Special Feature: History and Strengths of Core Businesses

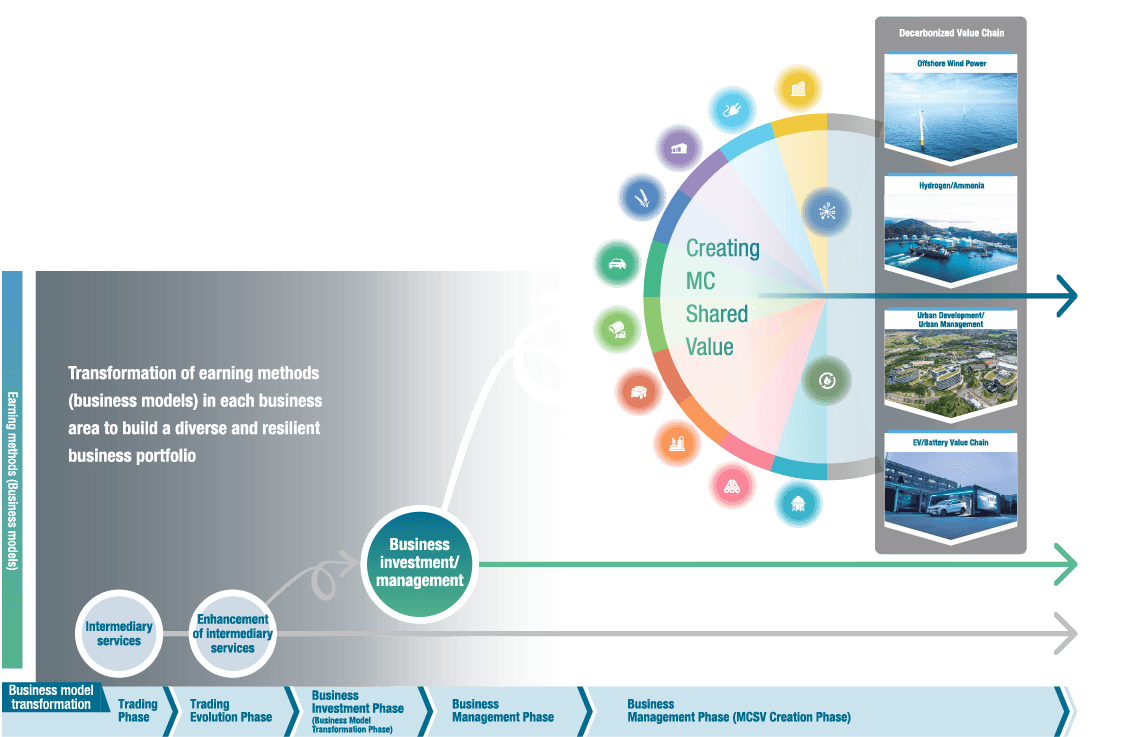

MC has pursued value creation by flexibly transforming its earning methods (business models) in accordance with the changing environment.

Our mineral resources business is a core asset and an essential part of MC’s business activities. The mineral resources business has continually evolved its business models in step with changes in the business environment. We are working to build prime assets with world-class competitive cost advantages and quality, especially in the areas of metallurgical coal and copper. It will be an increasingly important priority to establish a sustainable supply scheme for key essential resources, such as steel and copper, as society works to transition to carbon neutrality by 2050. We will continue to fulfill our mission to supply essential resources to those who need them through trading, resource investments, and business development. In this section, we will describe MC’s initiatives in this area, including the history and strengths of our mineral resources business, as well as our plans for future development.

