Governance: Board of Directors and Shares, etc.

Policy and Evolution of Corporate Governance at MC

Policy on Corporate Governance

Policy on Corporate Governance

- ①Guided by the Three Corporate Principles, MC is committed to continuously enhancing corporate value through activities rooted in the principles of fairness and integrity. The company believes that contributing to the enrichment of society is essential to meeting stakeholder expectations. To achieve this, MC views the ongoing strengthening of corporate governance as a core management policy, forming the foundation for sound, transparent, and efficient management.

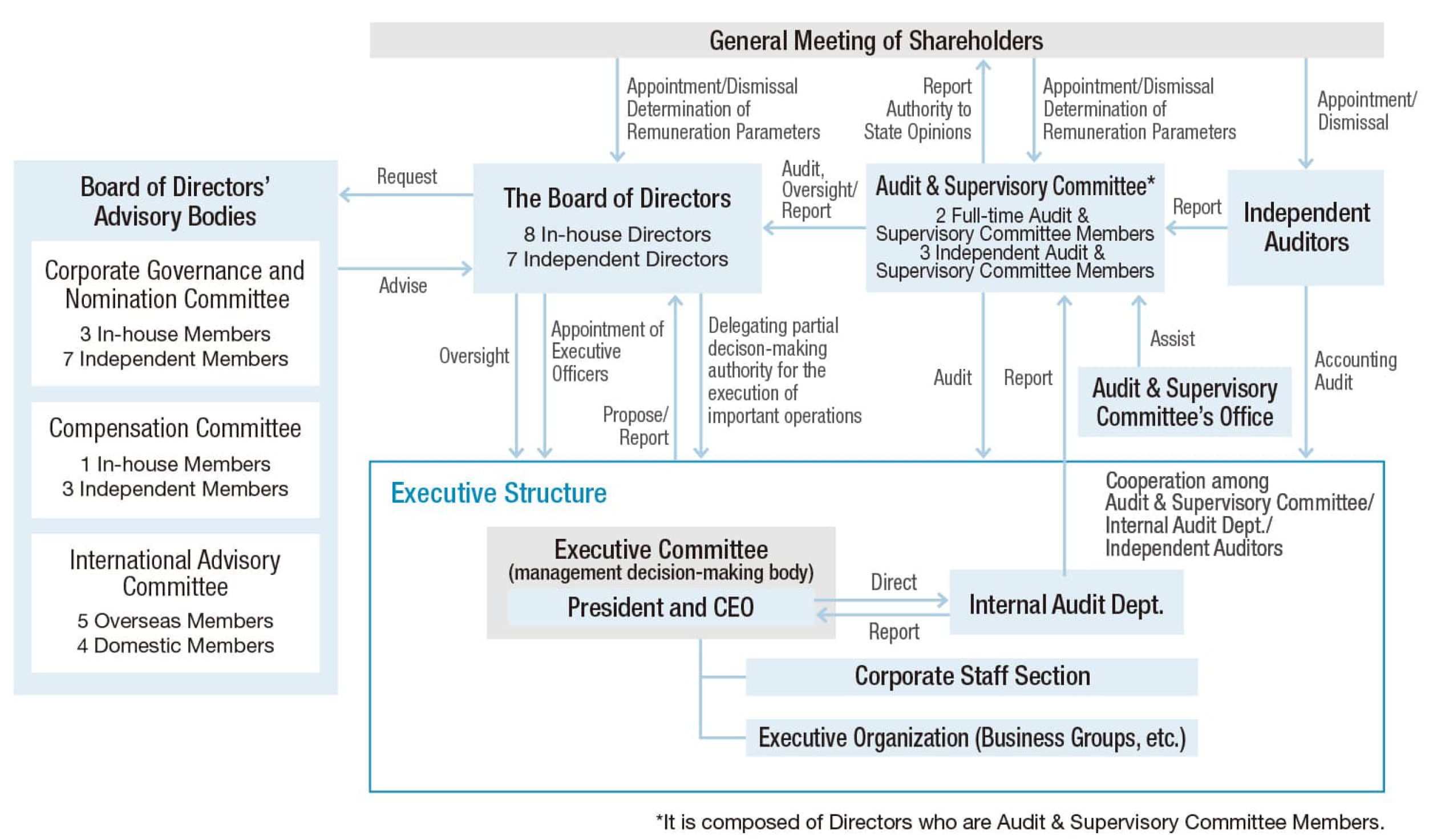

- ②In line with this policy, MC has adopted a Company with an Audit & Supervisory Committee to ensure a) separation of oversight and execution in management, b) oversight of management based on deliberation by the Board of Directors, and c) timely and decisive decision-making which can respond to changes by delegating partial decision-making authority for the execution of important operations to the President and CEO, as well as other Executive Directors.

- ③Under this corporate governance system, Executive Directors, who have been designated by the Board of Directors, formulate management strategies and business plans, which are then deliberated and approved by the Board. The Executive Directors periodically report on the progress of these strategies and plans, enabling the Board to monitor performance and ensure continuous improvement in corporate value.

- ④MC also establishes internal rules and regulations covering codes of conduct for officers and employees, company-wide lateral management systems, measures for prevention, correction, and improvement, and internal whistleblower systems. These rules are communicated to all relevant parties and rigorously applied in operations to maintain a robust compliance system. MC also establishes appropriate internal control systems, review their effectiveness annually, and endeavor to continuously improve and strengthen them.

