Governance: Remuneration for Directors, etc.

Remuneration for Directors, etc.

Following continued deliberations by the Compensation Committee, the Board of Directors decided, at its May 2025 meeting, to revise the remuneration package for directors responsible for business execution (excluding Audit & Supervisory Committee Members), effective from FY2025 onward.

This revision was subsequently approved at the 2025 Ordinary General Meeting of Shareholders, which adopted a resolution to determine the amount of remuneration for eligible Directors (excluding Audit & Supervisory Committee Members) and to introduce a stock-based remuneration system for these Directors.

The updated remuneration package is designed to strengthen alignment with shareholder interests and reinforce our commitment to continuous growth and the enhancement of medium- to long-term corporate value.The new policy on remuneration for Directors and its governance framework are outlined below.

Policy on Remuneration for Directors and Executive Officers

Policy on Remuneration for Directors and Executive Officers

MC has established its policy on remuneration of Directors as follows.

Remuneration levels

- Levels of remuneration are set based on the functions and roles of Directors and Executive Officers.

Remuneration Governance

The Compensation Committee, where a majority of the members are composed primarily of Independent Directors and the committee is chaired by one of them, who serves as Committee Chairperson, continuously deliberates and monitors the policy for setting remuneration for Directors and Executive Officers, the appropriateness of remuneration levels and composition including items subject to the clawback policy, the operating status of the remuneration package, and other matters.

The primary objective of the remuneration package for Executive Directors (excluding Audit & Supervisory Committee Members) is to promote value sharing with shareholders and strengthen awareness of medium- to long-term corporate value enhancement.

The following factors will be considered:

Alignment with Strategy

KPIs will be selected based on their strategic relevance to ensure that our remuneration package is aligned with the company’s overall corporate strategy. Remuneration levels will be benchmarked both domestically and globally to remain competitive, reflecting the roles, responsibilities and performance. This approach is intended to ensure the career development of future leaders and enhance the company’s overall vitality.

Further Value Sharing with Shareholders

We are introducing stock-based remuneration linked to share performance, significantly increasing its proportion in the overall remuneration structure.Strengthening Accountability