Business Environment Shift an Opportunity for a Major Transition

to Upstream Resource Development Investment

Between the post-war reconstruction period and the dawn of Japan’s era of rapid economic growth, MC took on the responsibility of importing the raw materials, such as metallurgical coal and iron ore, needed for the production of various industrial products in Japan. The demand for resources continued to expand in step with the development of Japan’s manufacturing industries during the era of rapid economic growth. MC began to explore opportunities for investment in upstream assets to ensure reliable procurement of resources, and in 1968 we became involved in the mining of metallurgical coal (which is used in steelmaking) in Australia. When Japan’s economic growth started to slow in the mid-1970s, we began to shift our focus to global trading and resource investment with the aim of harnessing growth not only in Japan, but also overseas. In 2001, we expanded our stake in the Australian metallurgical coal business to 50% and established a new company, BHP Billiton Mitsubishi Alliance (now BHP Mitsubishi Alliance, or BMA), as a 50:50 joint venture with BHP Billiton (now BHP), the world’s largest resource company. BMA has now grown into a major source of earnings for MC, generating average yearly net income of 200 billion yen over the past five years based on MC’s equity stake.

Focusing on the Copper Business as a Second Core Business

Our next step was to apply the business model that had brought us success in the metallurgical coal business to other areas. We began to build a presence in the copper mining industry, starting in 1988 with an investment in Escondida, the world’s largest copper mine. This early response to the growing demand for copper enabled us to acquire interests in high-quality assets that rarely come onto the market today. Since then, we have continued to build one of the world’s leading copper asset portfolios in terms of both cost-competitiveness and output. The biggest copper mine that we have developed in recent years is Quellaveco. Together with our partner, the resource company Anglo American plc, a leading global mining major company - we overcame numerous unexpected challenges during the COVID-19 pandemic and completed the construction of the mine on schedule over the course of approximately four years, with production commencing in 2022. Our copper equity production volume is now the largest of any Japanese company. We anticipate further expansion after the start of full-scale production at Quellaveco, and our world ranking is expected to rise to around 13th.

Transitioning to a Portfolio Centered on Societal Challenges

One of the biggest social priorities today is the development of measures to combat climate change. In our mineral resources business, we are responding to this issue by transitioning away from our traditional product-centered business portfolio with the aim of achieving new growth based on a portfolio centered on societal challenges. Specifically, we have divided our business activities into three categories—decarbonization, electrification, and circular economies—and are now working to address societal challenges in each of these areas through the sustainable supply of essential materials.

Trading Business

Our trading business, the origin of our mineral resources business, has achieved growth by adapting to changing needs. We have leveraged the added value gained through this business, including industry intelligence, our market presence, and the discovery of prime investment opportunities, to strengthen our other business operations.

Resource to Market (RtM) Business

Our trading business began with import agency business for customers in Japan. In 2013, we established Mitsubishi Corporation RtM International (RtMI) trading subsidiary in Singapore, a hub for information and human resources, in order to pursue medium- to long-term growth.

In the decade since then, RtMI has continually expanded and enhanced its trading capabilities and global customer base in collaboration with our major trading hubs in Tokyo, New York, London, and Shanghai. It has grown into a business with a substantial presence in the mineral resource trading field.

While initiatives toward the realization of a carbon-neutral society by 2050 are accelerating, we are also seeing rapid changes in the business environment, including the escalation of geopolitical risks. We will continue to achieve sustainable growth in this environment by fulfilling our mission to supply essential resources to those who need them, listening to our stakeholders, providing sustainable value, and adapting to a changing business environment.

Metallurgical Coal Business

Strengths

In 2001, MC established BMA in partnership with BHP Billiton (now BHP). In addition to operating seven coal mines*, BMA also owns and operates cargo trains, shipping terminals, and airports. The metallurgical coal that it produces has world-class competitive cost advantages and quality. With an annual output of approximately 60 million tons, BMA is the world’s largest metallurgical coal company and accounts for around 30% of seaborne trade in this resource. With reserves of approximately 11 billion tons, BMA is estimated to have sufficient resources for over 60 years of mining operations.

Consideration for local biodiversity, environments, and communities is an essential aspect of resource development. BMA closely monitors its operations and works to achieve harmonious coexistence with the natural environment and local communities. BMA minimizes the impact of its activities on local environments and communities by formulating and reviewing plans for the eventual closure and rehabilitation of its mines, taking into consideration both social needs and environmental regulatory requirements.