Corporate Governance System(as of July 1, 2025)

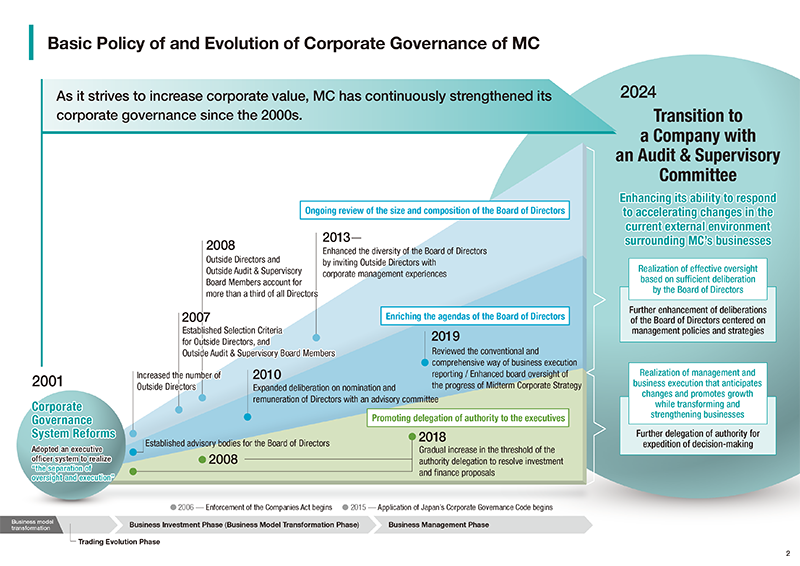

Evolution of Corporate Governance

~Transition to an Audit & Supervisory Committee~

Since the 2000s, MC has advanced corporate governance reforms in line with its policies. To enable management and business execution that anticipate change and drive growth through transformation and reinforcement, MC has continuously focused on enhancing corporate value through thorough deliberation and effective oversight by the Board of Directors.

In June 2024, MC transitioned to a Company with an Audit & Supervisory Committee, aiming to accelerate decision-making through the delegation of authority. This shift also strengthens the Board’s monitoring function by deepening discussions on management policies and strategies, further enhancing our ability to respond swiftly to rapid changes in the external environment.

Board of Directors

The Board of Directors deliberates on important management issues and supervises business execution through reports on major items such as Corporate Strategy, the business strategy of various Business Groups, and related matters. In addition, matters requiring resolution in accordance with laws and regulations, as well as loan and investment proposals exceeding a monetary threshold standard set by the Company, are deliberated and resolved not only with consideration not only for economic aspects, but also with a strong focus on sustainability perspectives. MC has also established appropriate internal control systems, review their effectiveness annually, and endeavor to continuously improve and strengthen them.

Business execution outside these matters requiring Board resolution is delegated to Executive Officers. The President serves as Chief Executive Officer, responsible for overall business execution, while the Executive Committee (which meets twice per month) functions as a key management decision-making body.

Roles and Responsibilities of Directors / Appointment Policy / Appointment Process of Directors

| Board of Directors | Audit & Supervisory Committee | |

|---|---|---|

| Roles and Responsibilities | Based on its fiduciary responsibility and accountability to shareholders, the Board of Directors fulfills the following roles and responsibilities to promote Mitsubishi Corporation’s (MC’s) sound and sustainable growth and continuous increase in corporate value. In doing so, the Board aims to help enrich society both mentally and materially, while ensuring transparent, fair, timely, and decisive decision-making and effective oversight of management.

| The Audit & Supervisory Committee, as a statutory independent body mandated by shareholders, audits the performance of directors in carrying out their duties. It is responsible for helping establish a corporate governance system through the appropriate execution of its duties and for contributing to MC’s monitoring function in cooperation with the Board of Directors. Through these roles and responsibilities, the committee supports the maintenance and development of MC’s corporate governance, considers the interests of its various stakeholders, and strives to work with them to achieve sound and sustainable growth, continuous enhancement of corporate value, and social credibility. |

| Size and Composition | To fulfill the roles and responsibilities of the Board of Directors as set forth above, MC’s Board of Directors shall maintain an appropriate size and composition that ensures diversity, with at least one-third of its members serving as Independent Directors who meetMC’s Standards for Independent Directors*. | To fulfill the roles and responsibilities of the Audit & Supervisory Committee as set forth above, MC’s Audit & Supervisory Committee shall maintain an appropriate size and composition that ensures diversity, with a majority of its members serving as Independent Audit & Supervisory Committee members who meetMC’s Standards for Independent Directors*. |

[Directors]

| Roles and Responsibilities | Directors (Excluding Directors Who Are Audit & Supervisory Committee Members) | Directors Who Are Audit & Supervisory Committee Members |

|---|---|---|

| Internal Directors | ||

| Chairman of the Board | Full-time Audit & Supervisory Committee Members | |

| The Chairman aims to ensure MC’s sound, sustainable growth and the continuous increase of corporate value by enhancing deliberations and ensuring the Board of Directors fulfills its roles and responsibilities. To achieve this, the Chairman works to maintain and advance corporate governance. As Chairman of the Board of Directors, lead discussions at meetings in a neutral manner, appropriately eliciting the opinions of Outside Directors while considering the challenges faced by executives. | Leveraging their companywide management experience within MC and their knowledge and experience in finance, accounting, legal affairs, risk management, etc., Full-time Audit & Supervisory Committee Members (1) together with the Chairman of the Board, fulfill the roles and functions of the Board of Directors as non-executive Internal Directors. They are also (2) responsible for the timely and accurate assessment of management execution, creating an environment for effective auditing and oversight by the Audit & Supervisory Committee and collaborating with other Audit & Supervisory Committee members to conduct audits and provide broad, objective oversight. They will also deliver candid, principled opinions directly to executives when necessary, with the aim of ensuring MC’s sound and sustainable growth, enhancing of corporate value, and strengthening social credibility. | |

