Risk Management: Risk Management System

Risk Management System

Overview

MC maintains the following risk management framework:

- The Executive Committee, a key management decision-making body, determines basic policies on risk management as well as matters related to individual and integrated risk management. It also decides whether to advance individual projects and submits items to the Board of Directors based on prescribed standards.

- MC has established categories of business activity risk aligned with the nature and scale of each risk, including credit, market, business investment, country, compliance, legal, information management, environmental, and natural disaster-related risks. For each category, MC designates directors in charge and specifies responsible departments.

- MC has created and maintains an overall system for reviewing individual projects and internal systems related to specific risk types through deliberative bodies under the Executive Committee. These include the Investment Committee, Sustainability Committee, Compliance Committee, and Human Resources Development (HRD) Committee. Matters discussed by these committees are submitted or reported by the responsible director to the Executive Committee, chaired by the President and CEO.

- To enable effective Board oversight of specific risk categories, a system is in place whereby matters deliberated by each committee are reported to the Board of Directors as needed. Each risk is then broadly classified into financial and non-financial risks, with the effectiveness of its corresponding management system reviewed and monitored by the Board on an annual basis.

- *The Internal Audit Department, which reports directly to the President and CEO, is independent from the directors in charge and the responsible departments mentioned above, and oversees auditing and risk management.

-

- For individual projects, personnel in the department responsible for a given project make decisions within the scope of their prescribed authority after analyzing and assessing the project’s risk-return profile in accordance with companywide policies and procedures. Projects are executed and managed individually under this framework. MC also conducts periodic reviews of risk‑return profiles in response to project progress or changes in the external environment.

In addition to managing risk at the individual project level, MC assesses and monitors risk on a consolidated basis for risks that can be quantified, and adjusts its risk management approach as necessary.

| Risk Type | Director in Charge | Duties Overseen |

|---|---|---|

| Credit risk, market risk, business investment risk, country risk | Yuzo Nouchi | Representative Director, Corporate Functional Officer, CFO |

| Environmental risk | Kenji Kobayashi | Corporate Functional Officer, CSEO (concurrently) Capital Alliances |

| Compliance risk | Kotaro Tsukamoto | Representative Director, Senior Executive Vice President, Senior Assistant to the President and CEO, (concurrently) Chief Compliance Officer |

| Legal risk, employee safety risk such as natural disasters/terrorism/emerging infectious diseases, etc., business continuity risk | Yoshiyuki Nojima | Representative Director, Corporate Functional Officer, Corporate Administration, Legal (concurrently) Officer for Emergency Crisis Management Headquarters |

| Information management risk | Yutaka Kashiwagi | Representative Director, Corporate Functional Officer, Human Resources, Global Planning & Coordination, IT |

Risk Management Framework

| Risk Type | Supervising Organization |

|---|---|

| Credit risk, market risk (foreign exchange, interest rate, stock price, foreign exchange mikoshi*, etc.), country risk | Finance Department |

| Credit risk (rating systems, conclusion of contracts, trade credits, bailment, payment extension, etc.) | Mitsubishi Corporation Financial & Management Services (Japan) Ltd. |

| Business investment risk and market risk (Investment Return Valuation System, new business investments, actions for existing operating companies, transactions by operating companies, granting loans/guaranty, acquisition and disposal of fixed assets, mikoshi, acquisition and disposal of non-affiliated investments, etc.) | Business Investment Management Department |

| Climate risk, etc. | Sustainability Department |

| Compliance risk (litigation/government investigations, laws and regulations, scandals/compliance issues) | Legal Department |

| Risk of natural disasters, etc. (risks related to employee safety, including natural disasters, terrorism, new infectious diseases, and business continuity risks) | Corporate Administration Department (Security & Crisis Management Office) |

| Information management risk | IT Service Department |

- (notes)The above list excludes those items that are related to major risks.

- *The Structured Finance, M&A Advisory Dept. also manages foreign exchange mikoshi.

Responding to Business Investment Risk

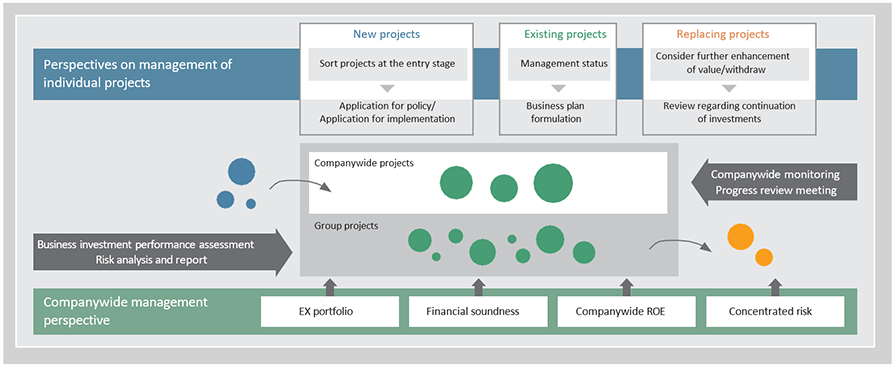

To properly manage business investment risk, MC has established a screening process to review and make decisions on new, existing, and recycling projects.

| New projects | Application for policy/Application for implementation | Narrow down new investment and finance proposals by comprehensively evaluating quantitative factors, such as invested capital and expected returns based on each business’s characteristics, together with qualitative factors including alignment with each business segment’s strategy, risk locations, and proposed countermeasures |

|---|---|---|

| Existing projects | Business plan formulation | Conduct an annual review of subsidiaries’ and affiliates’ management issues and initiatives, as well as MC’s functions and each business’s life cycle |

| Recycling projects | Review regarding continuation of investments | Conduct qualitative and quantitative evaluations of new investment and finance proposals based on the strategic priorities of each business segment and promote a healthy portfolio cycle |