Biodiversity : Structure

Structure

| Officer in Charge | Kenji Kobayashi (Executive Vice President, Corporate Functional Officer, CSEO) |

|---|---|

| Deliberative Body (A subcommittee under the Executive Committee, a management decision-making body) | Sustainability Committee Important matters related to biodiversity deliberated by the Sustainability Committee are formally approved by the Executive Committee and put forward or reported to the Board of Directors based on prescribed standards. |

| Department in Charge | Sustainability Dept. |

Risk Management

When reviewing and making decisions on loan and investment proposals, MC conducts a comprehensive screening process which considers not only economic aspects, but ESG factors as well. Since 2012, we have employed the Integrated Biodiversity Assessment Tool (IBAT) developed by organizations including the International Union for the Conservation of Nature (IUCN) to help assess potential business impacts by evaluating the status of protected or endangered species in the vicinity of project sites, along with other relevant data on special conservation areas. Besides screening new investment and exit proposals, MC strives to make improvements to existing business investments by monitoring their management practices.

In addition, when dealing with products with high environmental and social risks, MC conducts annual supplier surveys to confirm their compliance with the Mitsubishi Corporation Policy for Sustainable Supply Chain Management, which outlines MC’s actions to address human rights, labor rights, and environmental issues in the supply chain. These surveys include content on natural capital, including biodiversity, and cover a wide range of items, including consideration of the impact our business activities have on local communities and ecosystems and whether suppliers have policies, strategies, and guidelines designed to prevent soil contamination and preserve biodiversity. (See the Supply Chain Management page for further information.)

Re-assessing Nature-related Issues Using the TNFD v1.0 Framework

Many of our businesses interact with nature and depend upon the benefits that ecosystem services provide. We recognize that in order to ensure the sustainability of our business activities, we need to understand the extent of our businesses’ dependencies and impacts on nature, analyze risks and opportunities, minimize excessive dependencies and negative impacts, and pursue initiatives that contribute to its recovery.

From this perspective, MC supports the recommendations of the Taskforce on Nature-related Financial Disclosures (TNFD) and are working to analyze and disclose nature-related risks and opportunities as outlined below.

From Trial Analysis to Formal Disclosure

From Trial Analysis to Formal Disclosure

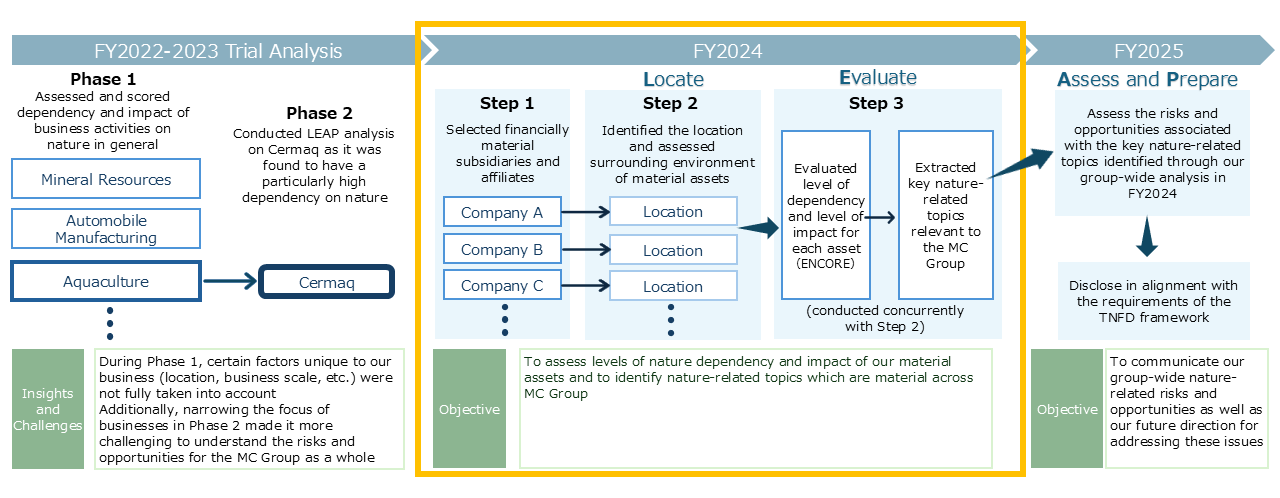

To identify and assess nature-related issues associated with our businesses, we conducted a trial analysis based on the beta version (V0.1-0.4) and the final recommendations (V1.0) of the TNFD framework from FY2022 to FY2023.

Based on the insights and challenges identified through this trial, in FY2024, we carried out the “Locate” and “Evaluate” steps of the LEAP analysis on our financially material*1 businesses as outlined below.