| Executive Directors | ||

| Executive Directors carry out business operations in accordance with the basic management policies approved by the Board of Directors, report on the status of execution to the Board, and work to ensure MC’s sound, sustainable growth and continuous enhancement of corporate value by executing day-to-day operations based on Board deliberations. | ||

| Outside Directors | Outside Audit & Supervisory Committee Members | |

| With a practical, objective and professional perspective on corporate management, Outside Directors oversee the execution of management strategies proposed by executives. Drawing on their experience and insight gleaned from their networks, they provide advice on overall direction from a medium- to long-term perspective while participating in Board decision-making, aiming to ensure MC’s sound, sustainable growth and continuous increase in corporate value. | In addition to the roles and responsibilities of Outside Directors described on the left, Outside Audit & Supervisory Committee Members audit and oversee MC from a neutral, objective standpoint. They leverage their diverse knowledge and experience in corporate management, along with their own expertise, aiming to ensure MC’s sound, sustainable growth and continuous enhancement of corporate value and social credibility. | |

| Appointment Policy | Directors (Excluding Directors Who Are Audit & Supervisory Committee Members) | Directors Who Are Audit & Supervisory Committee Members |

| Based on the roles and responsibilities set forth above, and in accordance with the following policy, overall character will be considered during the appointment process. | ||

| Internal Directors | Full-Time Audit & Supervisory Committee Members | |

| In addition to the Chairman of the Board of Directors and the President, who serves as Chief Executive Officer responsible for business execution, Internal Directors are appointed from among Executive Officers (Senior Executive Vice Presidents and Executive Vice Presidents) in charge of companywide management. | Full-Time Audit & Supervisory Committee Members are appointed from individuals with knowledge and experience in companywide management, finance, accounting, legal affairs, risk management, and other areas. | |

| Outside Directors | Outside Audit & Supervisory Committee Members | |

| 1. Outside Directors are appointed from those with a practical perspective drawing on extensive experience as corporate executives and those who bring an objective, professional perspective with deep insight into global dynamics and socio-economic trends. | 1. Appointed from individuals with diverse and extensive knowledge and experience in corporate management, as well as expertise that contributes to auditing and oversight. | |

| 2. To enable Outside Directors to fulfill their responsibilities, independence* is maintained; individuals who cannot ensure this independence will not be appointed. | ||

| 3. Given MC’s broad range of business domains, conflicts of interest may arise from relationships with firms employing a corporate executive appointed as an Outside Director. MC addresses this by preserving a variety of viewpoints through the appointment of numerous Outside Directors. | ||

| Appointment Process | Directors (Excluding Directors Who Are Audit & Supervisory Committee Members) | Directors who are Audit & Supervisory Committee Members |

| Based on the above appointment policy, the President and CEO prepares a proposal for the election of Director candidates (excluding those who are Audit & Supervisory Committee Members). This proposal is reviewed by the Corporate Governance and Nomination Committee and, after approval by the Board of Directors, is submitted to the General Meeting of Shareholders as the official proposal for the election of Directors (excluding Audit & Supervisory Committee Members). | In consultation with Full-time Audit & Supervisory Committee Members and based on the above appointment policy, the President and CEO prepares a proposal for candidates for Directors who are Audit & Supervisory Committee Members. After deliberation by the Corporate Governance and Nomination Committee and with the consent of the Audit & Supervisory Committee, the proposal is approved by the Board of Directors and submitted to the General Meeting of Shareholders for election. | |

- (Note)

*MC’s Standards for Independent Directors

To determine a candidate’s independence, Mitsubishi Corporation (MC) verifies whether the individual meets the Independence Criteria prescribed by the Tokyo Stock Exchange, Inc., and whether they currently fall under any of the following items (1) to (7), or whether they have done so at any time during the past 3 fiscal years.

If MC determines that a person remains effectively independent despite one or more of the below items (1) to (7) applying, MC will provide an explanation and disclose the reason for their appointment as an Independent Director.

- ①A major shareholder of MC (an individual or entity directly or indirectly holding 10% or more of voting rights), or a Member of Business Personnel*1 of such shareholder.

- ②A Member of Business Personnel of a creditor of MC exceeding the threshold set by Mitsubishi Corporation*2.

- ③A Member of Business Personnel of a supplier or a customer of MC exceeding the threshold set by MC*3.

- ④A provider of professional services (e.g., consultant, lawyer, certified public accountant) receiving cash or other financial benefits from MC, other than Directors’ remuneration, where the amount exceeds ¥10 million per fiscal year.

- ⑤A representative or partner of MC’s Independent Auditor.

- ⑥A person belonging to an organization that has received donations from MC exceeding a certain amount*4.

- ⑦A person who has served as an Outside Director and/or Outside Audit & Supervisory Board Member of MC for more than 8 years.

- *1“Member of Business Personnel,” for the purpose of MC’s Standards for Independent Directors, refers to a managing director, corporate officer, Executive Officer, or other employee of a company.

- *2“Creditors exceeding the threshold set by MC” refer to creditors to whom MC owes an amount exceeding 2% of MC’s consolidated total assets.

- *3“Suppliers or customers exceeding the threshold” refers to suppliers or customers whose transaction amount with MC exceeds 2% of MC’s consolidated revenues.

- *4“Donations exceeding a certain amount” refer to donations of more than ¥20 million per fiscal year.

Skills Matrix of Directors (As of July 1, 2025)

The Skills Matrix of Directors is shown on page 23-24 of the Notice of 2025 Ordinary General Meeting of Shareholders (English version), available on MC’s website below at the link below.

