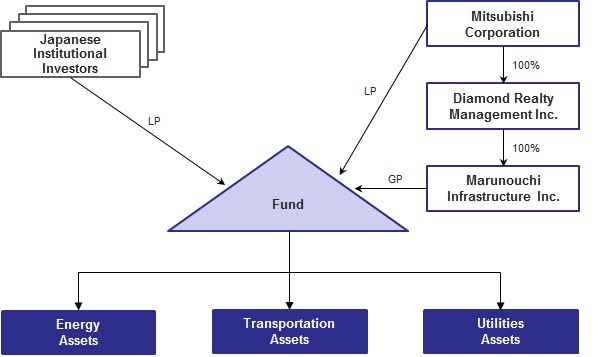

Mitsubishi Corporation (TSE 8058; LSE MBC, “MC”) is pleased to announce that its 100% subsidiary, Marunouchi Infrastructure Inc. (“MII”), has launched Japan’s first diversified infrastructure fund. The fund will invest in a portfolio of assets across all major infrastructure sectors.

MII has established a limited partnership (the “Fund”) with commitments from institutional investors in Japan reaching more than JPY 30 billion on its first closing, and expects additional commitments to bring the Fund to its targeted JPY 50 billion in total in the first half of the next year. The Fund has a hard-cap of JPY 100 billion.

The value of infrastructure assets held by the public sector in Japan, including the central and local governments, reaches several hundred trillion yen. The private sector also holds a large volume of infrastructure assets. Many of Japan’s infrastructure assets, particularly those developed during the period of rapid economic growth between 1954 and 1973, will need to be refurbished and replaced in the coming decades. In addition, a large number of new infrastructure projects, including those related to the rapidly expanding renewable energy space, are now being developed. With governments trying to ease their fiscal burden and with companies aiming to concentrate on their core businesses, MC sees infrastructure funds playing a greater role in developing and maintaining Japan’s infrastructure.

MC and its subsidiaries have been the front runners among Japanese companies in managing investor capital and in executing investments in infrastructure assets overseas since 2012. Those investments have included electricity distribution networks, toll road related business and seaports, particularly in Europe and the U.S. With that proven track record, we are in a good position to leverage our investment management capabilities to successfully launch this Fund to invest in infrastructure in Japan.

While most other infrastructure funds in Japan invest exclusively in renewable energy, the Fund is targeting all major infrastructure sectors, namely energy, transportation and utilities, making it the country’s first diversified infrastructure fund. Through this initiative, MC is seeking an opportunity in developing and maintaining infrastructure in Japan, while at the same time simultaneously generating economic value, environmental value, and societal value through this Fund.

Structure

For Reference

About Mitsubishi Corporation

Head Office: 3-1, Marunouchi 2-Chome, Chiyoda-Ku, Tokyo 100-8086, Japan

Establishment: 1954

Main Businesses: Mitsubishi Corporation is a global integrated business enterprise that develops and operates business across virtually every industry including industrial finance, energy, metals, machinery, chemicals, foods, and environmental business. Mitsubishi Corporation’s current activities are expanding far beyond its traditional trading operations as its diverse business ranges from natural resources development to investment in retail business, infrastructure, financial products and manufacturing of industrial goods.

Representative: Takehiko Kakiuchi, President and CEO

About Diamond Realty Management Inc.

Head Office: 16-1, Hirakawacho 2-Chome, Chiyoda-ku, Tokyo, Japan

Establishment: 2004

Main Business: Real estate asset management and advisory services.

Representative: Takashi Tsuji, President and CEO

About Marunouchi Infrastructure Inc.

Head Office: 16-1, Hirakawacho 2-Chome, Chiyoda-ku, Tokyo, Japan

Establishment: 2017

Main Business: Infrastructure investment, asset management and advisory services

Representative: Shinichi Nao, CEO and CIO

About the Fund, Marunouchi Infrastructure Investment Limited Partnership

First Closing: November 30, 2017

Investment Target: Infrastructure and its related services in Japan.

General Partner: Marunouchi Infrastructure Inc.

Limited Partners: Institutional investors in Japan, such as pension funds, commercial banks, and business enterprises, including Mitsubishi Corporation, Mizuho Bank, Ltd., The Toho Bank, and Private Finance Initiative Promotion Corporation of Japan.

Inquiry Recipient

Mitsubishi CorporationTelephone:+81-3-3210-2171 / Facsimile:+81-3-5252-7705