Mitsubishi Corporation Launches New ASEAN Private Equity Fund

March 3, 2015

Mitsubishi Corporation

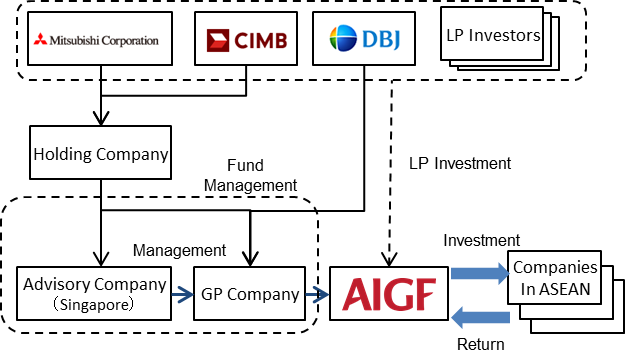

In February 2015, Mitsubishi Corporation (“MC”) and CIMB Group (“CIMB”), together with Development Bank of Japan Inc. (“DBJ”), launched a Southeast Asia-focused middle market private equity fund, AIGF (ASEAN Industrial Growth Fund, “AIGF” or the “Fund”), headquartered in Singapore.

AIGF had its first closing at USD130m, and is joined by Shinsei Bank, Limited, a leading diversified Japanese financial institution, as strategic investor, and leading Japanese industrial companies and prominent institutional investors including Hitachi, Ltd., Yamato Kogyo Co. Ltd., and THE TOHO BANK, LTD. The Fund is aiming to reach approximately USD200m over the next 12 months.

AIGF is a unique private equity platform that seeks to provide growth capital to the middle market, where many well established companies have needs for growth capital, particularly across the ASEAN region where promising economic growth potential is being buoyed by dynamic population increase. Mainly focusing on Indonesia, Malaysia, Singapore and Vietnam, the Fund intends to realize the intrinsic value of portfolio companies and maximize returns by leveraging Mitsubishi Corporation’s vast business ecosystems and management know-how, CIMB’s broad customer base and financial expertise as well as DBJ’s private equity experience in the ASEAN region.

Mitsubishi Corporation is Japan’s largest trading company. AIGF will be the core platform in Southeast Asia for MC’s private equity business which comprises of a diversified mix of investment strategies that span emerging and developed markets, with investment focus from small caps to large corporations.

CIMB Group is Malaysia’s second largest financial services provider and one of ASEAN’s leading universal banking groups. It offers products as well as services such as consumer banking, investment banking, Islamic banking, asset management, insurance and private equity business.

Development Bank of Japan Inc. is solely owned by the Government of Japan through the Ministry of Finance. Since its conversion to a joint-stock company in October 2008, DBJ has worked to expand its international business by preparing operating bases including DBJ Singapore Limited (“DBJS”) launched in December 2008. Intensive collaboration of DBJ and DBJS with its overseas partners uniquely positions the group to match companies anywhere in Asia with a Japanese partner.

About Mitsubishi Corporation

Mitsubishi Corporation (MC) is a global integrated business enterprise that develops and operates businesses across virtually every industry including industrial finance, energy, metals, machinery, chemicals, foods, and environmental business. MC’s current activities are expanding far beyond its traditional trading operations as its diverse business ranges from natural resources development to investment in retail business, infrastructure, financial products and manufacturing of industrial goods. With over 200 offices & subsidiaries in approximately 90 countries worldwide and a network of over 600 group companies, MC employs a multinational workforce of over 65,000 people. Within the region, MC is present in all 10 ASEAN countries with a diversified business footprint, having first established operations in Singapore and Indonesia in 1955.

| Head Office | 3-1, Marunouchi 2-Chome, Chiyoda-ku, Tokyo, 100-8086, Japan |

| Representative | Ken Kobayashi, President and Chief Executive Officer |

| Year Established | 1950 |

| Capital | JPY 204 billion (as of March 31, 2014) |

About CIMB Group

CIMB Group is Malaysia’s second largest financial services provider and one of ASEAN’s leading universal banking groups. It offers consumer banking, investment banking, Islamic banking, asset management and insurance products and services. Headquartered in Kuala Lumpur, the Group is now present in nine out of 10 ASEAN nations (Malaysia, Indonesia, Singapore, Thailand, Cambodia, Brunei, Vietnam, Myanmar and Laos). Beyond ASEAN, the Group has market presence in China, Hong Kong, Bahrain, India, Sri Lanka, Australia, Taiwan, Korea, the US and UK.

CIMB Group has the most extensive retail branch network in ASEAN of more than 1,000 branches as at 31 December 2014. CIMB Group’s investment banking arm is also one of the largest Asia Pacific-based investment banks, offering amongst the most comprehensive research coverage of more than 1,000 stocks in the region.

CIMB Group operates its business through three main brand entities, CIMB Bank, CIMB Investment Bank and CIMB Islamic. CIMB Group is also the 97.9% shareholder of Bank CIMB Niaga in Indonesia, and 93.7% shareholder of CIMB Thai in Thailand.

CIMB Group is listed on Bursa Malaysia via CIMB Group Holdings Berhad. It had a market capitalisation of approximately RM46.8 billion as at 31 December 2014. The Group has over 40,000 employees located in 18 countries.

About Development Bank of Japan Inc.

Development Bank of Japan Inc. (“DBJ”), the predecessors of which were established as Japan Development Bank in 1951 and as Hokkaido-Tohoku Development Finance Public Corporation in 1956, is 100% owned by the Japanese government, and provides seamlessly integrated investment and loan services. Since its conversion to a joint-stock company in October 2008, DBJ has worked to expand its international business by preparing operating bases including DBJ Singapore Limited (“DBJS”) launched in December 2008. At the same time, DBJ has worked to expand our network with trustworthy partners, and as of March 31, 2014, more than 40 countries, focusing on Asia, were reached for investments and loans. Intensive collaboration of DBJ and DBJS with its overseas partners uniquely positions the group to match companies anywhere in Asia with a Japanese partner. Using creative financing techniques, DBJ is committed to working with customers to resolve their problems, earn their trust and build a prosperous future.

【AIGF’s Profile】

| Name | AIGF LP |

| Launch Date | 19th February 2015 |

| Investment Strategy | Provision of growth capital to middle market in the ASEAN region |

| Fund size (as of 1st closing) | USD130m |

| Investors | Institutional investors and multi-national corporations etc |

【Structure Overview】

Inquiry Recipient

Mitsubishi CorporationTelephone:+81-3-3210-2171 / Facsimile:+81-3-5252-7705