Composition of the Board of Directors (As of July 1, 2025)

The Composition of the Board of Directors can be found at the link below.

Matters Deliberated by the Board of Directors

Matters Deliberated by the Board of Directors

The Board of Directors deliberates on important management issues and supervises business execution through reports on major items in Midterm Corporate Strategy 2024, business strategy of Business Groups, and related matters.

The results of deliberations for FY2024 are as follows.

Agenda of the Board of Directors FY2024

Management Strategy and Sustainability-related Items

Business Strategy Committee report/ Corporate Strategy 2027/ EX progress report/ Business Execution reports (risk management, human resources strategy, regional strategy, stakeholder engagement, business investment performance assessment, cyclical growth review, business portfolio monitoring and sustainability-related measures)Governance-related and corporate-related items

Governance, Nomination, and Compensation Committee report (before June 21, 2024)/ Corporate Governance and Nomination Committee report (on and after June 21, 2024)/ Compensation Committee report (on and after June 21, 2024)/ International Advisory Committee report/ Transition to a Company with an Audit & Supervisory Committee, including partial amendments to the Articles of Incorporation, and establishment and amendments of related internal rules and regulations/ Evaluation of Board effectiveness/ Appointments of Board and Audit & Supervisory Board Members, Chairman, President, and Executive Officers/ Remuneration for Directors and Audit & Supervisory Board Members/ Organizational structure/ Financial statements/ Share repurchase and cancellation policy/ Fundraising policy/ Issuance of corporate bonds/ Response to TSE requests/ Verification of cross-shareholding policy/ Internal control systems/ Compliance report/ / Disclosures (Annual Securities Report, Corporate Governance Report, and Internal Control Report)/ Internal audit policy and report/ Ordinal General Meeting of Shareholder-related items/ Agreements limiting Directors’ liabilities/ Company indemnification agreements/ Directors and officers (D&O) liability insuranceInvestment and finance proposals

Tangguh LNG Project / Chiyoda Corporation/ Malaysia LNG Dua and Malaysia LNG Tiga/ Cermaq/ Digital Realty Trust/ Nexamp/ Preferred Networks, Inc./ etc.

Advisory Bodies to the Board of Directors

Corporate Governance and Nomination Committee(after June 21, 2024)

To further strengthen corporate governance, enhance the objectivity and transparency of the Board of Directors’ nomination process, and ensure fairness, the Corporate Governance and Nomination Committee deliberates and monitors the following matters with the participation of all Independent Directors.

Matters Deliberated by the Committee

- Basic framework and fundamental policy of corporate governance

- Matters related to appointment and dismissal of members of the Board of Directors

- Matters related to nomination

- Other matters deemed necessary by the Committee Chair

Main Deliberated Matters in FY2024

- Operation of the new corporate governance system following the transition to an Audit & Supervisory Committee

- Evaluation of the effectiveness of the Board of Directors

- Board size and composition and nomination of Directors

Composition of the Committee (As of July 1, 2025)

- Independent Members (7):

Shunichi Miyanaga, Independent Director

Sakie Akiyama, Independent Director

Mari Sagiya, Independent Director

Mari Kogiso, Independent Director

Tsuneyoshi Tatsuoka, Independent Audit & Supervisory Committee Member

Rieko Sato, Independent Audit & Supervisory Committee Member

Takeshi Nakao, Independent Audit & Supervisory Committee Member - Internal members (3):

Takehiko Kakiuchi,* Chairman of the Board

Katsuya Nakanishi, Director, President and Chief Executive Officer

Mitsumasa Icho, Full-time Audit & Supervisory Committee Member

(notes)

Percentage of Independent Outside Directors on the Corporate Governance and Nomination Committee: 70% (7/10)

- *Committee Chair

Compensation Committee (after June 21, 2024)

To enhance the objectivity and transparency of the policy and amounts for the remuneration of Directors and Executive Officers—determined by the Board of Directors—and to ensure fairness throughout the decision-making process, the Compensation Committee deliberates and monitors the following matters.

Matters Deliberated and/or Determined by the Committee

Matters Deliberated and/or Determined by the Committee

Matters Deliberated

- Fundamental policy for remuneration of Directors and Executive Officers:

The policy for setting remuneration of Directors and Executive Officers, appropriateness of remuneration levels and composition, and the operation status of the remuneration system - Other matters deemed necessary by Committee Chair

Matters Deliberated and Determined

- Evaluation of sustainability factors tied to Executive Officers’ remuneration*

- Evaluation of the President and CEO’s performance*

Revised remuneration for Directors and Executive Officers

- Independent members (3):

Sakie Akiyama*, Independent Director

Mari Kogiso, Independent Director

Tsuneyoshi Tatsuoka, Independent Audit & Supervisory Committee Member - Internal members (1):

Takehiko Kakiuchi, Chairman of the Board - *Committee Chair

- Geopolitical Situation

- Economy & Society

- Energy Security

Main Deliberated and/or Determined Matters in FY2024

Main Deliberated and/or Determined Matters in FY2024

Composition of the Committee (As of July 1, 2025)

Composition of the Committee (As of July 1, 2025)

(notes)

Percentage of Independent Outside Directors on the Compensation Committee: 75% (3/4)

The Committee consists of overseas experts from diverse backgrounds, including industry, government, and academia. It provides recommendations and advice from an international perspective through discussions and exchanges of opinions on the external environment, with a focus on global affairs.

