Vietnam Pilot Project Utilizing TradeWaltz® Platform Adopted Under Government's Supply-Chain Diversification Scheme

December 24, 2020

TradeWaltz Inc.

Mitsubishi Corporation Plastics

Mitsubishi Corporation

MUFG Bank, Ltd.

Tokio Marine & Nichido Fire Insurance Co., Ltd.

Mitsubishi Corporation Plastics

Mitsubishi Corporation

MUFG Bank, Ltd.

Tokio Marine & Nichido Fire Insurance Co., Ltd.

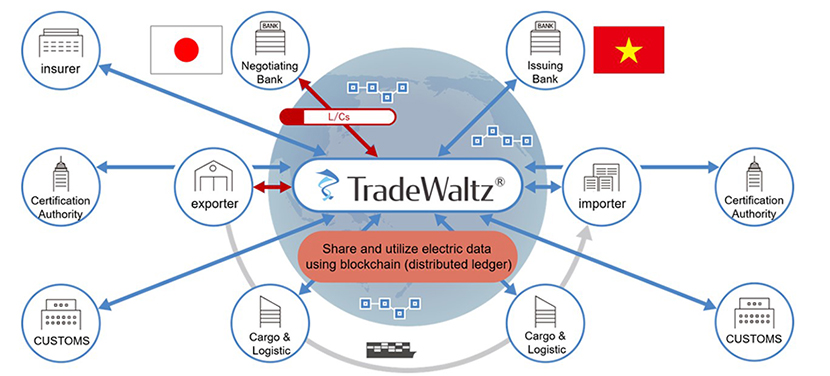

Five Japanese companies are pleased to announce that they will be collaborating on a digitalization pilot project for Vietnam-bound trade. Slated to begin in March 2021 with operations conducted by Mitsubishi Corporation Plastics Ltd. (MCP) and Mitsubishi Corporation (MC), the project will revolve around the TradeWaltz® information-sharing platform, which is managed by its namesake company TradeWaltz, Inc. (TradeWaltz). Participating in the project alongside TradeWaltz will be the platform’s four initial users1, namely MCP, MC, MUFG Bank, Ltd. (MUFG), and Tokio Marine & Nichido Fire Insurance Co., Ltd. (Tokio Marine Nichido).

This project has also been adopted as part of a larger scheme to help diversify overseas supply chains that was introduced in the fiscal year 2021 supplementary budget of Japan’s Ministry of Economy, Trade and Industry (METI). The Japan External Trade Organization (JETRO) is serving as secretariat for the diversification scheme.

Trading operations still require physical documents to be processed at both corporate and government offices, and even during the pandemic, some employees have had to report to their offices once or twice a week to do the work. If the pandemic were to worsen or some other crisis occur that prevented employees from doing this, it could slow trade and adversely impact supply chains. Recognizing that factors inhibiting fully-remote work have been on the rise during the pandemic, the Japanese government is taking urgent measures to address them. Its aim is to facilitate efforts to meet the growing need for digital documents and otherwise strengthen supply chains through diversification and digitalization.

TradeWaltz’s platform is designed to centrally manage digital, trade-related data, and with the company having recently digitized all documents pertaining to export standards, it is now set to commence the pilot project. Beginning in March, its systems will be connected to its four initial users, with the first set of trial operations focusing on their receipt of letters of credit, which comprise just some of the documents mentioned. Under current trade practices, one of the conditions for obtaining letters of credit from banks is that the information documented on them matches that on the relevant shipping documents. Cross checking those documents is just one of the complex, paper-based procedures that must be performed when goods are being traded. The pilot project aims to integrate within a single system all of those procedures, including the cross checks, and because it conforms to the government’s objective to bolster supply chains, it has been adopted as part of the aforementioned diversification scheme.

At present, the TradeWaltz® platform can accommodate letters of credit from all countries, but the pilot project will focus on transactions with companies in Vietnam due to that country’s status as 2020 ASEAN chair and the fact that it is one of Japan’s biggest trade partners in the region (Vietnam’s annual trade with Japan amounts to approximately 40 billion USD). The pilot project is being undertaken in accordance with the joint ministerial statement3 that was issued in August 2020 by Japan’s Minister of Economy, Trade and Industry, Mr. Hiroshi Kajiyama, and Vietnam’s Minister of Industry and Trade, Mr. Tran Tuan Anh, during the fourth meeting of the Japan-Vietnam Joint Committee on Cooperation in Industry, Trade and Energy.

