Announcement of Closing of AIGF II Small and Mid-cap Growth Fund in ASEAN

August 25, 2022

Mitsubishi Corporation

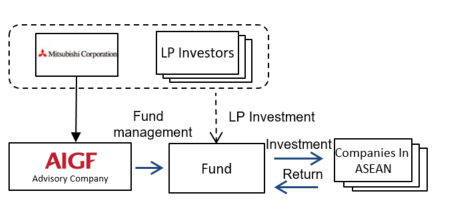

Mitsubishi Corporation (MC) is pleased to announce the final closing of AIGF II LP (AIGF II) with total capital commitments of 17.3 billion yen from institutional investors both in and outside Japan. AIGF II is the second fund established by MC’s wholly owned subsidiary AIGF Advisors Pte. Ltd. (AIGF), a private-equity (PE) firm based in Singapore that manages investment funds in the ASEAN region.

Launched in 2014 to accelerate growth at small and mid-cap enterprises in ASEAN and boost their industrial competitiveness, AIGF invests in the businesses and extends them management support. Through its first fund, AIGF I, the firm invested in Jaya Grocer (a company that runs premium supermarket chain in Malaysia), RDCL (the operator of Thailand’s Kentucky Fried Chicken stores), and KMC (the largest flexible workspace provider in the Philippines). AIGF has steadily built up a strong track record in creating new value and growth at its portfolio companies, as evidenced by its success with Jaya Grocer, which was sold back to the original owner in 2021 after enjoying a significant expansion in its network of stores.

Leveraging know-how gained through its first fund, AIGF has already begun investing through AIGF II in a variety of sectors. So far, the AIGF II portfolio includes BHS Kinetic, an integrated specialized logistics and installation services provider in Singapore, and Meatworld International, a leading meat retailer and distributor in the Philippines.

Although the ASEAN region is expected to enjoy stable economic and population growth in the coming years, when compared to Japan its market for direct investments is limited and underdeveloped. PE funds like those managed by AIGF are gaining a greater presence as providers of growth capital to promising businesses.

MC has been developing PE businesses both in Japan and around the world that distinguish themselves by taking advantage of the MC Group’s collective capabilities. As MC’s core PE platform in ASEAN, AIGF shall continue to do its part in strengthening both the region’s industry and business community by investing in the growth of promising enterprises and leveraging MC’s broad network and industry expertise.

[AIGF II]

| Name of Fund | AIGF II LP |

| Launch Date | January 2020 |

| Investment Strategy | Provision of growth capital to middle market in ASEAN. |

| Fund Size | 17.3 billion yen |

| Investors | Multinational institutional investors and corporations |

[AIGF II Fund Scheme]

References:

1.Mitsubishi Corporation

Headquarters:

2-3-1 Marunouchi, Chiyoda-ku, Tokyo

Main Operations:

MC engages in a wide range of businesses spanning multiple industries and overseen by its Industry DX Group and 10 industry-specific Business Groups: Natural Gas, Industrial Materials, Petroleum & Chemicals Solution, Mineral Resources, Industrial Infrastructure, Automotive & Mobility, Food Industry, Consumer Industry, Power Solution, and Urban Development.

Representative:

President & CEO Katsuya Nakanishi

Year of Establishment:

1954

2.AIGF

Headquarters:

50 Raffles Place, #31-04, Singapore Land Tower, Singapore

Main Operations:

AIGF leverages MC’s expansive business know-how and networks to manage funds in support of medium- to long-term value creation in the ASEAN region. AIGF’s funds provide both growth capital and management support primarily to the region’s small and mid-cap enterprises.

Representative:

CEO & CIO, Yasutaka Ichihara

Year of Establishment:

2014

Materiality

Based on the Three Corporate Principles, which serve as MC’s core philosophy, MC has continued to grow together with society by contributing to the sustainable development of society through its business activities while pursuing value creation. MC’s revised “Materiality” was announced in Midterm Corporate Strategy 2024 as a set of crucial societal issues that MC will prioritize through its business activities, towards the strategy’s goal of continuous creation of MC Shared Value (MCSV). Guided by this Materiality, MC will continue to strengthen its efforts towards sustainable corporate growth. Out of the six material issues relating to “Realizing a Carbon Neutral Society and Striving to Enrich Society Both Materially and Spiritually”, this project’s activities particularly support “Addressing Regional Issues and Growing Together with Local Communities”.

Inquiry Recipient

Mitsubishi CorporationTelephone:+81-3-3210-2171 / Facsimile:+81-3-5252-7705