Main Discussion Themes (FY2024)

International Advisory Committee

For data on International Advisory Committee, please refer to the ESG Data at the link below

Overseas Members (5) (As of October 1, 2024)

| Member | Origin | Title | Principal area of specialization and background |

|---|---|---|---|

| Joseph S. Nye | United States of America | Harvard University Distinguished Service Professor | Professor Nye is a globally renowned scholar in geopolitics. He has held important positions in multiple U.S. administrations, including Chairman of the National Intelligence Council. He is widely recognized for introducing and establishing the concept of "Soft Power" as a foundation for a stable world order. |

| Niall FitzGerald, KBE | Ireland | Former Chairman, Unilever | Mr. FitzGerald has served as Chairman of several major global companies, including Unilever and the British Museum. He possesses exceptional expertise at the intersection of industry and geopolitics in both emerging and developed countries. |

| Natarajan Chandrasekaran (Chandra) | India | Chairman, Tata Sons | Mr. Chandra brings extensive knowledge of global industries and many years of management experience within the Tata Group, India's largest conglomerate. Having led TCS as CEO for nearly a decade, he has served as Chairman since 2017. |

| Bilahari Kausikan | Singapore | Former Permanent Secretary, Ministry of Foreign Affairs Singapore | Ambassador Kausikan has a wealth of diplomatic experience, having held senior roles such as Ambassador to the Russian Federation, Permanent Representative to the United Nations, and Ambassador-at-Large for Singapore. |

| Victor L.L. Chu | Hong Kong | Chairman, Hong Kong-USA Business Council | Based in Hong Kong, Mr. Chu is implementing numerous investment projects across various sectors, with a focus on China, and has vast experience in East Asian. He is also familiar with Japan, having served as an external director for Peach Aviation and Nomura Holdings. Additionally, he has chaired the Hong Kong-USA and Hong Kong-Europe Business Councils, giving him deep insight into global industry trends. |

Domestic Members (4) (As of October 1, 2024)

Domestic Members (4) (As of October 1, 2024)

Takehiko Kakiuchi* (Chairman of the Board)

Katsuya Nakanishi (Director, President and Chief Executive Officer)

Kotaro Tsukamoto (Director, Senior Executive Vice President)

Tsuneyoshi Tatsuoka (Independent Director)

- *The Committee Chair

Initiatives to Enhance the Effectiveness of the Board of Directors

To ensure that Directors (excluding those who are Audit & Supervisory Committee Members) and Directors who are Audit & Supervisory Committee Members can adequately perform their monitoring and audit functions, the Board of Directors’ Office and the Audit & Supervisory Committee’s Office (herein collectively referred to as the “Support Offices”) have been established. These offices, appropriately and timely provide necessary information and support to enable Directors to fulfill their duties effectively.

For Independent Directors, the Support Offices implement the following measures to facilitate active participation in discussions and strengthen the Board’s monitoring function.

Briefing Sessions Before Board Meetings

Briefing Sessions Before Board Meetings

Prior to each Board meeting, executives from the Corporate Staff Section and Business Groups provide explanatory summaries of agenda items to Independent Directors. These sessions also serve to share information that enhances deliberations.

Meetings of Independent Directors

Meetings of Independent Directors

Regular meetings are held to provide a forum for open discussion among Independent Directors on a wide range of topics.

Main discussion themes (FY2024)

- Items discussed at the Business Strategy Committee

- Conglomerate management

- Disruption in Japan’s electronics manufacturing industry

Discussions Between Independent Members of the Board and Officers and Employees

MC organizes discussions with management executives from the Corporate Staff Section and Business Groups, small-group discussions with Executive Vice Presidents, and sessions with mid-level and young employees to strengthen engagement between Independent Directors and Officers and employees.

Site Visits to Subsidiaries and Affiliates

To deepen understanding of MC’s diverse businesses, Independent Directors visit subsidiary and affiliate sites annually and hold discussions with their management teams.

Site Visits

October 2022

Metallurgical coal mines and silica mines in Australia

November 2022

Discussions with management of automotive-related businesses in Thailand and Indonesia

March 2023

Shonan Health Innovation Park(Shonan iPark)

October 2023

Quellaveco copper mine in Peru and salmon farming sites in Chile

July 2024

Discussions with AI experts and exchange of views on geopolitics in Canada and the United States

Orientation Upon Assumption of Office

Orientation Upon Assumption of Office

To help new Independent Directors gain a deeper understanding of the Company, orientation sessions are conducted by each division and business group.