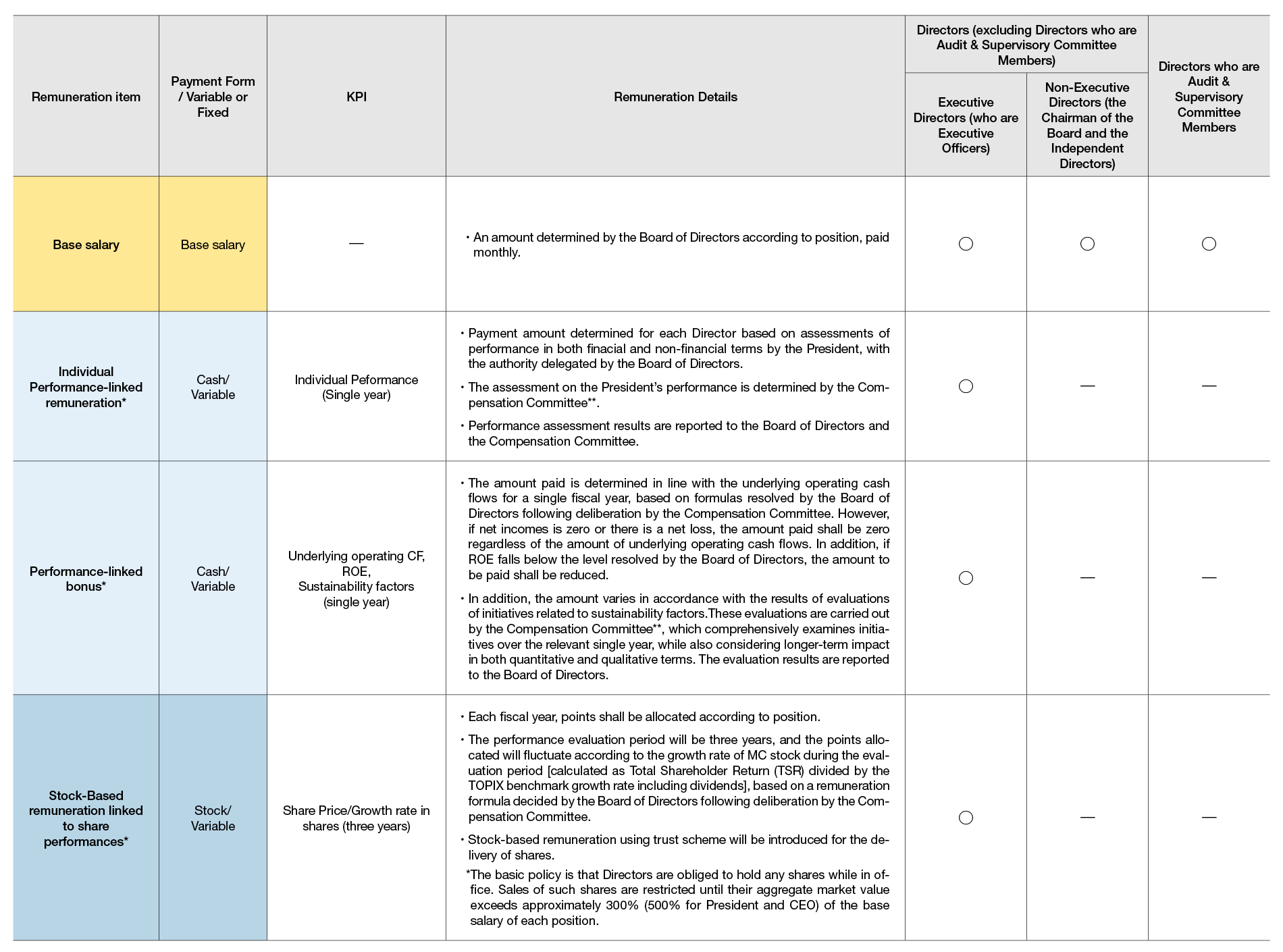

As described above, we will strengthen remuneration governance in accordance with these principles.- The Chairman of the Board and Independent Directors (excluding Directors who are Audit & Supervisory Committee Members) who perform management oversight functions and Audit & Supervisory Committee Members who perform audit and management receive only a fixed base salary, without any performance-linked compensation, to ensure their independence in carrying out management oversight.

Decision Policy on Remuneration for Directors and Executive Officers

The policy for determining remuneration for Directors and Executive Officers, as well as the process for deciding actual payment amounts, involves deliberation by the Compensation Committee followed by a resolution by the Board of Directors.

The respective policies for determining individual remuneration are as follows:

① Remuneration Governance for Executive Officers (Including Executive Directors)

- The total remuneration amount (actual payment amount) and individual payment amounts for Executive Directors, excluding individual performance-linked remuneration, are determined by a resolution of the Board of Directors within the upper limits approved at the 2025 Ordinary General Meeting of Shareholders held on June 20, 2025.

- Fixed base salary is paid in amounts determined by the Board of Directors.

- Variable remuneration, including performance-linked bonuses and stock-based remuneration tied to share performance, is determined based on key performance indicators and formulas set by the Board of Directors following deliberation by the Compensation Committee.

- Individual performance-linked remuneration for Executive Directors is based on annual assessments, including qualitative assessments, by the President, reflecting both financial and non-financial performance. The Board of Directors delegates authority to the President for determining these amounts, as the President serves as Chief Executive Officer. Performance evaluations of Executive Directors comprehensively take into account their contributions to the organizations and businesses they oversee; their contributions to management of the entire company, Corporate Staff Section, Business Segments and offices; and the initiatives related to value creation that lead to sustainable growth. The President’s own performance evaluation is conducted by the Compensation Committee, which is chaired by an Independent director and consists of a majority of Independent directors, and also participate in all Independent Directors (including Audit & Supervisory Committee Members).

- Results of performance assessments are reported to the Board of Directors and the Compensation Committee to ensure objectivity, fairness, and transparency.

