Notice of Integration of Domestic Petroleum Business (Partial Transfer of Mitsubishi Corporation's Domestic Petroleum Products Business Through Absorption-Type Company Split, and Merger of Wholly Owned Subsidiaries)

June 29, 2015

Mitsubishi Corporation

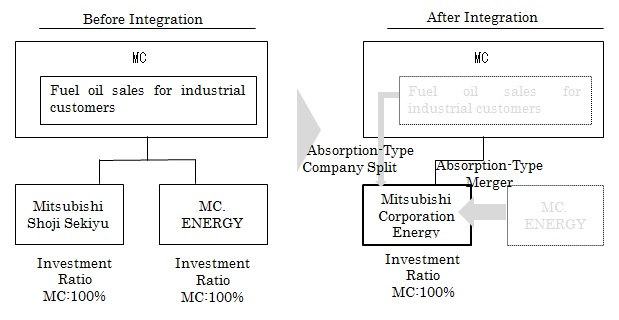

Mitsubishi Corporation (“MC”) hereby announces the following company decisions regarding its domestic petroleum business: (1) Transfer of fuel oil sales business for industrial customers to MC’s wholly owned subsidiary Mitsubishi Shoji Sekiyu Co., Ltd. (“MCS”) by way of an absorption-type company split; (2) Merger of wholly owned subsidiary MC. ENERGY, INC. (“MCE”) with MCS; and (3) Change of MCS’s name to Mitsubishi Corporation Energy Co., Ltd. (“Mitsubishi Corporation Energy”) effective October 1, 2015.

As the split is a simplified absorption-type company split and the merger is between MC’s wholly owned subsidiaries, some of the details have been omitted from this press release.

1. Purpose of Company Split and Merger

In addition to MC’s own fuel oil sales to industrial customers, the company also has two domestic petroleum products subsidiaries, MCS, which primarily handles gasoline and gas oil sales, and MCE, which primarily sells asphalt for road construction and bunker fuel oil.

The integration of these operations will streamline MC’s domestic petroleum products business and strengthen the management infrastructure of its newly merged and renamed subsidiary.

2. Outline of Company Split

(1) Timelines

| Resolution of Board of Directors | June 29, 2015 |

| Conclusion of Contract | June 29, 2015 |

| Estimated Effect Date of Company Split | October 1, 2015 |

Note: Since this company split constitutes a simple absorption-type company split as stipulated in Article 784, Paragraph 2 of the Companies Act, obtaining approval at the MC’s general meeting of shareholders is not required.

(2) Method of Company Split

This is an absorption-type company split in which MC will be the split company and MCS will be the successor company.

(3) Allotment of Shares Relating to the Company Split

Based on the conditions of this absorption-type company split, there will be no related allotment of shares.

(4) Required Action Regarding Stock Acquisition Rights and Convertible Bonds

Not applicable.

(5) Amount of Decrease in Capital Stock

There will be no change in MC’s capital stock.

(6) Outline of Businesses To Be Transferred

Fuel oil sale business for industrial customers

(7) Assets and Liabilities To Be Transferred (as of March 31, 2015)

(Million Yen)

| Assets | Liabilities | ||

| Items | Book value | Items | Book value |

| Current Assets | 90 | Current Liabilities | 108 |

| Fixed Assets | 36 | Fixed Liabilities | 18 |

| Total | 126 | Total | 126 |

(8) Rights and Obligations of Successor Company

All assets, liabilities and attendant rights will be transferred from MC to MCS.

(9) Expectations Regarding Fulfillment of Obligations

There are no concerns regarding MCS’s ability to fulfill its obligations upon completion of the company split.

(10) Outline of the Parties Involved

| | Split Company | Successor Company |

| Company Name | Mitsubishi Corporation | Mitsubishi Shoji Sekiyu Co., Ltd. |

| Headquarters | Chiyoda-ku, Tokyo, Japan | Chiyoda-ku, Tokyo, Japan |

| Representative | Ken Kobayashi, President & CEO | Noboru Kamakura, President & CEO |

| Business Activities | Develops and operates a range of businesses across seven Business Group domains, namely: environmental and infrastructure business, industrial finance and logistics, energy, metals, machinery, chemicals, food business and other daily living essentials; and an additional domain that focuses on business-related services. | Sells gasoline, kerosene, gasoil, fuel oil, lubricant oil, and other products. Constructs and leases gas station facilities. Provides management proposals and support on service station operations. Develops new business models through joint ventures in other industries. Handles all other all businesses related to service station operations. |