As part of its efforts to enhance the productivity and safety of its mining operations, BMA has established the Integrated Remote Operations Centre (IROC) and is actively introducing digitally-controlled autonomous heavy mining vehicles.

Future Outlook

As a basic material, steel is essential to economic growth in every country around the globe. It is also a vital material for the development of the infrastructure needed to create a carbon-neutral society. We therefore anticipate continuing growth in demand. The steel industry is working toward decarbonized steel production through the increased use of hydrogen to reduce iron ore use, as well as the growing adoption of electric furnaces for steelmaking that can produce steel from scrap iron. However, the adoption of these methods on a commercial scale will take a considerable period of time, and reduction in blast furnaces with metallurgical coke as the reducing agent is likely to remain the primary steelmaking method in the interim. We expect this situation to heighten the importance of high-grade metallurgical coal as a material that helps to reduce CO2 emissions while maintaining blast furnace production efficiency. BMA will continue to contribute to the reduction of CO2 emissions from steelmaking processes by producing world-class high-grade metallurgical coal and reliably supplying this resource to users.

Copper Business

Strengths

Our copper business has achieved steady growth since we first began investing in copper mines in the 1980s. We currently own five copper mines located in the South American countries of Chile and Peru. These mines are high-quality assets with substantial resources and reserves. At present, our copper equity production volume is 250,000 tons per year, positioning ourselves as the largest production company among Japanese companies. This figure will rise even further once full-scale production begins at the Quellaveco copper mine. We aim to increase our copper production to around 400,000 tons per year.

Future Outlook

Copper is an essential material used to produce lifeblood of industry, such as electrical wiring and IT networks. Demand for copper is expected to increase even further in the medium- to long-term future because of the shift to renewable electricity, especially wind and solar power, and the increased use of electric vehicles (EVs). However, a variety of issues are emerging, including a decline in ore grades at existing copper mines, as well as the increasing difficulty of resource development due to fluctuating political situations and stricter criteria to acquire environmental permits as well as social acceptance in unstable producer nations. As a result, access to reliable supplies of this resource has become a vital priority. To ensure the growth of our copper business, we prioritize maintaining and expanding productions from our existing projects, purchasing additional exposures in existing projects and acquiring new assets, as well as leveraging new technologies to collect copper contents.

In 2023, we began work toward the development of a new project—the Marimaca copper mine—in Chile.

MC Employees on the Frontlines of Business

(Left) Former Head of CEO Office

(Right) Former Head of GM Office

At the Quellaveco copper mine site during its development

In July 2022, we commenced production of copper concentrate at the Quellaveco copper mine. Construction and development of the mine were completed on schedule and within budget, despite the unprecedented difficulties caused by the COVID-19 pandemic. This success can be attributed to the behind-the-scenes efforts of the MC employees seconded to the Quellaveco Project, who worked together with our partner, Anglo American on the frontline, to complete construction and start-up of the operations at the mine. Leveraging skills acquired through their work in MC, especially the experiences developed through business management in various countries and commodity categories, these MC employees contributed from a shareholder’s perspective to allocate management resources to realize the overall success of this mega project that spends around 5 million US dollars per day. Our employees also demonstrated a role model to motivate people, such as by sharing vision and goals of the project as well as building teams on the ground, which are vital to move people in the reality.

The history of our LNG business has been a continuous challenge of entering unknown territory. The growth of our energy business was driven primarily by oil imports and sales, but in the postwar era we began to focus on liquefied natural gas (LNG). Since the 1960s, we leveraged the customer relationships and networks developed through the oil business to create and expand our LNG business. In this section, we will look at the history of MC’s LNG business, our strengths in this area, and our future development plans.