- Based on the policy for determining remuneration packages (including methods for calculating performance-linked bonus) that was approved by the Board on May 2, 2025, each year, the Compensation Committee deliberates and the Board of Directors makes a resolution determining that the total remuneration packages and payment methods for individual directors align with this policy.

- MC has adopted a clawback policy applicable to individual performance-linked remuneration, performance-linked bonuses, and stock-based remuneration tied to share performance of Executive Directors.

- Each year, the Compensation Committee reviews and monitors the appropriateness of remuneration levels, composition (including components subject to clawback), and operational status, referencing external benchmarking data provided by consulting firm Willis Towers Watson.

② Remuneration Governance for Non-executive Directors (Excluding Directors Who Are Audit and Supervisory Committee Members)

The remuneration for the Chairman of the Board and Independent Directors (excluding Directors who are Audit & Supervisory Committee Members) is deliberated by the Compensation Committee and decided by the Board of Directors.

③ Remuneration Governance for Directors Who Are Audit and Supervisory Committee Members

The total and individual remuneration amounts for Directors who are Audit & Supervisory Committee Members are determined following deliberations among those members, within the upper limits approved at the 2024 Ordinary General Meeting of Shareholders held on June 21, 2024.

Remuneration Package for Directors (from FY2025)

*All Independent Directors (including those who are Audit & Supervisory Committee Members) participate alongside the members of the Compensation Committee, which is chaired by an Independent Director and consists of a majority of Independent Directors.

Note:

The amount of remuneration for Directors (excluding Directors who are Audit & Supervisory Committee Members) was resolved at the 2025 Ordinary General Meeting of Shareholders, as described in (①) and (②) below. The number of Directors (excluding Directors who are Audit & Supervisory Committee Members) subject to this remuneration is 10, including 4 Independent Directors.

- ①The total annual amount for base salary and individual performance-linked remuneration will be up to 1.8 billion yen (including up to 250 million yen for the base salary of Independent Directors).