Looking forward, TradeWaltz and its four initial users are hoping to build on these Vietnam trials to help digitalize trading operations throughout ASEAN and other parts of the world.

――――――――――――――――――――――――――――――――――――――――――――――――

- The trial operations will mainly cover MCP’s trade of low-density polyethylene, which will be used in Vietnam to make plastic bags, packaging for foods and daily necessities, and additional products for which demand has been driven up by the pandemic in supermarket, takeout, and other industries.

- A letter of credit is a letter issued by a bank guaranteeing that payments will be received on time and in the full amounts.

- Joint Ministerial Statement (excerpt): The ministers recognized the ongoing initiative of the private sector to streamline trade procedures by building a platform for companies to exchange trade-related documents digitally. This is expected to help the region develop more sophisticated supply chains.

――――――――――――――――――――――――――――――――――――――――――――――――

Hirohisa Kojima

President and Chief Executive Officer

TradeWaltz Inc.

“This project is being undertaken as part of METI’s diversification scheme and focuses on the operations of two of our initial users, Mitsubishi Corporation Plastics and Mitsubishi Corporation. Looking more to the future though, we plan to expand the use of TradeWaltz® to help ASEAN and RCEP countries with their trade digitalization efforts and strengthen supply chains, which have been hit hard by the COVID-19 pandemic.”

Yukihiko Kaburaki

President and Chief Executive Officer

President and Chief Executive Officer

Mitsubishi Corporation Plastics

“Mitsubishi Corporation Plastics is honored to be one of the first users of the TradeWaltz® platform. We are confident that it will not only make our trade processes more competitive, but also increase efficiency at each company in our supply chain and help to shore up trade operations in general. As a first user, we look forward to assisting with TradeWaltz’s efforts to build and refine a truly cutting-edge trade platform.”

Takuya Hirakuri

General Manager of Digital Strategy Dept.

Mitsubishi Corporation

“In March we will finally begin using the TradeWaltz® platform. On behalf of MC, I wish to extend my profound gratitude to METI and JETRO for supporting this pilot project. The pandemic has ramped up the need to work remotely, both here in Japan and around the world, so we hope to make steady progress with these trials and ultimately help TradeWaltz® become the go-to solution for global traders.”

Noritoshi Murakami.

Managing Director, Head of Transaction Banking Division

MUFG Bank, Ltd.

“With COVID-19 having provided greater impetus to digitalization in so many industries, I am convinced that the TradeWaltz® platform will be the best solution in Japan for those engaged in trade. MUFG is pleased to represent the banking sector in this pilot project, which is the first step towards making the platform a commercial success. We will do our best to promote its initial uses and hone its services, with an eye to rolling it out to more customers in the years ahead.”

Kosuke Hashimoto

General Manager, Marine Underwriting Dept.

Tokio Marine & Nichido Fire Insurance Co., Ltd.

“The practical use of TradeWaltz® is a groundbreaking step. Tokio Marine Nichido will continue to work with Mitsubishi Corporation Plastics, Mitsubishi Corporation and our other partners on this project to promote greater digitalization in global trade.”

[Overview of TradeWaltz Inc.]

Company Name: TradeWaltz Inc.

Representative: Hirohisa Kojima, President & CEO

Headquarters: 2F, Marunouchi Nijubashi Building, 2-2 Marunouchi 3-Chome, Chiyoda-ku, Tokyo

Date of Establishment: April 2020

Business Description: Delivery of the TradeWaltz SaaS1, a trade data sharing platform using blockchain technology.

Capital: 2.1 billion yen (including capital surplus)

1. SaaS stands for Software as a Service. It is a model that makes software available for use over the Internet.

*TradeWaltz is a registered trademark of NTT DATA in Japan. Other product, company, and entity names are trademarks or registered trademarks of each company.

Inquiry Recipient

Mitsubishi CorporationTelephone:+81-3-3210-2171 / Facsimile:+81-3-5252-7705