Diversifying Business Activities across Value Chains

In the 1960s, we introduced LNG into Japan for the first time with the start of imports from Alaska. Our function was far more complicated than to simply move products from one place to another. Instead, we advanced the project through tenaciously negotiating long-term contracts with American and European companies as sellers, and with Japanese power and gas companies as buyers to reach a long-term sale and purchase agreement. The arrival of the first LNG carrier ship at Yokohama in November 1969 marked the start of our LNG business.

In 1972, we had a breakthrough in our business through our participation in the Brunei LNG Project. This was a massive project involving a total investment of over 45 billion yen. We joined the project on an equal footing concept with one of the world’s oil majors. Our equity share was 45%, while Shell held 45%, and the Brunei government 10%. Since the 1980s onward, we have continued to invest in LNG liquefaction plants around the globe in response to social requirement for a shift to clean energy and increasing demand for LNG, especially in Japan.

Starting with the North West Shelf Project in Australia, we have also expanded our value chains to encompass not only gas liquefaction and transportation, but also upstream gas development and production. With the Donggi-Senoro Project in Indonesia, we have taken on the new challenge of becoming an LNG plant operator. This has allowed us to obtain a wide range of expertise, while also taking a more proactive role in business management. In addition, MC is participating in the Cameron LNG Project in the U.S. state of Louisiana, which involves converting an existing LNG import terminal as an LNG export terminal.

The project liquefies natural gas procured from North American markets, and MC offtakes around 4 million tons per year, which is equivalent to one-third of the total output. The gas is being exported to users throughout the world, including Japan.

Strengths of the LNG Business

The LNG projects in which we are participating in various parts of world account for approximately 25% of global LNG imports. Our equity production capacity follows the oil majors, such as Shell plc and Exxon Mobil Corporation. Our market share and market presence in this area are especially high when compared with the various other products we handle. These achievements can be attributed to our success in building strong relationships of trust with all stakeholders, including users, gas-producing countries, and business partners. In addition, access to high-quality information through the networks that we have built helps us to conceive and realize new business projects. This virtuous cycle is a key strength for MC and is one of the factors that have enabled us to build a deep presence across the entire LNG supply chain.

The Future of the LNG Business

MC views natural gas and LNG, which have limited environmental impact, as essential sources of energy during the transition toward a carbon-neutral society. In addition to our initiatives to ensure reliable supplies of energy, we are also working to develop decarbonized LNG supply chains. We are also collaborating closely with the Next-Generation Energy Business Group on initiatives to reduce GHG emissions across the entire LNG value chain through the use of CCUS, carbon credits, and other methods. See pages 60-63 for additional information about our next-generation energy initiatives.

In the late 1950s, our automotive and mobility business began making major inroads into the emerging economies of Asia. By collaborating with Japanese automobile manufacturers and taking a proactive approach to sales and production activities, we have built a locally-based automotive value chain that encompasses both upstream and downstream activities, and established the automotive and mobility business as one of our Core Businesses. In this section, we will outline our activities in this area, including the history and strengths of our automotive and mobility business, as well as our plans for future development.

Business Model Transformation

Lateral Expansion of Value Chain, Entry into New Business Fields

MC first became involved in the automotive and mobility business as an exporter of vehicles (completely build-up). The impetus for the subsequent change in our business model was the development of the automobile business in Thailand. In 1957, MC launched a business in Thailand importing and selling trucks in partnership with Isuzu Motors Limited. In response to an approach from the Thai government, which was eager to develop an automobile manufacturing industry in Thailand, we began to establish assembly plants and build a supply chain for the production and sale of automobiles. We also worked to expand after-sales services and automobile finance services, leading to the creation of a locally-based value chain capable of satisfying customer needs. As a result, Isuzu has become a byword for pickup trucks in Thailand.