| Capital | 204,447 million yen | 2,000 million yen |

| Date of Establishment | April 1, 1950 | January 5, 1990 |

| Number of Shares of Common Stock Issued | 1,624,036,751 | 40,000 |

| Fiscal Year End | March | March |

| Largest Shareholder (%) | Japan Trustee Services Bank (5.85%) | Mitsubishi Corporation (100.0%) |

| Recent Financial Results | As of March 2015 (consolidated) | As of March 2014 |

| Net Assets | 5,570,477 million yen (note 1) | 19,774 million yen |

| Total Assets | 16,774,366 million yen | 94,937 million yen |

| Net Assets Per Share | 3,430 yen (note 2) | 494,350 yen |

| Operating Transactions | 7,669,489 million yen (note 3) | 643,907 million yen |

| Operating Income | ---(note 4) | 2,479 million yen |

| Net Income | 400,574 million yen | 1,729 million yen |

| Net Income Per Share | 246 yen | 43,227 yen |

note 1: ”Net Assets” records MC’s “Equity attributable to owners of the Parent” for the period as defined by IFRS.

note 2: ”Net Assets Per Share” records MC’s “Equity per share attributable to owners of the Parent” for the period as defined by IFRS.

note 3: “Operating Transactions” records MC’s “Revenue” for the period as defined by IFRS.

note 4: Operating Income is not recorded under IFRS, which MC adopted in March 2014.

(11) Expected Status of MC and MCS Following the Split

MC’s name of representative, business description, capital and accounting period will not change following the company split. However, MCS’s company name and scope of business operations will change as follows (effective October 1, 2015):

(i) Company Name : Mitsubishi Corporation Energy Co., Ltd.

(ii) Scope of Business Operations : Domestic Sales and trade (export/import) of gasoline, gasoil, kerosene, fuel oil type-A, fuel oil for industrial customers, bunker fuel oil, lubricant oil for ships, and asphalt for road construction.

(12) Outlook for MC

This company split is expected to have a negligible impact on MC’s performance.

3. Outline of Absorption-Type Company Merger

(1) Timelines

| Resolution of Board of Directors | June 29, 2015 |

| Conclusion of Contract | June 29, 2015 |

| Resolution of Share Holders | July 14, 2015 |

| Estimated Effective Date of Company Split | October 1, 2015 |

(2) Merger Method

This is an absorption-type merger in which MCS will be the surviving company and MCE will be dissolved.

(3) Allotment of Shares Relating to the Merger

Because this is a merger between MC’s wholly owned subsidiaries, there will be no related allotment of shares.

(4) Outline of the Parties Involved (as of March 2015)

| | Surviving Company | Dissolved Company |

| Company Name | Mitsubishi Shoji Sekiyu Co., Ltd. | MC. ENERGY, INC. |

| Headquarters | Chiyoda-ku, Tokyo, Japan | Chiyoda-ku, Tokyo, Japan |

| Representative | Noboru Kamakura, President & CEO | Shunichiro Kuwahara, President & CEO |

| Business Activities | Sells gasoline, kerosene, gasoil, fuel oil, lubricant oil, and other products. Constructs and leases gas station facilities. Provides management proposals and support on service station operations. Develops new business models through joint ventures in other industries. Handles all other all businesses related to service station operations. | Sells asphalt for road construction and other industrial purposes, industrial use fuels, bunker fuel oil, marine lubricants, industrial lubricants, base oil, and other petroleum-related products |

| Capital | 2,000 million yen | 490million yen |

| Date of Establishment | January 5, 1990 | October 1, 2010 |

| Number of Shares of Common Stock Issued | 40,000 | 201 |

| Fiscal Year End | March | March |

| Largest Shareholder (%) | Mitsubishi Corporation (100.0%) | Mitsubishi Corporation (100.0%) |

| Recent Financial Results | As of March 2014 | As of March 2014 |

| Net Assets | 19,774 million yen | 3,455 million yen |

| Total Assets | 94,937 million yen | 23,032 million yen |

| Net Assets Per Share | 494,350 yen | 17,191,912 yen |

| Operating Transactions | 643,907 million yen | 114,209 million yen |

| Operating Income | 2,479 million yen | 714 million yen |

| Net Income | 1,729 million yen | 435 million yen |

| Net Income Per Share | 43,227 yen | 2,163,317 yen |

(5) Expected Status Following the Merger

As mentioned in 2.(11), MCS’s name and scope of operations will change as of October 1, 2015.

(6) Outlook for MC

Because this is a merger between MC’s wholly owned subsidiaries, it is expected to have a negligible impact on MC’s performance.

Inquiry Recipient

Mitsubishi CorporationTelephone:+81-3-3210-2171 / Facsimile:+81-3-5252-7705