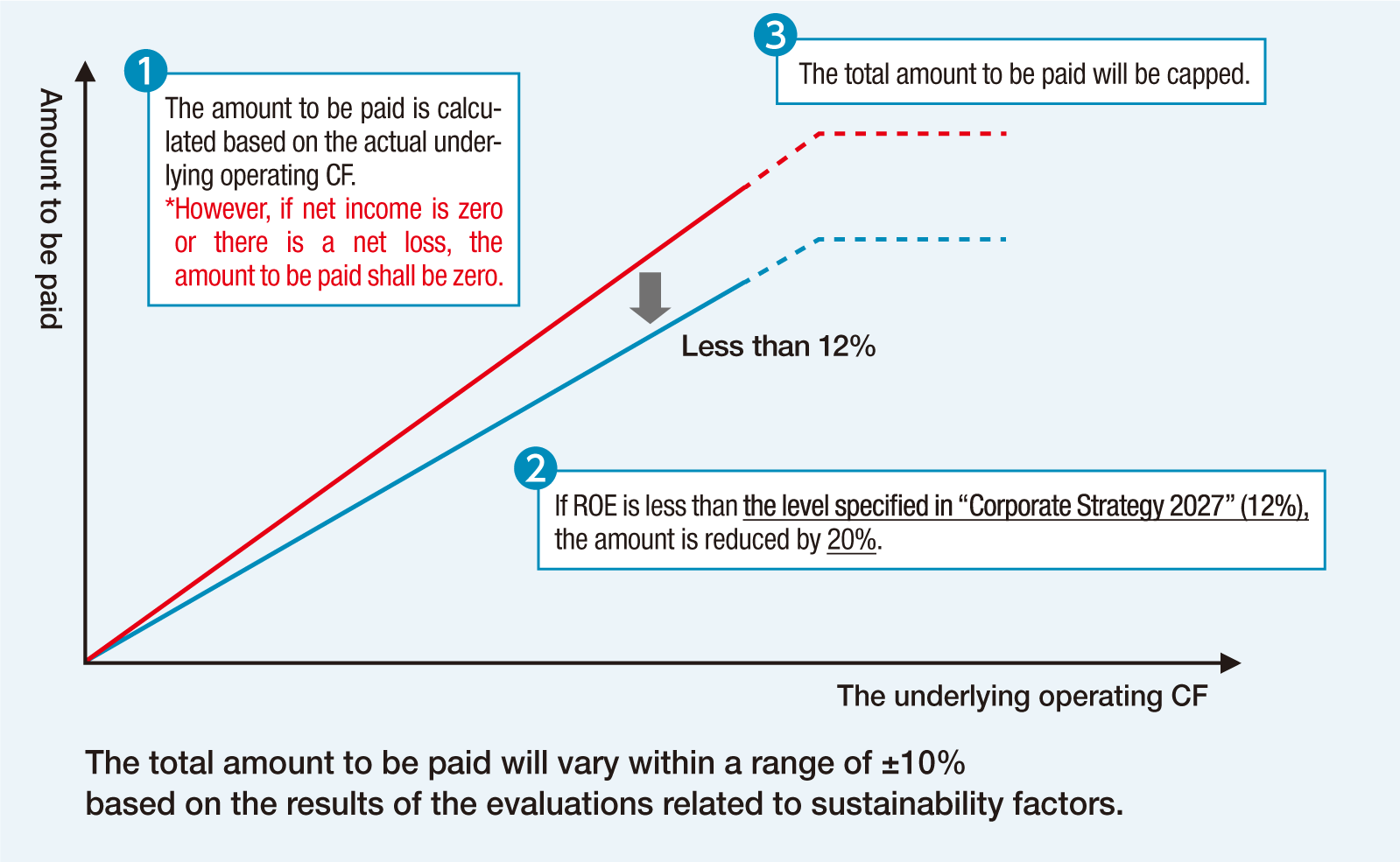

- ②The annual amount for performance-linked bonuses, which reflect profit for a single fiscal year, will be up to 1 billion yen. Payment amounts are adjusted based on evaluations of underlying cash flows, ROE, and initiatives related to sustainability factors, and calculated according to the formula approved by the Board of Directors. An upper limit is also placed on the total amount payable.

Remuneration for each Director (excluding Directors who are Audit & Supervisory Committee Members) is determined through deliberation and decision-making by the Board of Directors and the Compensation Committee within these upper limits.

In the event of a material revision of financial statements, etc., due to actions by Directors, MC may withhold or require repayment (malus and clawback) of individual performance-linked remuneration and performance-linked bonuses. Each item of remuneration marked with* is subject to the clawback policy.

Annual deferment for retirement remuneration under the previous remuneration package (up to FY2024) will not accumulate from FY2025 onward. The accumulated amount up to FY2024 will be calculated and paid upon Board resolution at the time of retirement from a business execution role.

Performance-linked bonuses (medium- to long-term) will also be abolished from FY2025. However, individual performance-linked remuneration, short-term performance-linked bonuses, medium- to long-term performance-linked bonuses, and stock-based remuneration linked to medium- to long-term share performances for past fiscal years will continue to vest and be paid based on the basic approach, governance, and remuneration package applicable for each fiscal year.- ①The total annual amount for base salary and individual performance-linked remuneration will be up to 1.8 billion yen (including up to 250 million yen for the base salary of Independent Directors).