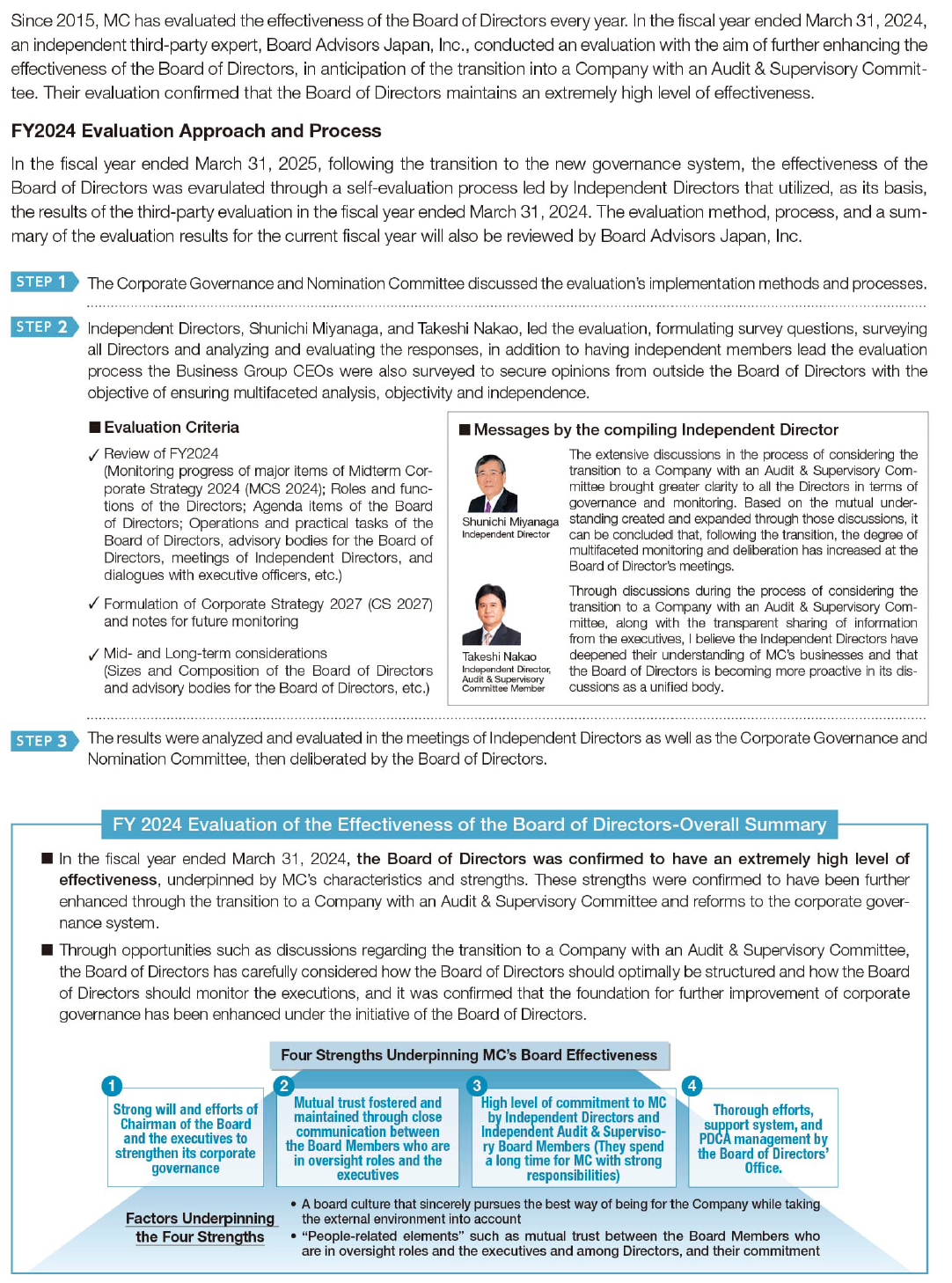

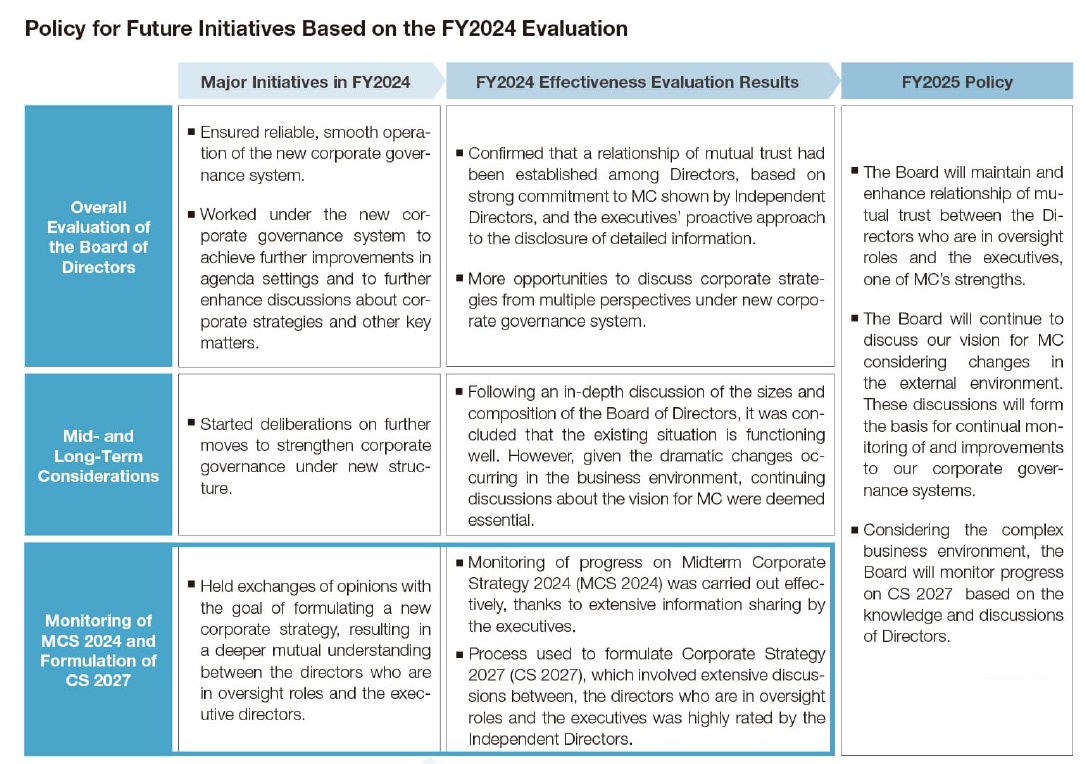

Evaluation of the Effectiveness of the Board of Directors

Evaluation of the Effectiveness of the Board of Directors

Initiatives on Corporate Governance

Based on thePolicy of Corporate Governance, MC continuously works to strengthen its governance and fully implements all principles of Japan’s Corporate Governance Code.