- *1The criteria for identifying financially material subsidiaries and affiliates are as follows.

Affiliates: Investment balance exceeding JPY 50 billion

<Non-Financial Thresholds>

Subsidiaries: Scope 1 & 2 GHG emissions exceeding 1 million tons

Affiliates: Scope 1 & 2 GHG emissions exceeding 1 million tons

Step 1: Selection of Financially Material Subsidiaries and Affiliates

We believe it is increasingly important to treat sustainability information not merely as "non-financial information," but as "sustainability-related financial information."

In Step1 of our TNFD analysis, with future mandatory disclosure requirements in mind, we began by identifying subsidiaries and affiliates that are financially material to our company.

As these entities typically operate at a larger scale and have relatively greater impacts on nature, we believe that refining the focus based on financial materiality is consistent with the TNFD’s concept of double materiality.

Step 2: Identification of Financially Material Assets and Assessment of the Surrounding Environment (Locate)

In Step 2, we identified the key assets and geographic locations (latitude and longitude) of the material subsidiaries and affiliates (group companies) identified in Step 1. Using various TNFD-recommended tools*2 to study the surrounding natural environment as well as other tools for evaluating climate-related physical risks (heat stress, typhoons, high tides, floods, forest fires) , we assessed the surrounding natural environment and gained a better understanding of local biodiversity and ecosystem conditions.

- *2Surrounding natural environments were evaluated using the Aqueduct Baseline Water Stress tool and IBAT, while climate-related physical risks were evaluated using NEX-GDDP-CMIP6, Aqueduct Flood, IBRaCS, and the Global Fire Atlas.

Step 3: Heatmap Analysis (Evaluate)

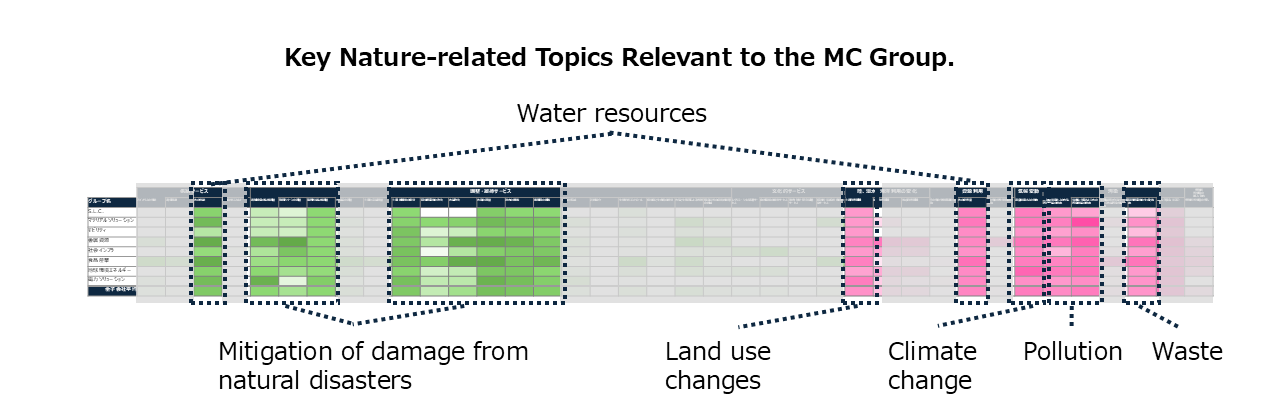

In Step 3, we conducted a heatmap analysis of the material group companies. By utilizing TNFD-recommended tools such as ENCORE, we assessed the level of dependency and impact each company has on nature.

Specifically, dependencies on nature were assessed using 25 types of ecosystem services (e.g., water supply, climate regulation, flood mitigation), while impacts on nature were evaluated using 13 types of impact drivers (e.g., water use, pollutant emissions). Each factor was scored on a six-level scale, and high-dependency or high-impact services and drivers were identified.

Based on this assessment, we extracted key nature-related topics relevant to our group companies.

Below is a heatmap of the analysis results categorized by business group.Our business activities are diverse, and the material nature-related issues vary by business (group company). However, by analyzing our financially material group companies and its assets and gaining a bird’s eye perspective, we have been able to learn that the MC group as a whole has a relatively high dependence on water resources and nature’s role in mitigating damage from natural disasters . We also identified that particular attention should be paid to our impact on climate change through GHG emissions, pollution, land use changes, and waste.

Toward FY2025

In FY2025, we will assess the risks and opportunities associated with the key nature-related topics identified through our group-wide analysis in FY2024. Based on this two-year assessment, we will then work toward further disclosure in alignment with the requirements set forth by the TNFD framework and take steps to formulate a policy to minimize risks and maximize opportunities related to key nature-related topics.