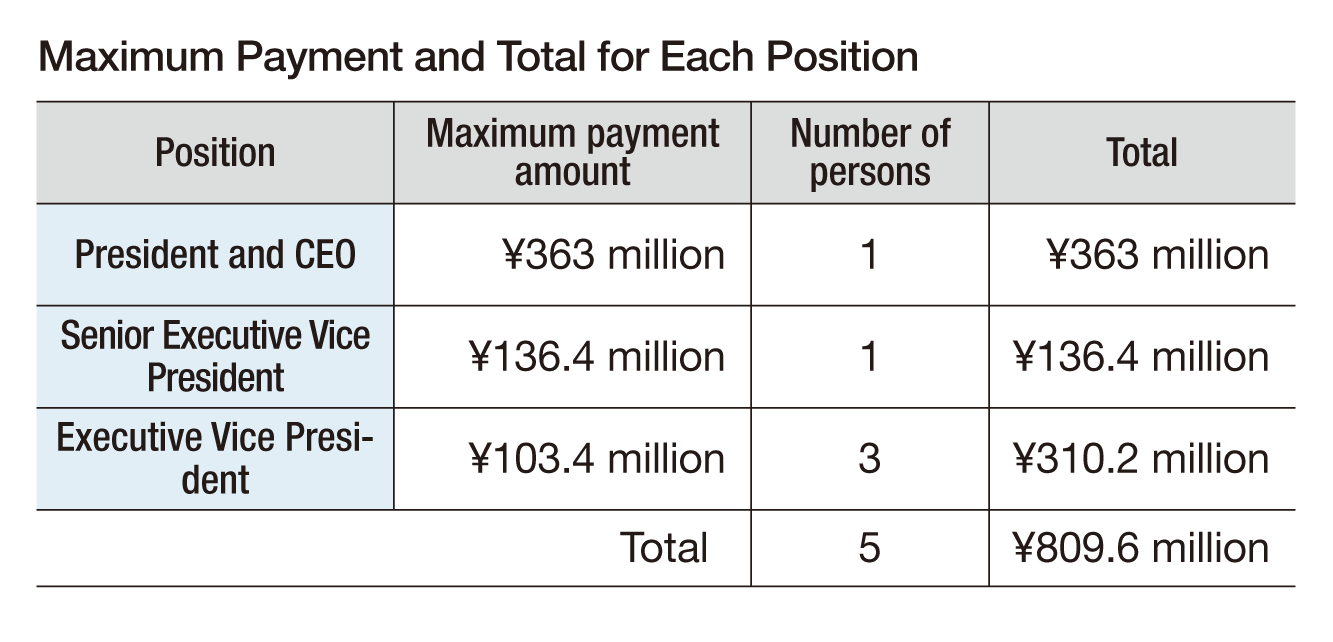

From FY2025 onward, following a resolution at the 2025 Ordinary General Meeting of Shareholders, the previous stock-based remuneration linked to medium- to long-term share performance was abolished. In its place, a new trust-based stock remuneration plan, with an annual limit of 1.7 billion yen, has been introduced for eligible Directors. This system aims to promote value sharing with shareholders and further strengthen awareness of medium to long-term corporate value enhancement. Five directors are eligible for this plan. From FY2025, MC will no longer issue stock acquisition rights as medium- to long-term share performance-linked remuneration for Executive Directors; however, stock acquisition rights already issued will remain in effect.

The amount of remuneration for Directors who are members of the Audit & Supervisory Committee will not exceed 450 million yen per year, as resolved at the 2024 Ordinary General Meeting of Shareholders. The number of Directors subject to this remuneration is 5, including 3 Independent Directors.

Calculation Method for Performance-Linked Remuneration

Calculation Method for Performance-Linked Remuneration

- The amount paid is determined based on the underlying operating cash flows for a single fiscal year, using formulas approved by the Board of Directors following deliberation by the Compensation Committee. However, if the net income is zero or there is a net loss, the amount paid will also be zero, regardless of operating cash flows. In addition, if ROE falls below the threshold set by the Board of Directors, the payment amount will be reduced.

- The amount also varies based on evaluations of initiatives related to sustainability factors. These evaluations are conducted by the Compensation Committee, which reviews initiatives for the relevant single fiscal year while considering both quantitative and qualitative long-term impacts. The evaluation results are then reported to the Board of Directors.

Calculation and Maximum Payment and Total for Each Position in FY2025

Stock-Based Remuneration linked to Share Performance

Stock-Based Remuneration linked to Share Performance

Stock-based remuneration linked to share performance within the remuneration package is as follows:

(1) Overview of the Plan

MC contributes funds to the Trust (hereinafter referred to as the “Trust Fund”), which then acquires shares of MC stock (hereinafter referred to as “MC Shares”) and delivers or transfers (hereinafter referred to as “Delivered, etc.”) MC Shares or their monetary equivalent (hereinafter referred to as “MC Shares, etc.”) through the Trust as remuneration to Directors, based on their positions, achievement of targets, and other criteria.