In 1970, we partnered with Mitsubishi Motors Corporation, from which Mitsubishi Fuso Truck and Bus Corporation spun off later, to establish an automobile production and sales company in Indonesia. Since the 1970s, we have expanded our business network in Indonesia to include not only vehicle production and sales and after-sales services, but also automobile finance and used car sales. As in Thailand, we have established a strong, locally-based value chain in Indonesia. Thanks to these efforts, our businesses in Thailand and Indonesia have become Core Businesses for our automotive and mobility business. Going forward, we intend to use the value chain that we have developed in Thailand and Indonesia as a blueprint for expansion into other markets around the world, including other Southeast Asian countries and emerging countries, as well as Australia, Europe, and the Americas. In addition, we plan to use our automotive and mobility business as a foundation for collaboration with our other business operations as we strive to create new businesses that can contribute to the realization of a carbon-neutral society.

Tri Petch Isuzu Sales Co., Ltd. (TIS)

Building Strong Businesses through the Creation of a Locally-Based Value Chain

The Isuzu business in Thailand began back in 1957 as importer of heavy-duty trucks manufactured by Isuzu Motors. As noted above, in 1963, MC built an automobile assembling plant and set about vehicle production in Thailand in response to an approach from the Thai government. Isuzu Motors Limited. invested in this assembling plant and established Isuzu Motors Co., (Thailand) Ltd. (IMCT). In 1974, we spun off the automobile sales unit of Mitsubishi Company (Thailand) Ltd. to create the MC investee TIS.

TIS has developed a business with deep roots in the Thai market. Thailand poses unique challenges, such as extremely rough and muddy rural roads, drivers who need to travel over 100,000 kilometers every year and are therefore concerned about fuel efficiency, and a need for vehicles that can operate for over a decade with minor repairs. In addition to its sales network, TIS has also enhanced and expanded its after-sales service and parts supply system to ensure that repair services are available anytime, anywhere. It has also worked with the manufacturer to introduce products that anticipate customer’s needs and reflect market requirements. By building a value chain with deep local roots and taking a market-in perspective, TIS determined that Thai customers wanted highly versatile pickup trucks with superior fuel efficiency, reliability, and durability. Since then, it has tirelessly focused on customer’s needs to become a pioneer in the pickup segment; TIS was the one who launched Space Cab or first pickup with automatic transmission. These efforts pushed up the pickup trucks as best-seller in Thailand market. The Isuzu pickup emerged as the leading brand as Thailand began to achieve rapid economic growth in the 1980s.

We have built a value chain with deep local roots by developing business operations that span both upstream and downstream activities, including the manufacturing operations of components and build-up vehicles, wholesaling and retailing in domestic markets, automobile finance, after-sales services, automobile insurance, and overseas exports and sales. As a result, we have been able to establish an unmatched reputation for reliability among local users. This reputation is a key source of strength for our automotive and mobility business, which has become a Core Business for MC.

Working Toward Building a Total Mobility Service Business

As we approach an era of electrification, we are working to build a total mobility service business in countries and regions in which we have strong business foundations, including Japan. To achieve this goal, we are leveraging the integrated knowledge of mobility and energy that is one of the strengths of the Automotive & Mobility Group. We will work to accelerate our business development activities by implementing approaches that combine EX and DX through mutual collaboration between our Multi-brand Downstream Business, Battery Solution Business, and Local Transportation DX activities.

One area in which we have traditionally excelled is the marine products business. We have helped to support the Japanese diet through our extensive involvement in activities ranging from fish harvesting to wholesaling, in partnership with fishing and seafood processing companies and logistics firms. A particular priority is our salmon business, through which we are working to ensure a stable supply of high-quality goods at a time when global demand for marine products is expanding. In this section, we will look at the history and strengths of MC’s salmon business, as well as our future development plans.

Business Model Transformation

Expansion from Trading to Processing in Response to Market Changes

MC’s salmon farming business began with exports of canned salmon. As Japan entered an era of rapid economic growth, we expanded the business to include the importation of wild salmon. We also strengthened our sales capabilities in Japan through the establishment of a sales subsidiary specializing in marine products, as well as the acquisition of a major processing company.