(For more information, please refer to the Corporate Governance Report on MC’s website.)

Stance on Acquisition, Holding, and Reduction in Listed Stocks

Stance on Acquisition, Holding, and Reduction in Listed Stocks

MC may hold shares acquired for purposes other than pure investment as a means of creating business opportunities and building, maintaining, and strengthening business and partner relationships. When acquiring such shares, MC confirms the necessity of the acquisition based on its economic rationale in accordance with internal rules. MC also conducts an annual review of the rationality for continuing to hold these shares with the Board of Directors and aims to reduce holdings that have lost significance. In the Fiscal Year ended March 31, 2025, MC sold approximately 54.9 billion yen of its shareholdings (including 14.1 billion yen in deemed holding shares), a decrease of approximately 10% from the previous fiscal year.

Verification Policy for Holding Individual Shares

The Board of Directors reviews all listed shares held by MC from the perspectives of both economic rationale and qualitative reason of continuing to hold them.

The economic rationale is confirmed by whether related earnings, such as dividends and business profits from transactions, exceed MC’s target capital cost relative to the market price of each share.

The qualitative reason is confirmed by the achievement or progress toward the expected purpose for holding the share.

Matters Verified by the Board of Directors

The Board of Directors for all listed shares held by MC as of March 31, 2025. Based on verification from both economic and qualitative perspectives, several shares were identified as candidates for reduction due to diminished significance of their original purpose and other factors.

Stance on Exercising Voting Rights Relating to Listed Stocks

Stance on Exercising Voting Rights Relating to Listed Stocks

MC places great importance on dialogue and communication with its investee companies to create business opportunities, strengthen partnerships, and enhance corporate value for both MC and these companies. Exercising voting rights is considered one of the most critical tools for such engagement. When voting on proposals related to investee companies, including listed shares acquired for purposes other than pure investment, the responsible department reviews business conditions (e.g., earnings, capital efficiency, etc.) from both quantitative and qualitative perspectives in accordance with internal rules. These rules outline considerations for decisions on proposals such as appropriation of surplus, election of Directors and Audit & Supervisory Board Members, and revisions to executive remuneration. Furthermore, for proposals concerning the election or dismissal of Independent Directors and Independent Audit & Supervisory Board Members of listed subsidiaries, MC’s internal rules require an assessment of their independence from MC before voting.

Roles of Corporate Pension Funds as Asset Owners

To leverage personnel with market and investment experience, individuals responsible for pension management are appointed from MC’s Finance Department and concurrently serve as employees of the Mitsubishi Corporation Pension Fund. The fund drafts and issues policies and management guidelines for safe and efficient reserve management to contracted institutions, which are then continuously monitored. As part of its autonomous allocation responsibilities, the fund has adopted Japan’s Stewardship Code and requires entrusted institutions to carry out stewardship activities.

Board Policies and Procedures for Appointment/Dismissal of Management Executives

For the appointment of the President and CEO, the Corporate Governance and Nomination Committee—where Independent Directors form a majority (7 out of 10 Committee Members)—deliberates and reviews the requirements for the role, the appointment policy, and potential candidates. The Committee then submits its recommendation to the Board of Directors, which makes the final decision. The Board also deliberates and determines the appointment of Executive Officers and their respective responsibilities.

For Directors who are Audit & Supervisory Committee Members, the President and CEO, in consultation with Full-Time Audit & Supervisory Committee Members and based on the appointment policy, prepares a proposal for candidates. After deliberation by the Corporate Governance and Nomination Committee and with the consent of the Audit & Supervisory Committee, the proposal is resolved by the Board of Directors and submitted to the General Meeting of Shareholders.

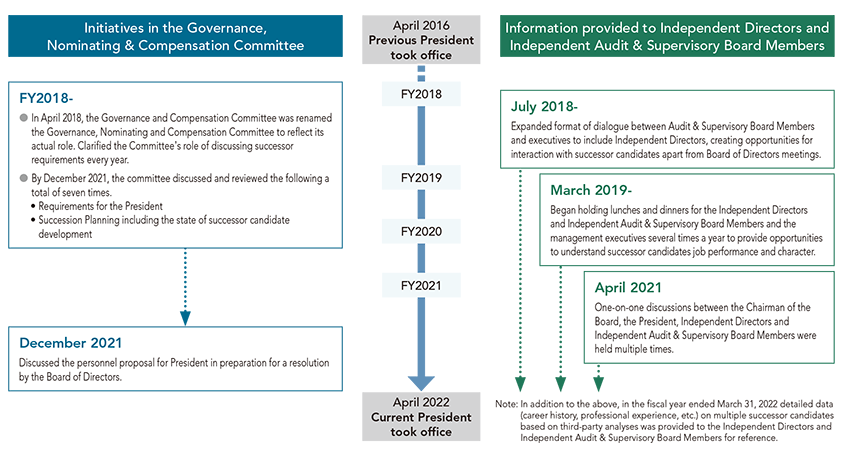

President and CEO Selection Process in April, 2022

Since Former President Kakiuchi assumed office in April 2016, the Governance, Nomination & Compensation Committee, an advisory body to the Board, implemented a thorough succession planning process, including discussions on the requirements for the President role. Independent Directors, Independent Audit & Supervisory Board Members, and successor candidates engaged in ongoing dialogue outside of formal committee meetings. This process ultimately led to the selection of President Nakanishi.