① Eligible Directors

This system applies to directors who concurrently serve as executive officers responsible for business execution. The Chairman of the Board of Directors and Independent Directors, who do not concurrently serve as Executive Officers are ineligible for payment in light of their roles.

② Upper limit of the Trust Fund

An amount equal to 1.7 billion yen multiplied by the number of fiscal years in the target period. For the initial target period, this is 5.1 billion yen for the three fiscal years ending March 31, 2028.

③ Upper Limit of MC Shares to Be Delivered to the Eligible Directors and the Acquisition Method.

- An amount equal to 1.4 million shares multiplied by the number of fiscal years in the target period. For the initial target period, this is 4.2 million shares for the three fiscal years ending March 31, 2028.

- The ratio of 1.4 million shares per fiscal year to the total number of shares issued by MC (as of March 31, 2025, net of treasury stock) is approximately 0.03%.

- MC Shares will be acquired by the Trust through the issuance of new shares via third-party allotment, disposal of treasury stock by MC to the Trust, or purchases from the stock market through the Trust.

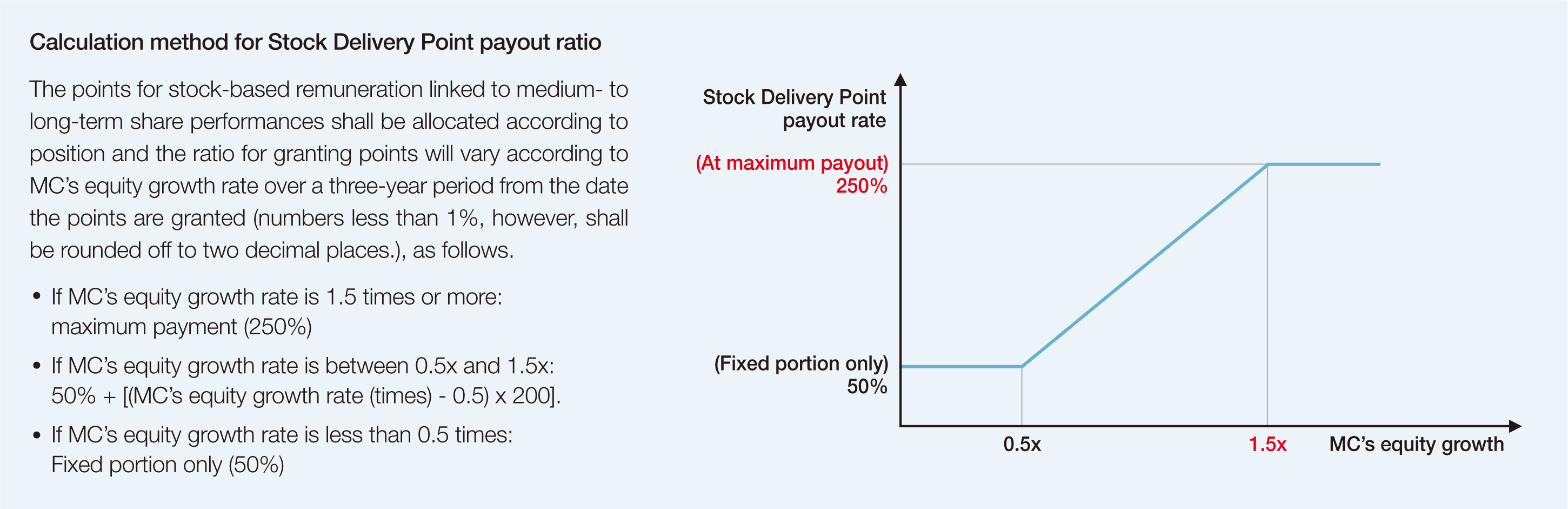

④ Calculation Method for the Number of MC Shares, etc. to Be Delivered, etc. to Eligible Directors

The number will fluctuate within a certain range based on performance achievement. For the initial target period, performance achievement will be calculated by dividing the Company’s Total Shareholder Return (hereinafter referred to as “TSR”) during the period by the growth rate of the Tokyo Stock Price Index with dividends (hereinafter referred to as “TOPIX Total Return Index”) during the same period.