In the 1990s, farmed salmon and trout production began to exceed the amounts harvested from the wild, and there was also a decline in the market prices of wild salmon and trout. We adapted to these changes by transitioning to handling farmed salmon and trout, which could be stably supplied. In addition, we successfully stabilized our income in this area by expanding into the processing business in collaboration with a seafood processing company in Thailand.

Combining Production, Processing, and Sales to Create a Global Supply Chain

In the late 2000s, the market price of farmed salmon and trout, which are high-quality sources of protein, began to increase due to changes in the business environment, including growing global demand in emerging economies, as well as heightened health awareness in Europe and the United States. MC saw this growth in demand as an opportunity and decided to enter the upstream area of farming. In 2011, we established a farming business in Chile, South America, with an annual production capacity of around 1,000 tons. The subsequent acquisition of a leading Chilean company immediately expanded our annual production to 30,000 tons. We now had a supply chain encompassing production, processing, and sales. In November 2014, we acquired the Norwegian company Cermaq, which at the time was ranked third in the world in terms of market share, as a wholly-owned subsidiary. This brought our annual production of farmed salmon and trout to a total of 180,000 tons. Cermaq has production facilities not only in Norway, but also Canada and Chile, as well as sales channels to both European and North American markets. Through these moves, we have succeeded in building a global supply chain that combines production, processing, and sales operations across Europe, North America, Chile, and Asia.

Our Advantages in the Salmon Farming Business

Scarcity of Suitable Production Areas, Steady Growth in Demand

Salmon can only be produced in calm waters, such as coves, fjords, and bays, with temperatures of 6-16°C. The scarcity of such locations around the world limits opportunities for new players to move into the farming business. MC has built a strong market presence by engaging in farming activities at three major facilities located in Chile, Norway, and Canada, which are among the few areas in the world where suitable conditions can be found.

Consumers are becoming more health-conscious, and there is also growing concern regarding sustainability. Factors such as these are expected to drive continuing strong growth in demand for salmon and trout as high-quality, sustainable sources of protein. We therefore believe that latent demand for these products will continue to exceed supply.

World-Class Profitability

Since becoming a wholly-owned subsidiary of MC, Cermaq has consistently maintained world-class profitability by continually implementing measures designed to improve its production efficiency, profitability, and sales.

The Future of the Salmon Farming Business

Expanding Existing Farming Businesses and Enhancing Profitability

We will continue to expand the production capacity of our salmon farming business, while also striving to stably supply products in response to growing demand. At the same time, we will use digital technology and other methods to reduce environmental impacts, enhance productivity, and reduce costs.

Creating a New Future and Revitalizing Regions through Land-Based Aquaculture Activities

In October 2022, MC and Maruha Nichiro Corporation established ATLAND Corp. (ATLAND). ATLAND is a land-based salmon aquaculture company based Nyuzen, Toyama Prefecture. Given the constraints placed on marine aquaculture operations due to the limited availability of suitable production areas, it is believed that the land-based aquaculture business has the potential for further growth. We view the establishment of ATLAND as an opportunity to develop a sustainable, stable, and efficient land-based salmon production system through the use of digital technologies, and establish a local-production-for-local-consumption business model. We also intend to further strengthen the foundations of our salmon farming business by creating synergies through collaboration and information exchanges between ATLAND and Cermaq.

Creating MC Shared Value by combining our strong businesses to establish new earning methods and new businesses

MC’s strength is that it has a diverse and resilient business portfolio as a result of constantly transforming ideas and perspectives in response to changes in the environment and flexibly changing its earning methods (business models) in each business area. Currently, the environment in Japan and overseas is changing rapidly, with the polarization and fragmentation of the international community, the growing geopolitical risks, the declining birthrate and aging of Japanese society, etc., making it increasingly difficult to address societal challenges. It is precisely because of these tough conditions that we will create new earning methods (business models) and new businesses by combining our strong businesses that have grown amid these significant transformations. Through this new combination, we will help address societal challenges and create MC Shared Value (MCSV).