Status of Individuals Who Have Retired as Representative Directors, President, etc.

| Name | Job Title/Position | Responsibilities | Terms and Conditions of Employment (Full/Part Time, With/Without Remuneration) | Date When Former Role as President/CEO Ended* | Term |

|---|---|---|---|---|---|

| Ken Kobayashi | Corporate Advisor | External affairs | Part-time, no remuneration | March 31, 2022 | March 2028 |

- *Date of retirement from the position of Chairman of the Board

| Number of Individuals Holding Advisory Positions (Sodanyaku, Komon, etc.) After Retiring as Representative Director, President, etc. | 1 |

|---|

MC may appoint retired executives (e.g. former President and CEO) as Corporate Advisors when necessary. Currently, Ken Kobayashi serves as the sole Corporate Advisor. The role does not include serving as a Director, participating in internal management meetings, or involvement in the Company’s decision-making process. The Corporate Advisor primarily engages in external activities of high social significance at the Company’s request.

Effective July 2020, the Corporate Advisor performs duties on a part-time basis and receives no remuneration.

Policy for Dialogue with Shareholders

Policy for Dialogue with Shareholders

(a) Policy

Under MC’s Policy on Stakeholders Engagement, in addition to the Ordinary General Meeting of Shareholders, MC organizes various informational meetings and interactive forums to actively engage in dialogue with shareholders and investors. These efforts aim to deepen understanding of MC’s corporate philosophy, principles, fundamental management policies, targets, and strategies.

(b) Persons in Charge and Promoting System

To strengthen communication with shareholders and investors, MC appointed a Chief Stakeholder Engagement Officer (CSEO) in April 2023. The CSEO oversees the Corporate Communications, Sustainability, and Investor & Shareholder Relations Departments to address stakeholder needs in an integrated manner. The Investor & Shareholder Relations Department is responsible for shareholders and investor dialogue and acts as a liaison between the Business Groups and the Corporate Staff Section.

For information disclosure, MC prepares documents in compliance with the Financial Instruments and Exchange Act, the Companies Act, and other relevant regulations, and discloses information promptly and appropriately in accordance with Financial Instruments Exchange rules. Additionally, MC has established a Disclosure Committee—a subcommittee of the Executive Committee—that deliberates and confirms the appropriateness of content in the Annual Securities Report and related disclosure documents. MC has also developed and disclosed Information Disclosure Rules and Policies to ensure all officers and employees are fully informed of its approach to disclosure.

(c) Policy on Dialogue with Shareholders and Investors and Activity Results

To continuously enhance corporate value over the medium to long term, MC promotes constructive communication with shareholders and investors through the following initiatives:

i. Ordinary General Meeting of Shareholders

MC positions the General Meeting of Shareholders as its highest decision-making body and a key forum for constructive dialogue. In addition to proactively disclosing information through the meeting notice (issued in both Japanese and English), MC fulfills its accountability by respectfully responding to shareholder questions during the meeting.

ii. Communication with Individual Investors

MC regularly holds briefing sessions for individual investors.

<Activities Conducted in the Fiscal Year Ended March 31, 2025>

Individual investor briefing sessions: 2 sessions (both included participation by the President, CFO, and others)

Additionally, short explanatory videos for individual investors were created and made available on MC’s website and on securities firms’ websites.

iii. Dialogue with Institutional Investors

In addition to quarterly financial results briefings, MC hosts sessions and meetings for domestic and international institutional investors, including individual briefings and investor days such as the MCSV Creation Forum.

<Activities Conducted in the Fiscal Year Ended March 31, 2025>

Financial results briefings*: 4 meetings

MCSV Creation Forum*: 2 meetings (1 ESG Briefing, 1 Discussion on Business Strategy)

Interviews with domestic and foreign institutional investors and analysts: approximately 600 meetings (about 20 included participation by the President and CEO, CSEO, and others)

Additional interviews with institutional investors: approximately 30 meetings (including 1 session with CSEO, Independent Directors, and others)

- *Depending on the purpose and content, the President and CEO, Independent Directors, CFO, CSEO, and Group CEOs participated.

(d)Management Feedback and Control of Insider Information

MC has established a feedback system whereby opinions and comments from shareholders and investors obtained through IR and SR activities are reported to management, including the President and CEO, the Board of Directors, and the Executive Committee. In addition, relevant departments provide internal feedback from discussions with shareholders and investors, as well as financial results briefings, to help improve management practices. To prevent the intentional or accidental leakage of insider information during communication with shareholders, MC has implemented a Standard for the Prevention of Unfair Stock Trading in accordance with its Code of Conduct for Officers and Employees. All officers and employees are fully informed of these requirement.

- MC posts various types of relevant information on its IR website, including the documents listed below. Details are available at the following URL.

- Investor Relations

- Presentation Materials

- Earnings Releases

- Integrated Reports

- Financial Statements

- Quarterly Reports

- Corporate Brochure

- Sustainability Report

(e) Action to Implement Management Conscious of Cost of Capital and Stock Price

MC believes its recent stock price performance reflects the expectation that medium- to long-term ROE will exceed the cost of equity. MC aims to further raise ROE over the medium to long term by achieving sustainable growth and efficiency through the value creation framework of ”Enhance, Create, Reshape” outlined in Corporate Strategy 2027. In parallel with efforts to achieve the quantitative targets set forth in Corporate Strategy 2027, MC is strengthening disclosure and engagement with shareholders and investors to foster positive market expectations for sustained growth and efficiency. Furthermore, MC seeks to increase corporate value by incorporating insights gained through these initiatives in management decisions.

- Quantitative targets set forth in Corporate Strategy 2027 are disclosed on MC’s IR website for investors below.

- Investor Relations