⑤ Timing of MC Shares, etc. to be Delivered, etc. to Eligible Directors

⑤ Timing of MC Shares, etc. to be Delivered, etc. to Eligible Directors

In principle, delivery will occur after the end of the target period.

(2) Upper limit of the Trust Fund

This Plan will, in principle, cover three fiscal years, with the initial target period being the three fiscal years ending March 31, 2028.

MC will set an upper limit of 1.7 billion yen multiplied by the number of fiscal years in the target period as the maximum amount of the Trust Fund and establish a trust (the “Trust”) for the term corresponding to the target period, with Eligible Directors who meet the requirements as beneficiaries.

Under the trustee’s instructions, the Trust will acquire MC Shares using the Trust Fund as the source of funds. MC will grant points to Eligible Directors as described in section (3) below, and MC Shares will be delivered by the Trust equivalent to the number of points granted at a predetermined time. The Trust may be extended upon expiration by amending the trust agreement and making additional contributions. In such cases, the new target will, in principle, be three fiscal years, and the Trust term will be extended accordingly. MC will make additional contributions within the scope approved by resolution at this General Meeting of Shareholders regarding the Trust Fund and continue granting points to Eligible Directors and making MC Shares, etc. to be Delivered, etc. for the new target period. However, if additional contributions are made, any remaining MC Shares (excluding shares equivalent to points already granted to Eligible Directors that have yet to be delivered) and funds in the Trust property (hereinafter collectively with MC Shares, the “Residual Shares”) at the end of the prior trust period will be considered. The sum of the Residual Shares to be delivered to Eligible Directors and the additional Trust Fund contribution must remain within the scope approved by resolution at this General Meeting of Shareholders.

Such extensions are not limited to once; the trust period may be extended again in the same manner thereafter.

(3) Calculation Method and Upper Limit of MC Shares to be Delivered to Eligible Directors

The number of MC Shares to be delivered to Eligible Directors will be determined based on “Share Delivery Points.” One MC Share per point, or a cash payment equivalent to the value of one MC Share, will be delivered with any fractional points rounded down. However, if a share split or reverse share split occurs during the Trust period, MC will adjust the number of the shares per Share Delivery Point, as well as the upper limit on shares and cash equivalents, in proportion to the split or reverse split ratio. Share Delivery Point shall be calculated as follows:

Each fiscal year, points are allocated to Eligible Directors based on their position. After the target period ends, the points allocated are multiplied by a performance-based coefficient* reflecting achievement of performance targets and other factors. This determines the final number of Share Delivery Points. If an Eligible Director who meets beneficiary requirements resigns during the target period, the performance-based coefficient will still be applied after the target period ends to calculate their Share Delivery Points.

- *The coefficient fluctuates within a certain range depending on performance achievement. For the initial target period, achievement will be calculated by dividing MC’s TSR by the growth rate of the TOPIX Total Return Index during the same period. The fluctuation range for the initial Target Period is set at 50-250%. Please note that both the indicator and the range may be changed in the future by resolution of the Board of Directors.

The maximum number of MC Shares to be delivered (the number of points to be granted to the Eligible Directors) during the Trust period is 1.4 million shares multiplied by the number of fiscal years in the target period. This limit is set with reference to factors such as the current share price and the upper limit of the Trust Fund.

(4) Method and Timing of Delivery of MC Shares to Eligible Directors

Eligible Directors who meet the beneficiary requirements will, after the target period ends, receive a delivery of MC Shares from the Trust equivalent to their accumulated Share Delivery Points, following prescribed beneficiary identification procedures.

At that time, a portion of the Share Delivery Points will be delivered as MC Shares, and the remaining points will be converted into cash within the Trust, and the Eligible Directors will receive a payment equivalent to the converted value. In addition, Eligible Directors who are determined to be non-residents of Japan will receive from MC an amount calculated by multiplying their Share Delivery Points by the share price of MC Shares at the time of payment. If, for any reason, the Trust cannot make the cash payment, MC may pay an equivalent amount directly (hereinafter referred to as the “cash plan”). Under the cash plan, the total number of points (hereinafter referred to as the “cash plan points”) used to calculate payments and the number of MC shares (including those converted to cash) to be delivered will not exceed the number calculated by multiplying 1.4 million shares by the number of fiscal years in the target period. The payment amount will be based on the market share price at the time of payment.

In the event of an Eligible Director’s death, all MC Shares corresponding to their Share Delivery Points will be converted into cash within the Trust, and an heir to said Eligible Director will receive a payment equivalent to the converted value.

(5) Malus and clawback policy

In the event of a material revision to financial statements, etc., due to actions by an Eligible Director, MC may require forfeiture of the beneficial interest in MC Shares to be delivered (malus) or the return of MC Shares already delivered (clawback).

(6) Exercise of Voting Rights Related to MC Shares Held by the Trust

To ensure management neutrality, voting rights for MC Shares held by the Trust will not be exercised during the Trust period.

(7) Treatment of Dividends on MC Shares Held by the Trust

Dividends on MC Shares held by the Trust will be received by the Trust and applied to trust fees and expenses.

(8) Other details of this Plan

Other details of this Plan will be determined by the Board of Directors whenever the Trust is established, the trust agreement is amended, or additional contributions are made.

Guideline for Share Ownership (Policy)

Guideline for Share Ownership (Policy)

MC has established a share ownership guideline requiring Executive Directors and Executive Officers to hold MC shares while in office. Sales of these shares are restricted until their aggregate market value reaches approximately 300% of the base salary of each position (500% for the President and CEO).

Deliberation Process for Revising the Remuneration Package for Executive Directors and Executive Officers

MC resolved to revise the remuneration package for Executive Directors and Executive Officers following ongoing deliberations by the Board of Directors and the Compensation Committee. The review process was as follows.

October 2024, Compensation Committee

- The Compensation Committee discussed the basic design (grand design) proposal for the new remuneration package for Executive Officers (including those who are Directors)

January 2025, Compensation Committee

- The Compensation Committee discussed the detailed proposal for the new remuneration package for Executive Officers

March 2025, Compensation Committee

- The Compensation Committee discussed the final proposal, including the disclosure plan for the new remuneration package for Executive Officers

May 2025, Board of Directors’ Meeting

- The Board of Directors resolved to revise the remuneration package (including the policy and remuneration governance) for Executive Directors, including the FY2025 remuneration package for Executive Officers

June 2025, Ordinary General Meeting of Shareholders

- The General Meeting of Shareholders resolved to determine the amount of remuneration for Eligible Directors (excluding Audit & Supervisory Committee Members) and introduced a stock-based remuneration system for Eligible Directors (excluding Audit & Supervisory Committee Members)

Directors’ and Audit & Supervisory Board Members'* Remuneration: Total Amounts and Number of Eligible Persons

Please refer to our ESG Data at the link below for information on the total remuneration amounts and the number of eligible persons for Directors and Audit & Supervisory Board Members’* Remuneration: Total Amounts and Number of Eligible Persons in the Fiscal Year.

- *Prior to the transition to a Company with an Audit & Supervisory Committee in June 2024

Names, Titles, Total Amounts of Consolidated Remuneration and Amount by Type of Remuneration for Each Director and Audit & Supervisory Board Member*

Please refer to the ESG Data at the link below for details on names, titles, total amounts of consolidated remuneration and amount by type of remuneration for each Director and Audit & Supervisory Board Member*.

- *Prior to the transition to a Company with an Audit & Supervisory Committee in June 2024

Significant Employee Salaries of Directors Concurrently as Employees

Significant Employee Salaries of Directors Concurrently as Employees

None of MC’s Directors serve concurrently as employees.

Employee Salaries

MC has a performance-linked bonus system for non-executive employees, including certain fixed-term contract employees.